Crypto Markets Lose $100B: ETH Beneath $3K as BTC Failed at $44K (Market Watch)

After failing to overcome $44,000 decisively, bitcoin has retraced once again to around $42,000. Most alternative coins have also bled out in the past 24 hours, with Ethereum struggling well below $3,000.

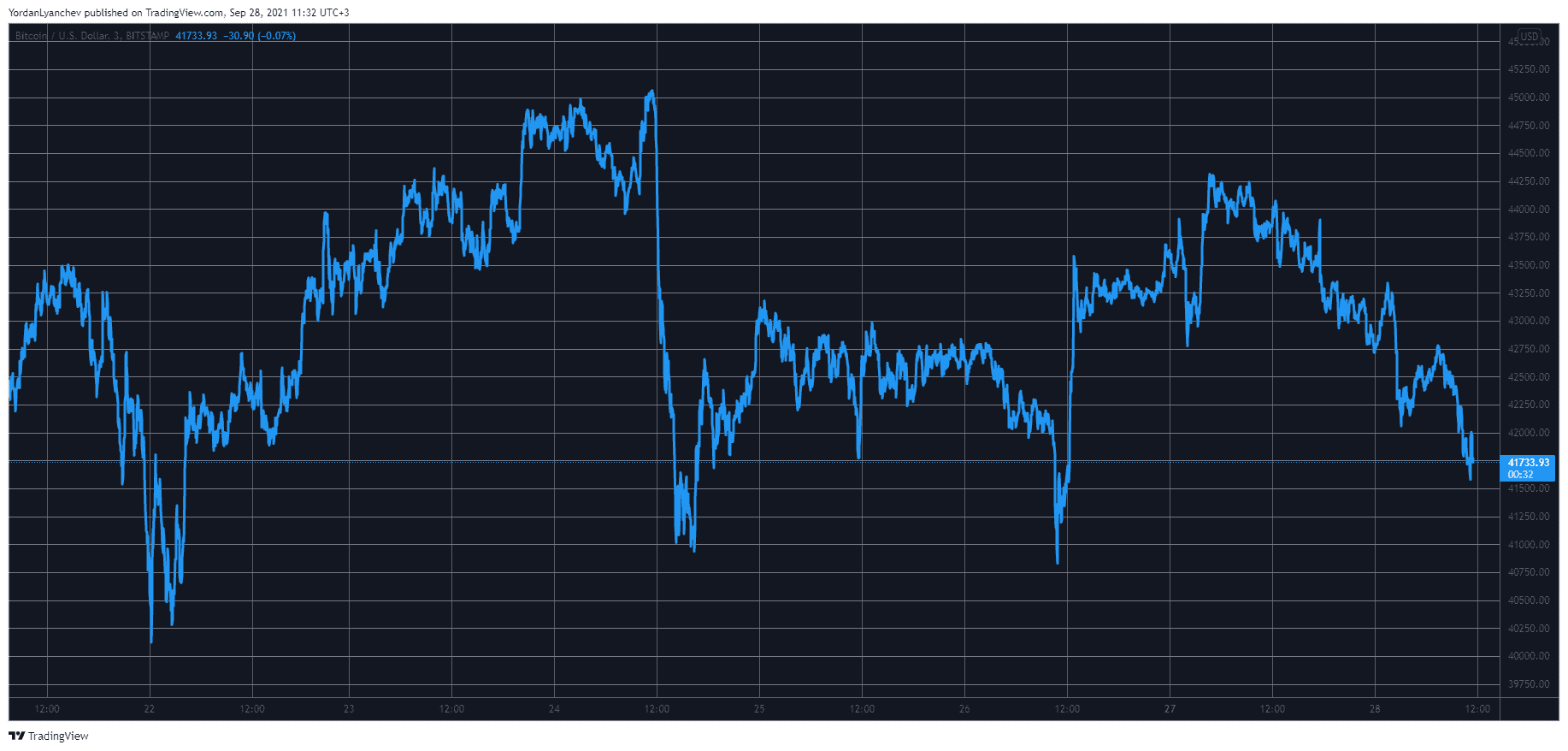

Bitcoin Falls to $42K

The past several days have been quite volatile for the primary cryptocurrency. It had just recovered from the drop below $40,000 and was riding high on Friday at $45,000 when a new set of Chinese FUD pushed it south once more. In just a matter of minutes, BTC plummeted by $4,000.

The weekend started on a more positive note, and bitcoin bounced off to $43,000. However, Sunday begun with a massive dump to $40,500 before a sudden price surge drove the asset to above $43,000.

The bulls drove it a step further on Monday, as reported, and BTC tapped a three-day high of $44,300. However, it failed to remain there and started to lose value gradually in the following hours.

As of now, BTC has dropped below $42,000 once more, and its market capitalization stands beneath $800 billion.

Altcoins Covered in Red

As it typically happens when BTC heads south, most of the altcoins follow suit. Ethereum leads the adverse trend with a 6.5% drop. Just a few days ago, ETH was well above $3,100, but it’s now down to approximately $2,900.

The rest of the larger-cap alts are in a similar situation. These include Cardano (-5%), Binance Coin (-5%), Ripple (-4%), Solana (-3%), Polkadot (-7%), Dogecoin (-3%), Avax (-3.5%), Luna (-3%), and Uniwap (-5%).

Even more losses are evident from the lower- and mid-cap alternative coins. Perpetual Protocol has dropped the most in a day (-15%) to $15. Celer Network (-12%), Arweave (-11%), Curve DAO Token (-10%), ICON (-10%), SushiSwap (-10%), Hedera Hashgraph (-10%), Aave (-10%), and Algorand (-10%) are next.

As such, the cumulative market capitalization of all cryptocurrency assets has declined by $100 billion from yesterday’s peak to $1.850 billion.