Crypto Markets Lost $60B in 2 Days as Bitcoin Slipped Below $20K (Market Watch)

After struggling to remain above the coveted $20,000 line yesterday, bitcoin finally dipped below it earlier today. Most altcoins are also well in the red on a daily scale once more, with ETH, SOL, DOGE, and SHIB painting notable losses.

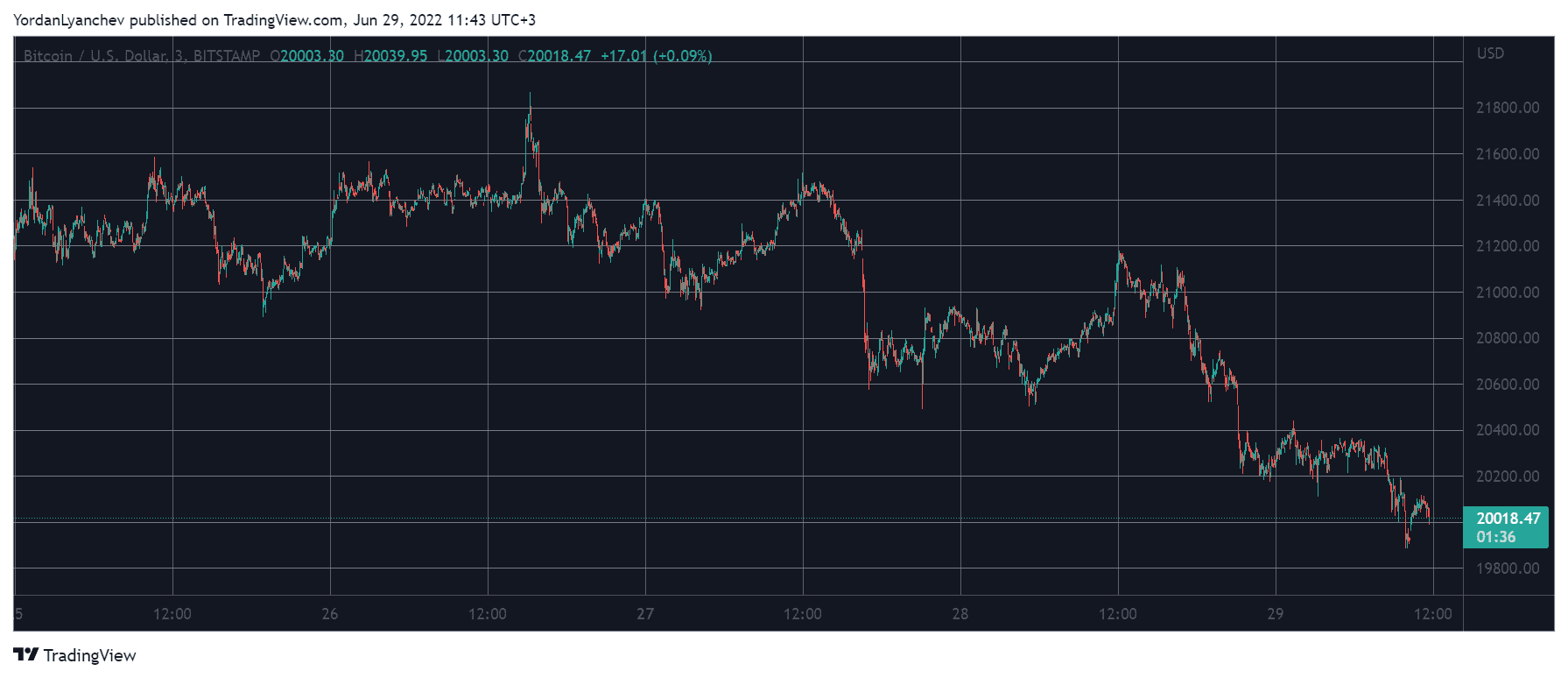

Bitcoin Slipped Below $20K

Bitcoin tried to recover some of the recently lost value last week and jumped from the 18-month low of $17,500 to around $21,000. It maintained that level for most of the weekend before the bulls initiated a leg up that resulted in charting a 10-day high at just over $21,800.

However, BTC failed to continue upwards and retraced to just under $21,000. It tried to reclaim that level in the following hours but was stopped in its tracks.

As such, it dipped towards $20,000 but managed to sustain above it yesterday. Today, though, the situation changed, and BTC found itself slipping below that round-numbered milestone hours ago. As of now, it trades around that line as well, and its market cap has plummeted further below $400 billion.

Alts See Red

Most altcoins continue to follow BTC, meaning that red is evident across almost all charts.

Ethereum set a multi-day high of its own during the weekend above $1,200 but has lost over $100 since then. A 6.5% daily drop has pushed the second-largest crypto to $1,130 now.

BNB is down to $220 after a 7.5% decline. More similar and even worse dips are evident from Ripple, Solana, Dogecoin, Polkadot, and Shiba Inu.

Cardano, Tron, and LEO are in the red as well, even though they have taken today’s retracement slightly better.

With the lower- and mid-cap altcoins in similar positions, the overall market cap of all crypto assets has dumped to $900 billion. This means that the metric has seen $60 billion evaporate in two days.

Industry and Altcoin News

The CFO and CEO of Compass Mining stepped down after reports emerged that the company failed to pay some of its electricity bills.

CryptoCom removed 15 cryptocurrencies from its Earn program while adding only three new ones.

Russia’s government approved a draft law allowing certain tax exemptions for crypto issuers.

CoinFLEX launched a $47 million token recovery plan and blamed Roger Ver for defaulting on a $47 million USDC margin call.

The team behind Celsius denied the rumors that the firm’s CEO – Alex Mashinsky – tried to flee the US.

The hacker that stole $100 million from Harmony refused the whitehat offer and started laundering the proceeds.