Crypto Markets Lost $40B as Bitcoin Dumped to 10-Day Low: Weekend Watch

Bitcoin didn’t react well to the latest PCE data coming from the US and dropped by almost a grand to a ten-day low.

The altcoins also sit deep in the red, with the most substantial losses coming from MATIC, DOT, UNI, and others.

Bitcoin Fell to $23K

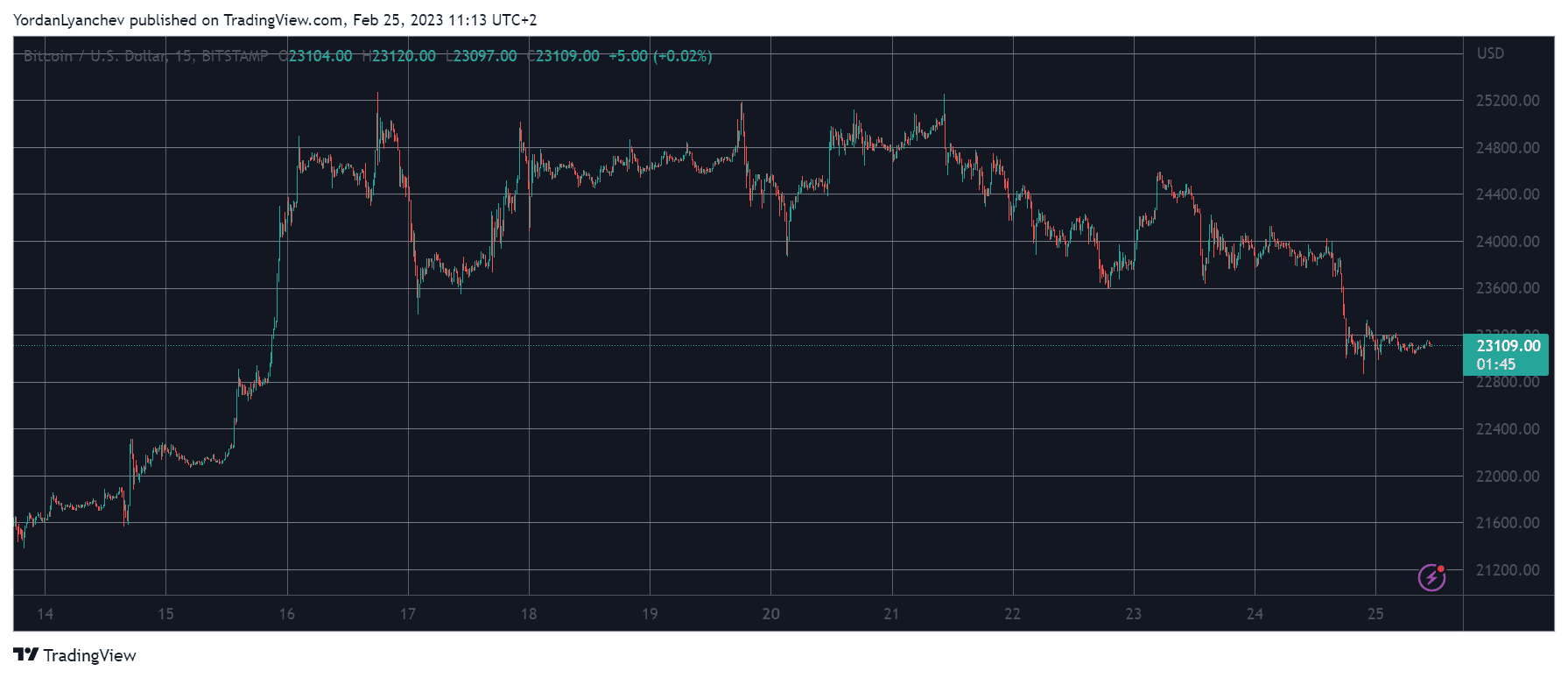

The end of last week went a lot better than this one as BTC skyrocketed by double-digits to chart a six-month high above $25,000. It failed to decisively overcome that line at first but kept trying. However, all three attempts saw quick rejections.

The latest, which came mid-week, pushed the cryptocurrency south to $23,500. The bulls tried to intercept the move and drove bitcoin back to above $24,000 hours later. It seemed that the asset had calmed around that level, but the landscape changed once the US announced that the PCE inflation metric had increased by 0.6% for January.

