Crypto Markets Lost $60 Billion as Bitcoin (BTC) Dropped by $3K (Market Watch)

Bitcoin’s price was on a roll for a few days and tapped a local peak of over $65,500 yesterday but was pushed down immediately by over two grand.

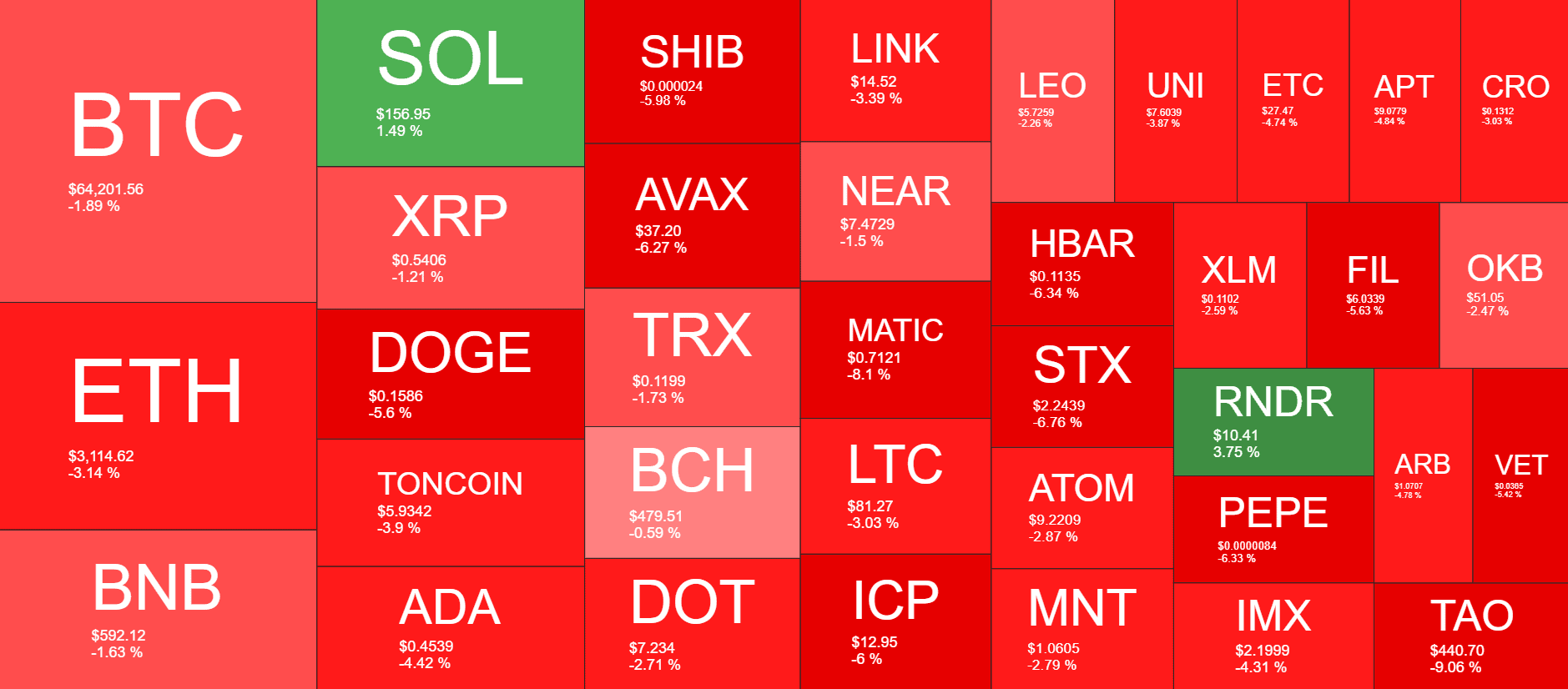

The altcoins are also deep in the red today, with DOGE, SHIB, and AVAX among the poorest performers from the larger caps.

