Crypto Market Cap Gains $30 Billion As Bitcoin Eyes $19K (Market Watch)

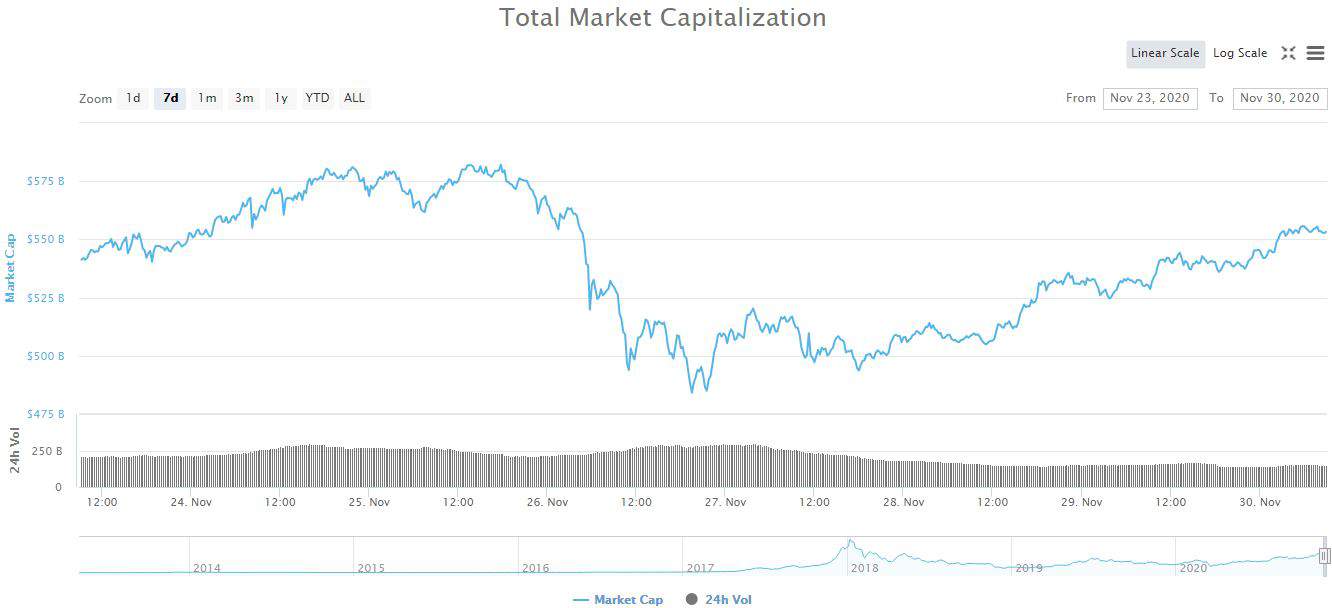

Following the recent price drops to sub-$16,500 levels, Bitcoin has reacted positively and has gradually added over $2,000 of value. The alternative coins have also doubled-down on their recovery sessions, and the total market cap has expanded by another $30 billion in a day.

Bitcoin Reclaims $18K

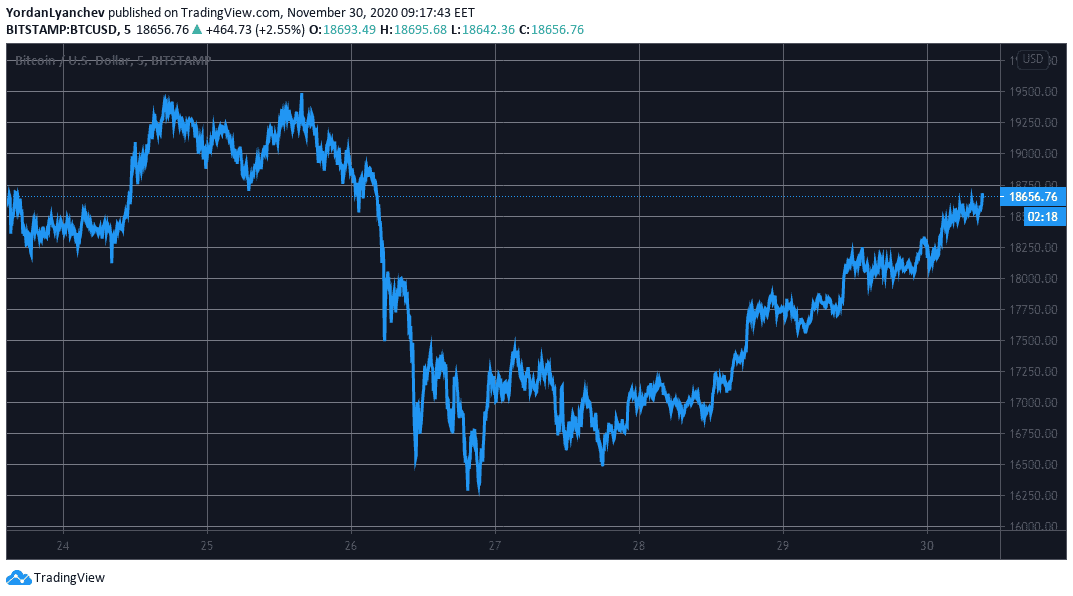

Thanksgiving didn’t provide many reasons for BTC bulls to be thankful for, as the cryptocurrency went on a vigorous price drop that resulted in the loss of over $3,000 in hours.

After bottoming at about $16,250, Bitcoin managed to recover some of its losses and traded around $17,000 for a few days. The situation changed during the weekend, as the primary cryptocurrency began gradually increasing in value.

Bitcoin firstly reclaimed the $17,000 price tag decisively before doing the same with $18,000. As of writing these lines, BTC has risen above $18,600.

From a technical viewpoint, Bitcoin’s next obstacles lie at the resistance lines situated at $18,800 and $19,440 before having a chance to head for a new yearly high.

On the other hand, the support levels at $18,240, $17,850, $17,715, and $17,150 could assist in case the trend reverses once again, and BTC heads south.

Three In A Row: Altcoins Rejoice

The alternative coins suffered the most during the Thanksgiving price drops. Similarly to Bitcoin, though, they have been mostly in the green for a few consecutive days now.

Ethereum bottomed at $485 on November 26th. However, the second-largest cryptocurrency by market cap has recovered most of its losses. After adding another 8% to its price in the past 24 hours, ETH has increased back to $585.

Ripple (3.5%), Bitcoin Cash (5%), Binance Coin (4%), Cardano (5.5%), and Litecoin (7%) are also well in the green.

Chainlink (9%) and Polkadot (11%) are the most impressive top ten gainers. LINK has exploded north of $14, while DOT has neared $5,50.

More double-digit gains are evident from lower and mid-cap altcoins. Aave leads with a 19% surge. Ampleforth (15%), Synthetix (14%), SushiSwap (13%), Yearn.Finance (11%), and Kusama (10%) are next.

Naturally, the aforementioned price developments have affected the total market cap. The cumulative market capitalization of all cryptocurrency assets has surged to $555 billion. This means an increase of $70 billion since November 26th.