Bitcoin reacted with a sharp price drop, which drove it from $24,000 to just under $23,000. Thus, the asset charted its lowest price tag in ten days.

It trades just inches above $23,000 as of now, but its market cap struggles beneath $450 billion. Its dominance over the alts is rather stagnant at 42.1% on CMC.

Altcoins See Red

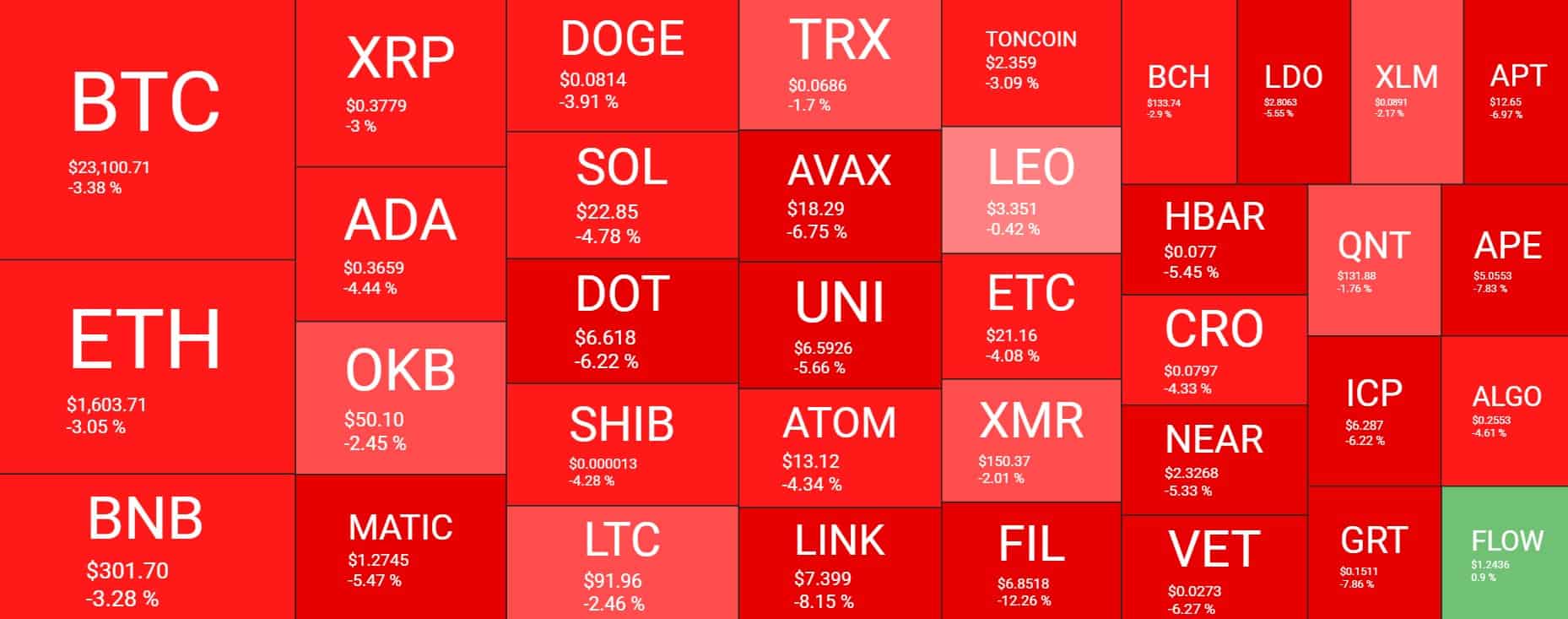

As it typically happens when there’s enhanced volatility with bitcoin, the altcoins feel it even more vigorously.

Ethereum is down by 3% on the day and struggles to remain above $1,600. Binance Coin has declined by a similar percentage and sits at $300. Cardano, Ripple, OKB, Dogecoin, Solana, Shiba Inu, and Litecoin are also in the red, losing up to 5% in a day.

Those who have declined by over 5% now are Polygon, Polkadot, Avalanche, Uniswap, Chainlink, Filecoin, and many others.

As such, it’s no surprise that the cumulative market cap of all crypto assets has declined to $1.060 trillion after losing $40 billion in a day.

The post Crypto Markets Lost $40B as Bitcoin Dumped to 10-Day Low: Weekend Watch appeared first on CryptoPotato.