Crypto Market Leaders and Laggards: The Biggest Movers of the Week

The CoinDesk Market Index of 183 assets – a broad-based indicator of crypto market sentiment – is down 1.4% for the last week. But that is just a blip in its 60.1% growth year to date.

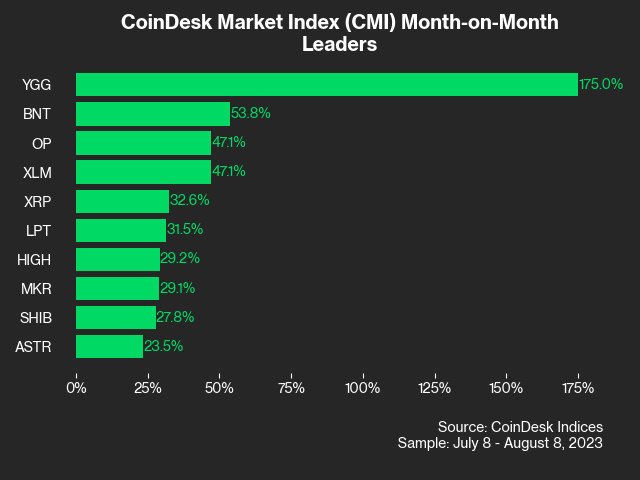

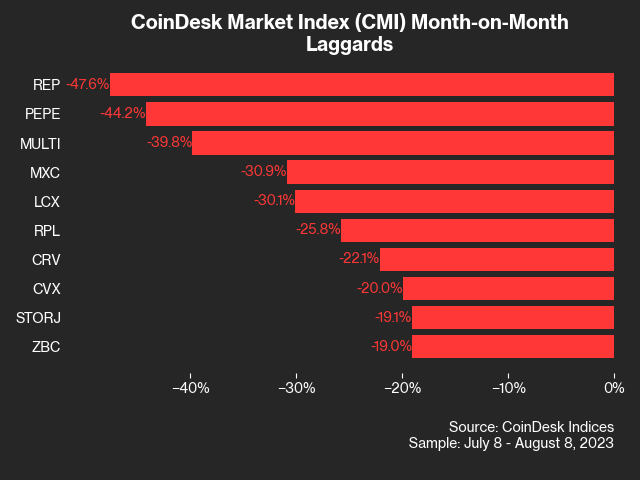

Let’s take a look at the bigger picture of the top-10 and bottom-10 assets based on their performance month on month.

Culture and entertainment assets and currencies predominated the leaders. Small gaming and metaverse protocols including Yield Guild Games (YGG), a global community that bands gamers together to play, and HighStreet (HIGH), a decentralized metaverse and massively multiplayer online role-playing game, as well as LivePeer (LPT), a decentralized video streaming network protocol, made a huge impression in the top 10 leaderboard. But their impact overall was not so large. As these are all small players, the culture and entertainment sector, which is market-cap weighted, was pretty flat month on month (down 0.4%).

The spectacular up and down of Yield Guild Games is a story still in progress. On Aug. 3, the guild announced the launch of its fourth audience-building campaign that features numerous quests and rewards. The token rose a dizzying 600% over the next four days, but on Aug. 7 began to plummet as rumors that the guild’s initial backers were using the opportunity to take their money out. “It appears to be a pump and dump,” said CoinDesk Indices Data Analyst Reilly Decker.

Stellar (XLM), XRP (XRP) and Shiba Inu (SHIB) were the biggest currency leaders over the last week.

XRP is still benefiting from a U.S. judge’s ruling last month that the sale of XRP tokens on exchanges do not constitute investment contracts (and therefore are not covered by securities laws).

Just this month, Shiba Inu (SHIB) announced it would tie digital identity services across all of its platforms, another sign of its effort to distance itself from its meme coin origins and become a serious DeFi protocol. Recently, a shiba inu investor – believed to be a founder or founders holding 10% of the token’s total supply – moved some $30 million worth of their stash to eight wallets, on-chain analytics tool Lookonchain said in a tweet.

Going the other way, the two biggest laggards month on month were also in culture and entertainment and in currencies. Augur (REP), a decentralized prediction market, otherwise known as betting, and Pepe (PEPE) is a meme coin. Both of these tokens seem to have lost investors’ interest lately.

Another tumbler was Curve Finance (CRV), which suffered a $70 million hack in July, at one point raising doubts as to its viability as a going concern.

In crypto, there are always winners and losers, often massively so.

Edited by Ben Schiller.