Crypto Market March Roundup: Bitcoin Rises Amid Banking Uncertainties, Macro Headwinds

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

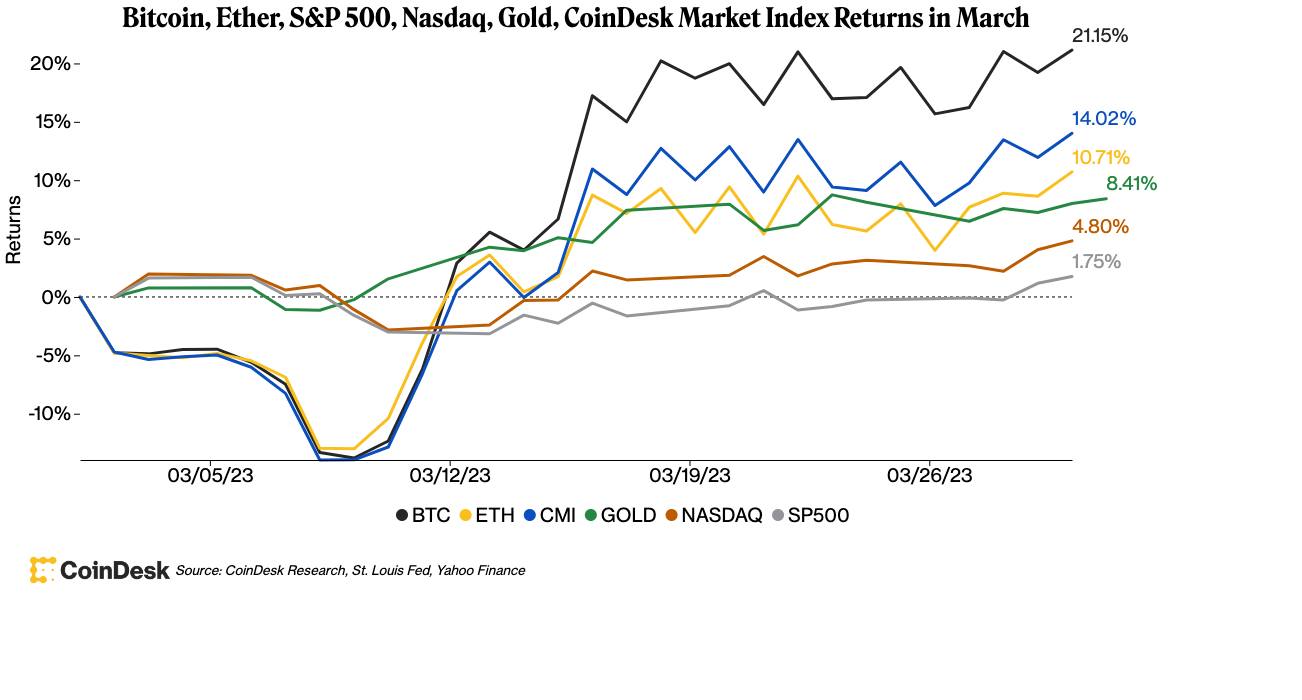

An eventful March of bank failures, ongoing inflationary and other macroeconomic headwinds left investors mulling where to place their trust – and cash – and ultimately proved favorable for bitcoin and other cryptos considered stores of value impervious to turmoil.

Bitcoin (BTC) was recently trading at around $28,500, up over 21% in March. At one point Wednesday, the largest cryptocurrency by market value broke the $29,100 mark to reach its highest mark since June 2022. BTC has widely outperformed the S&P 500, Nasdaq and other traditional assets. The tech-focused Nasdaq rose over 4% for the month.

(Chart data source: CoinDesk Research, St. Louis Fed and Yahoo Finance)

“The macro landscape has been extremely constructive for ‘alternative money’ in March,” Greg Magadini, director of derivatives at crypto analytics firm Amberdata, told CoinDesk in an email, adding that both BTC and gold, traditionally viewed as safe-haven assets, had seen “explosive upside volatility” this month.

Magadini wrote that recent BTC’s volatility in the options market following the implosion of crypto-friendly Silvergate and Silicon Valley banks differed significantly from the more dramatic shifts following the collapse of exchange FTX and other crypto calamities last year.

“BTC is exploding higher,” he said. “This rush into ‘alternative money’ (BTC and GOLD) shows some panic around purely holding USD.”

This month’s gains came, even as the crypto industry endured the collapse of crypto-friendly banks Silvergate and Silicon Valley Bank and a flurry of regulatory enforcement activity. This week, the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance, the world’s largest crypto exchange by trading volume, and its founder Chengpeng Zhao over alleged regulatory violations. The aftershocks of the banking crisis rocked the stablecoin sector earlier in the month, but cryptos were largely unaffected.

For institutional investors, one of their biggest concerns hasn’t been “the market volatility around bitcoin” but “the regulatory volatility and the regulatory uncertainty,” Ben McMillan, chief investment officer of crypto asset manager IDX Digital Assets, told CoinDesk prior to the Binance-CFTC lawsuit news.

Ether (ETH), was recently changing hands at $1,820, up 13% in March. Earlier in the month, the second-largest crypto in market value hit $1,861, its highest level since August 2022.

