Crypto Markets Lost $300B in 4 Days, Bitcoin Saw Lowest Daily Close Since July 2021 (Market Watch)

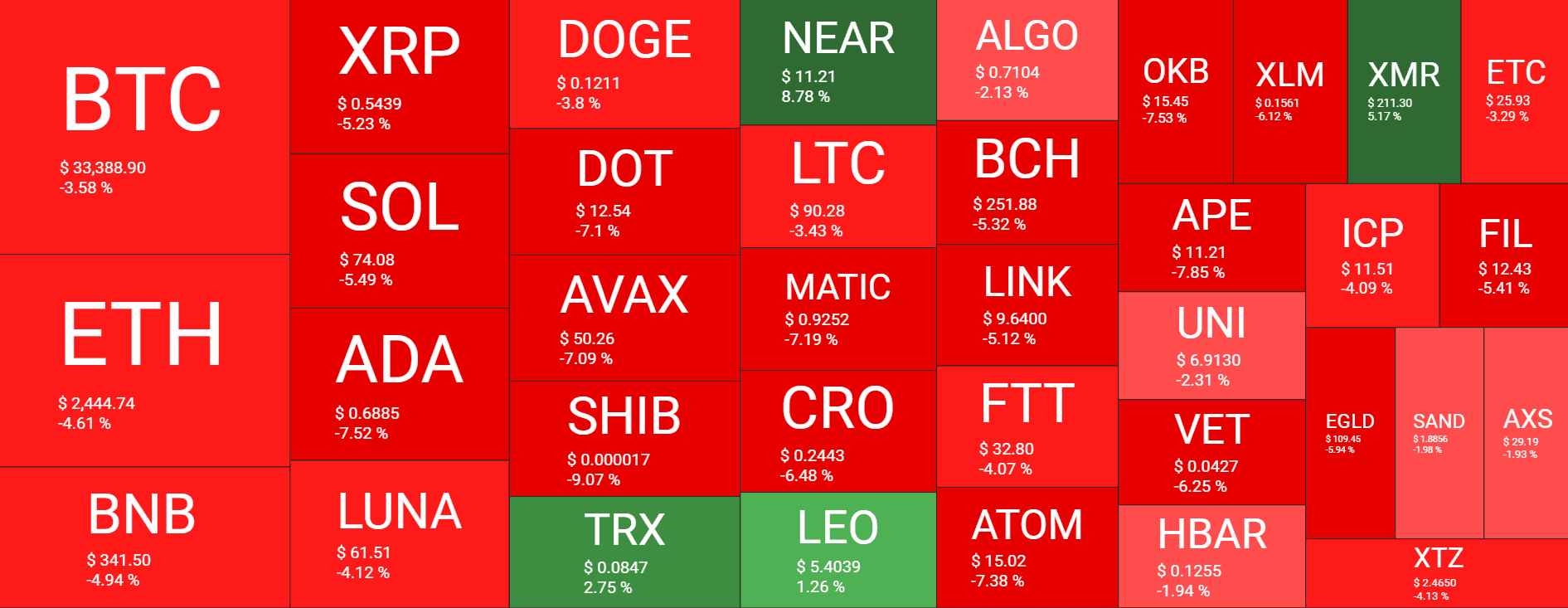

Bitcoin’s nosedives continued in the past 24 hours as the asset just doesn’t seem to stop losing value. Most altcoins are in a similar or even worse position, with massive price drops from Ripple, Solana, Cardano, Shiba Inu, Polkadot, and others. In contrast, NEAR Protocol is among the few gainers.

