Crypto Market Regulatory Uncertainty Overshadows Blockchain Development: Bank of America

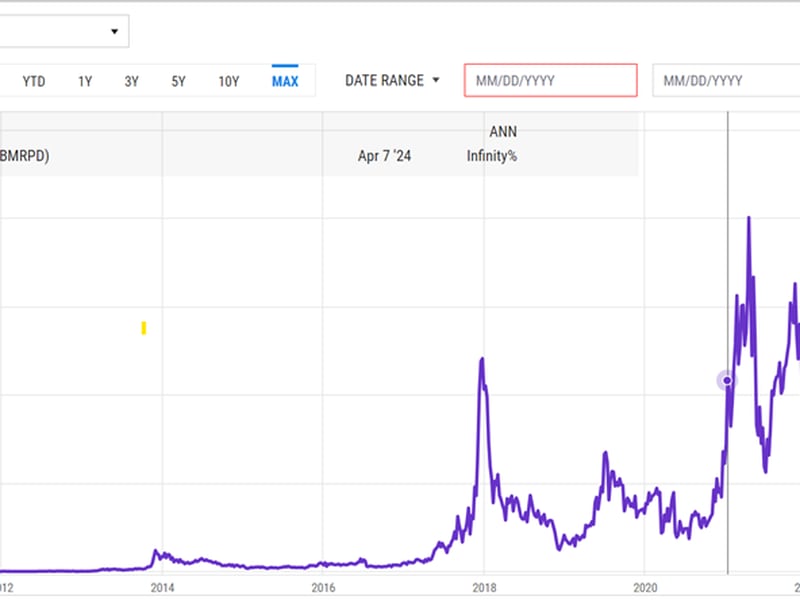

The rally in risk assets continues, but digital assets have underperformed the Nasdaq stock index by 24% since the beginning of May after gaining 52% from the start of the year, Bank of America (BAC) said in a Friday research report.

“Digital asset sentiment remains poor as the U.S. Securities and Exchange Commission’s (SEC) enforcement actions create regulatory uncertainty, pressuring token prices,” analysts Alkesh Shah and Andrew Moss wrote, adding that “digital asset trading platforms are just one piece of the broader ecosystem.”

The regulator said earlier this month that it was suing Binance, its founder Changpeng “CZ” Zhao and the operating company for Binance.US on allegations of violating federal securities laws. A day later it sued rival exchange Coinbase on similar charges.

Bank of America says an excessive focus on regulatory headwinds, spot bitcoin exchange-traded-fund (ETF) approval in the U.S. and illicit activity is “overshadowing the rapid development and integration of distributed ledger and blockchain technology infrastructure.”

“Specifically private permissioned distributed ledgers and blockchain subnets,” that enable the tokenization of traditional financial assets, the report added.

The bank says it expects blockchain infrastructure and tokenization to “transform financial and non-financing infrastructure and markets over the next five to 10 years.

Edited by Sheldon Reback.