Crypto Market Has Evolved in the Past Year, Canaccord Says

-

The crypto market is back in growth mode following a period of consolidation, the report said.

-

Canaccord noted that the launch of spot ETFs in the U.S. has led to broader institutional adoption of digital assets.

-

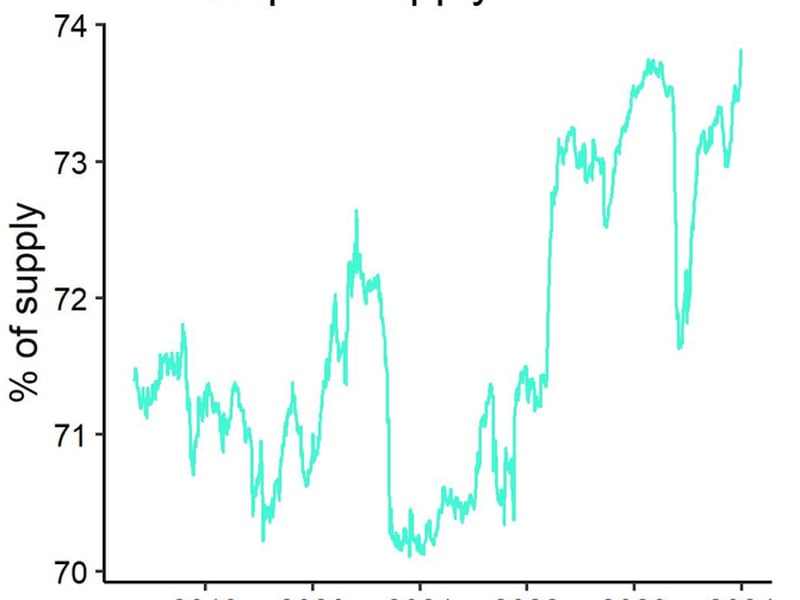

Institutional allocations to crypto are expected to increase, the broker said.

The digital assets industry has bounced back from the collapse of crypto exchange FTX in November 2022 and has returned to growth in the past year, broker Canaccord said in a research report on Wednesday.

FTX, the crypto exchange founded by Sam Bankman-Fried, filed for Chapter 11 bankruptcy following a CoinDesk exclusive highlighting the weakness of the company’s balance sheet. The company’s collapse was a major contributor to the crypto winter and bear market for digital assets.

“In the last year, we believe the broader digital assets industry has transitioned from a post FTX consolidation/recovery phase back to one focused on growth and business model/total addressable market (TAM) expansion,” analysts led by Joseph Vafi wrote.

The launch of spot exchange-traded funds (ETFs) in the U.S. earlier this year was a positive catalyst for the crypto market.

With the approval of both bitcoin (BTC) and ether (ETH) spot ETFs, “we have also seen broader institutional adoption of digital assets and expect portfolio allocations here to continue to increase,” the authors wrote.

Spot ether ETFs started trading in the U.S. on July 23, about six months after the bitcoin funds.

The broker praised Michael Saylor’s MicroStrategy (MSTR) for its “continued evolution into a Bitcoin development company,” and noted that the shares have risen around 325% in the past year, outperforming most asset classes including BTC, which has gained about 148%.

Wall Street giant Citi (C) noted that the crypto market has struggled since the launch of spot ether ETFs in the U.S., in a report last week.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)