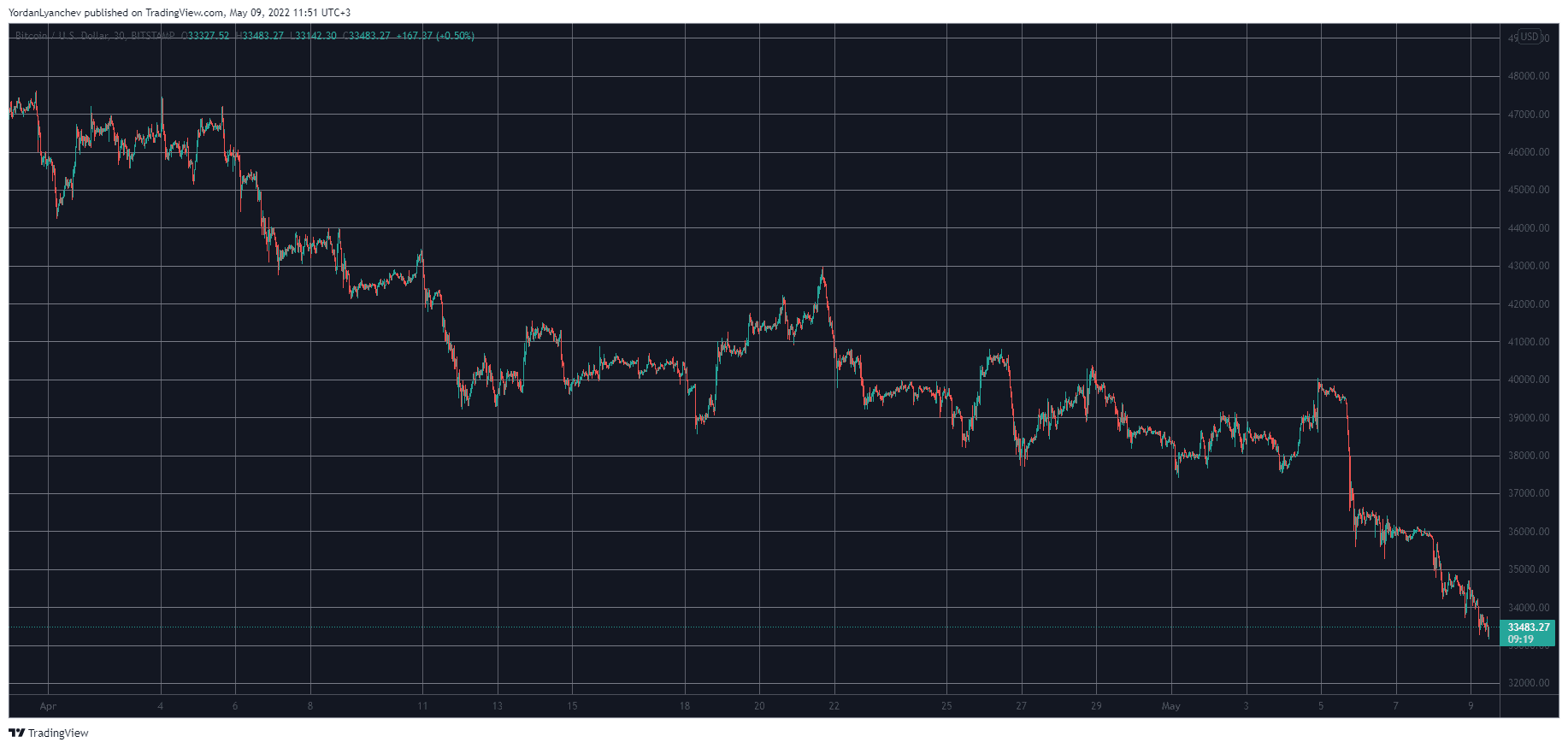

Bitcoin’s Dump to $33K

It was just four days ago when the primary digital asset had spiked to $40,000 following the latest FOMC meeting. Although it failed at overcoming this level, it stood close to it for several hours before the market outlook changed entirely.

In just a matter of hours, BTC dumped by $4,000 to a multi-week low (at the time) of $36,000. While that was a substantial price drop of its own, it wasn’t the end. As reported yesterday, bitcoin slid below $35,000 to chart a new local bottom – this time, the lowest since late January.

However, that was not all either, as the cryptocurrency fell once again to just over $33,000. This became its lowest daily close price since the summer of last year.

As of now, bitcoin still struggles around that level. As such, its market capitalization has taken another hit and is now down to $635 billion.

Altcoins Keep Losing Value

Similar to bitcoin, most alternative coins have been freefalling in the past several days as well. Many charted multi-month lows of their own.

Ethereum touched $3,000 earlier this month, but it has lost over $500 since then. Another 4.5% decline in the past 24 hours brought the second-largest cryptocurrency well beneath $2,500.

Binance Coin (down by 5% in a day) now trades at $340 after standing above $400 less than a week ago. Terra and Dogecoin have declined by similar percentages.

Ripple, Solana, Cardano, Polkadot, Avalance, and Shiba Inu have lost even more substantial chunks of value.

NEAR Protocol is among the few exceptions, with a notable price increase of 9%. Consequently, NEAR trades above $11.

Nevertheless, the cumulative market cap of all crypto assets is down to just over $1.5 trillion. This means that the metric has seen about $300 billion gone in four days.