BTC Stopped at $65.5K

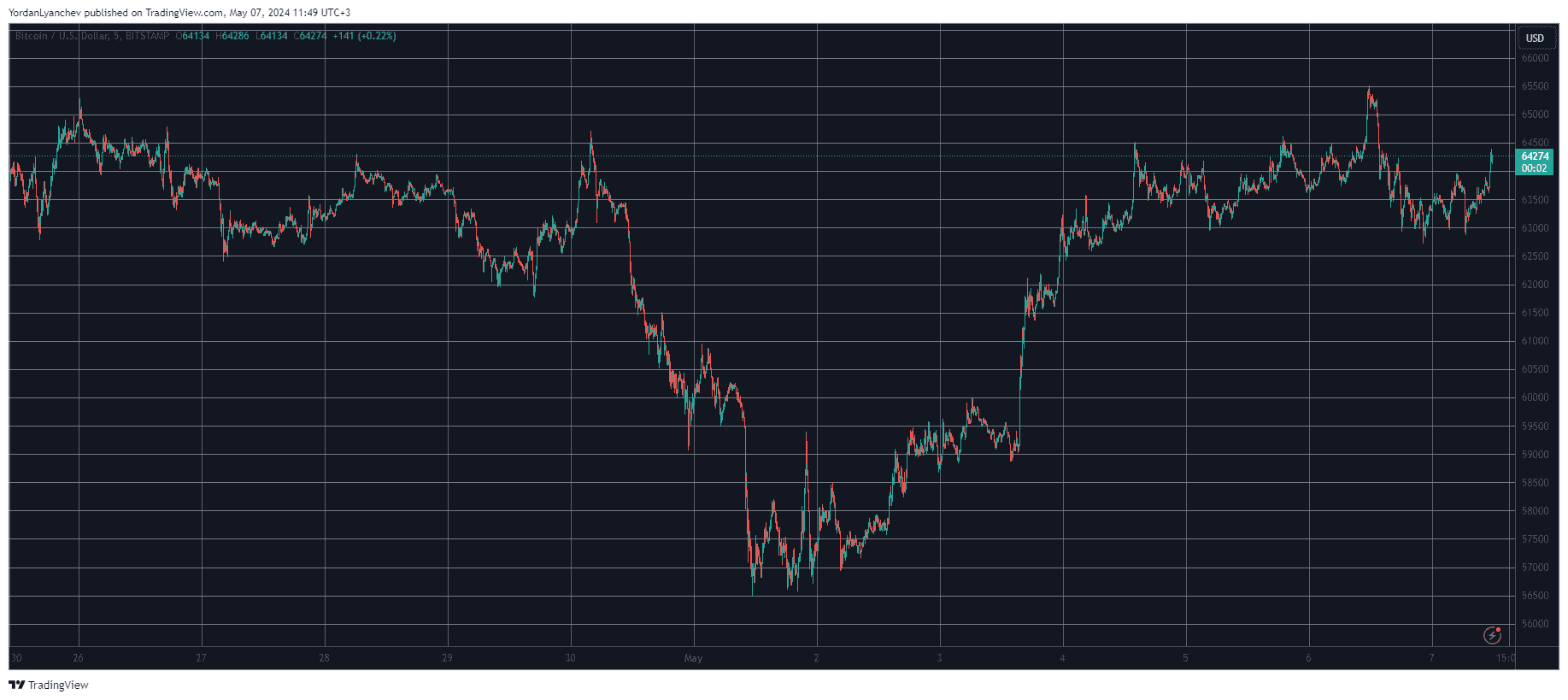

The primary cryptocurrency had a highly volatile and painful last week, which culminated with a massive drop to a two-month low of $56,500 on Wednesday. Another rollercoaster followed when the US Fed said it would not be raising the interest rates later that day, but the actual bounce-off began on Thursday and Friday.

In fact, the asset skyrocketed on Friday by several grand and blew past $60,000. It kept climbing during the weekend and neared $64,500. After a brief retracement on Sunday, the asset went on the offensive Monday morning again and shot up to a 12-day peak of $65,500.

As the bulls were preparing for another charge up, the bears resumed control and pushed bitcoin south by roughly three grand. As a result, BTC slumped to $62,650 (on Bitstamp).

It has recovered some ground since then and currently trades above $64,000. Its market cap has calmed at $1.260 trillion but its dominance over the alts has neared 51%.

DOGE, SHIB, AVAX Go Down Hard

The altcoins were surging hard yesterday, but the trend has now changed for most. Actually, SOL is the only larger-cap alt in the green now, having neared $160 after a 2% increase.

In contrast, DOGE has dumped by 5.3% to under $0.16, SHIB is down by 6% to $0.000024, and AVAX has retraced by 5.8% to $37.

The situation with the mid-cap alts is similar, with MATIC, HBAR, STX, PEPE, TAO, and ICP declining by somewhere between 5-9%. RNDR is the only exception. The asset has soared past $10 after another 5% daily surge.

The total crypto market cap has declined by about $60 billion in a day and is at just under $2.5 trillion.

The post Crypto Markets Lost $60 Billion as Bitcoin (BTC) Dropped by $3K (Market Watch) appeared first on CryptoPotato.