Crypto Markets Erased $300B in Days, Bitcoin Dipped to $20.8K: Market Watch

Bitcoin kept plunging in the past 24 hours to a new multi-year low of under $21,000. Most of the altcoins followed suit with massive price losses. ETH is among the leaders in this adverse trend as it dipped below $1,100.

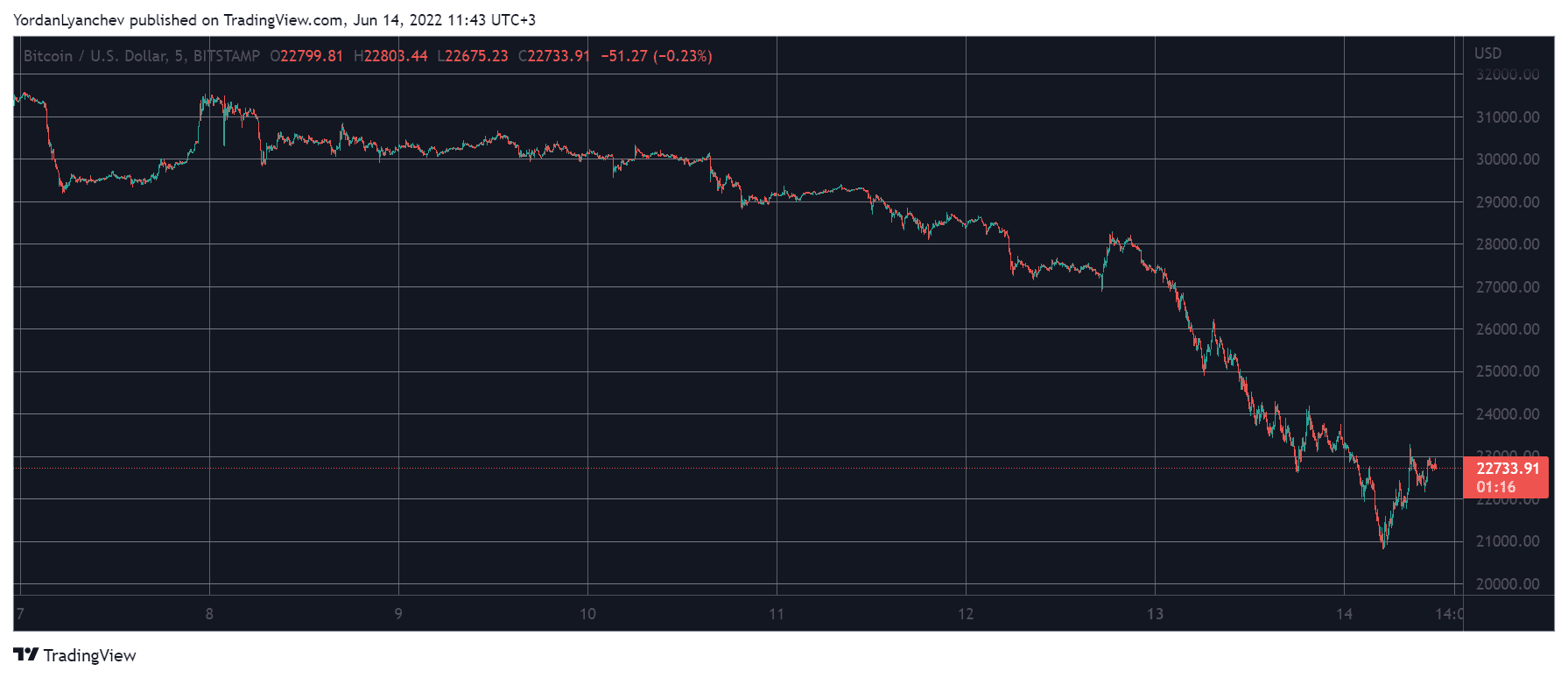

Bitcoin’s 24H Decline

It’s safe to say that the bears have complete control over the market. Just a week ago, BTC challenged $32,000 on a few occasions but to no avail. The subsequent rejections brought the cryptocurrency south to around $30,000.

The record-setting inflation numbers from the US pushed it down to $29,000 on Friday before the situation took another turn for the worse during the weekend and on Monday.

At first, BTC dumped to $27,000 before slipping to $25,000. Yesterday, though, bitcoin lost another sizeable chunk of value and dumped to just under $21,000, resulting in over $1 billion in liquidations.

As of now, the asset has reclaimed some ground and stands close to $23,000. Nevertheless, its market cap is down to $430 billion, and its dominance has been reduced by 2% in a day.

Notable 24H BTC News

Amid the ongoing price crisis, bitcoin’s monthly relative strength index dropped to its lowest point ever. The number of addresses in profit declined to under 50%.

The Spent Output Profit Ratio (SOPR) suggested more bad news for the primary cryptocurrency since the bottom might not be here yet.

Despite the recent price turmoil, legacy investor Stan Druckenmiller stays bullish on BTC, saying he would prefer it over gold in times of enhanced inflation.

ETH’s New Low, While Some Alts Recover

Ethereum continues to be among the most substantial losers in this market crash. ETH stood above $2,000 a week ago and lost almost 50% of its value in the past seven days. Just hours ago, the second-largest crypto found itself trading below $1,100. Now, though, it has bounced off and sits above $1,200.

Most of the larger-cap alts, are in a better position on a daily scale. Following the massive declines yesterday, ADA, SOL, Polkadot, and Avalanche have recovered double-digit percentages.

Shiba Inu is up by around 8%, while BNB, XRP, TRX, and LEO are approximately at the same positions as yesterday.

The crypto market cap dropped below $1 trillion yesterday and fell all the way down to $900 billion earlier today. Despite recovering $60 billion since then, the metric is still down by $300 billion in less than a week.

Altcoin News

CEL slumped the most yesterday as Celsius halted withdrawals citing extreme market conditions.

Cardano launched its own Ethereum Virtual Machine (EVM) sidechain alpha on its testnet.

The recent MimbleWimble Extension Blocks upgrade has caused issues for Litecoin as several exchanges said they will stop supporting the asset.

The Ethereum dev team said they had delayed the difficulty bomb once again to better prepare for The Merge.