Crypto Market Watch: DeFi Tokens Explode As Bitcoin Price Stagnant

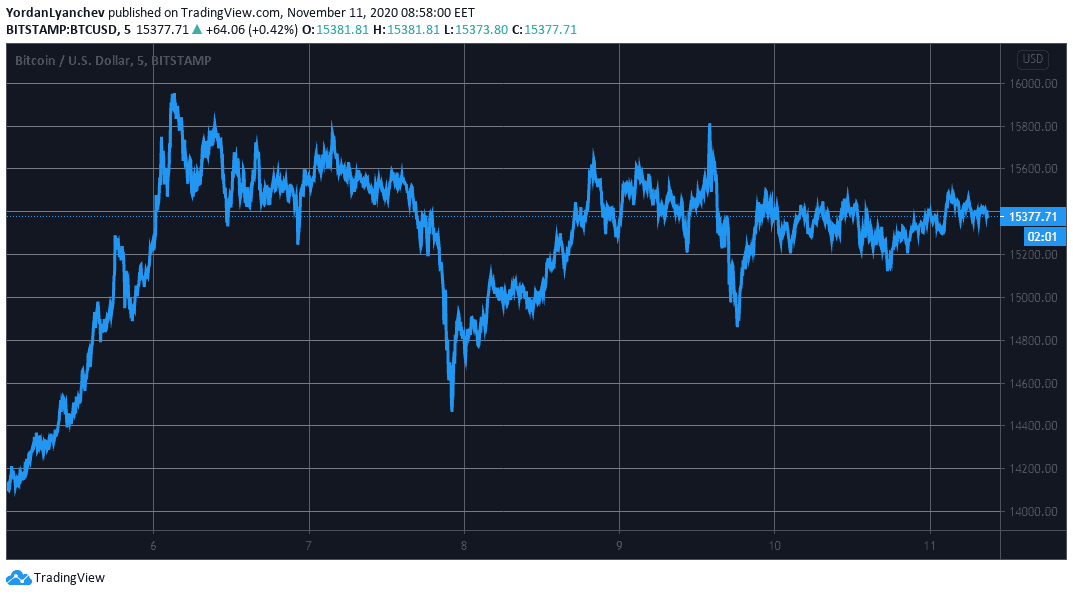

During the past 24 hours, Bitcoin tanked to $15,100, but it has recovered since then and trades around $15,400. Most high and mid-cap altcoins have outlined substantial gains and have reduced BTC’s dominance to below 64%.

Bitcoin Price Slides But Recovers

After peaking at nearly $16,000 last week, Bitcoin has struggled with maintaining such a high price tag. It dropped below $14,300 a few days after, but managed to initiate a false breakout towards $15,800 when news broke that Pfizer’s COVID-19 vaccine has worked successfully in 90% of trial cases.

Nevertheless, the primary cryptocurrency slumped once more to below $15,000 just hours after. It reclaimed the $15,000 mark on November 9th and hasn’t looked back since.

In the past 24 hours, the asset slipped briefly to $15,100. However, the bulls quickly took charge and sent it to its current level of about $15,400.

The technical indicators suggest that BTC would have to conquer the resistance lines at $15,600 and $15,800 before potentially challenging the year-to-day high at $16,000.

Alternatively, BTC could rely on $15,200, $15,000, and $14,900 in case another price dip arrives.

Altcoins In Green: DeFi Tokens Explode

Most alternative coins have been soaring in the past 24 hours. Ethereum has increased by 3% and trades slightly above $460. Thus, ETH’s impressive performance since the US Presidential election day continues. The second-largest cryptocurrency traded at $370 on November 3rd and has gained nearly 25% in a week.

Ripple has jumped by 2%, but XRP still sits beneath $0.26. Chainlink (3%), Polkadot (3%), and Litecoin (2%) have also increased in value. As a result, LINK sits above $13, Polkadot is at $4.5, while LTC has neared $60.

Even more impressive performances come from lower-cap altcoins and especially DeFi tokens. Loopring is the most notable gainer in the past 24 hours, with a 26% surge. UMA (19%), SushiSwap (16.5%), Compound (14%), Celo (13%), Reserve Rights (13%), Ampleforth (12%), Kyber Network (10.5%), Yearn.Finance (10%), and Uniswap (10%) complete the double-digit price gainers.

With the increases among the altcoins and BTC’s static performance on a 24-hour scale, Bitcoin’s dominance has suffered. The metric comparing BTC’s market capitalization against all alternative coins has fallen to 63.8%. Only a few days ago, it hovered above 66%.