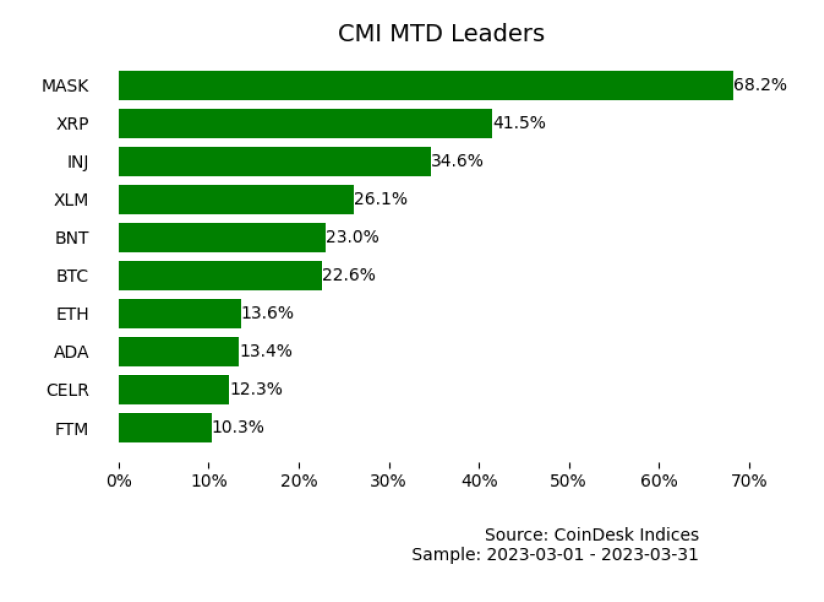

Encrypted messaging protocol Mask Network’s native MASK token grabbed the trophy as the best-performing token among 160 assets in the CoinDesk Market Index (CMI), soaring 68% in March to change hands at $6.30.

CoinDesk Market Index’s Monthly Leaders (CoinDesk Indices)

The jump came after a whale withdrew some 3.6 million MASK tokens, worth around $14.8 million at that time, from several exchanges through multiple addresses, according to an analysis by on-chain researcher Lookonchain.

Lookonchain said that past data patterns show that “in many cases, transfer-in will lead to higher MASK prices, while transfer-out will cause a price drop.”

Crypto payment platform XRP Ledger’s XRP token was the second-best performer, climbing over 41% to recently trade at 54 cents. Part of the surge came after reports that XRP issuer, Ripple was well-placed to win a landmark case with the U.S. Securities and Exchange.

“XRP has been in a legal struggle for a while, but the fact that we may finally see a legal conclusion for XRP makes it gain a lot of value,” Amberdata’s Magadini said.

Injective Protocol’s INJ token and Stellar’s XLM token rose 34% and 26%, respectively.

Looking by sectors, the CoinDesk Currency Index was the month’s biggest winner with a 21% gain, followed by the Smart Contract Platform sector’s 9% advance.

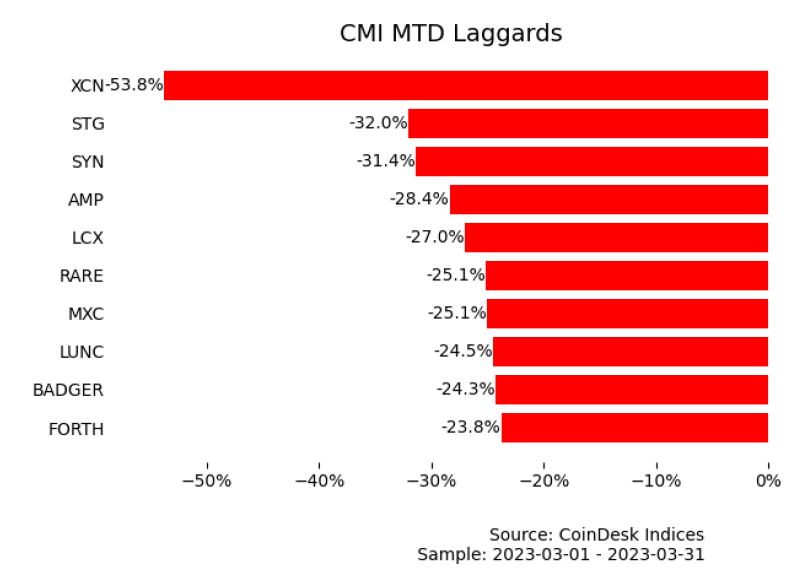

Chain’s XCN token in the CMI’s Currency sector was among the biggest CMI laggards, plunging over 53% in March.

CoinDesk Market Index’s Monthly Laggards (CoinDesk Indices)

Cross-chain bridge protocol Stargate Finance’s STG token in the Decentralized Finance (DeFi) sector tanked over 32% to trade at 71 cents, according to data aggregator CoinGecko.

The StargateDAO intended to reissue STG tokens by March 15 amid community concerns about liquidity and security stemming from the protocol’s entanglement with Alameda Research, the trading arm of embattled crypto exchange FTX. But the group abandoned those plans after a rebuke from FTX liquidators.

The AMP token, a collateralized token designed to accelerate transactions in crypto networks, dropped 28%, while crypto exchange LCX’s LCX token fell 27%.

Stefan Rust, a crypto investor and CEO of data aggregator Truflation, wrote in an email to CoinDesk on Wednesday that traditional finance (TradFi) had reached a tipping point. “It seems people are realizing that the banking crisis isn’t really over,” he wrote.

Rust noted that the bank collapses had eliminated valuable resources for investors and others eager to participate in the digital-asset ecosystem and alluded to rising regulatory pressures in the U.S. that may be creating obstacles to the industry’s growth. “Many are trying to navigate the on and offramp situation and find loopholes,” he wrote.

But he added that the recent unsettled relationship between DeFi and TradFi is likely to steady. “Over the long term, there will be a whole new on and offramp system between DeFi, crypto and the fiat world, as trust in centralized, regulated institutions has definitely had its back broken,” he wrote. “There is no longer a need to keep all your funds in one bank, one central entity that holds all of your assets in custody, as who knows what will happen with that entity and ultimately your savings.”

“Markets always take a bit of time to readjust, reacquire confidence and find new paths and funding streams. Money will always move uphill, however,” he wrote.

James Rubin contributed to this report.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.