Crypto Market Cap Gains $15 Billion as Bitcoin Price Touches $14,100 (Market Watch)

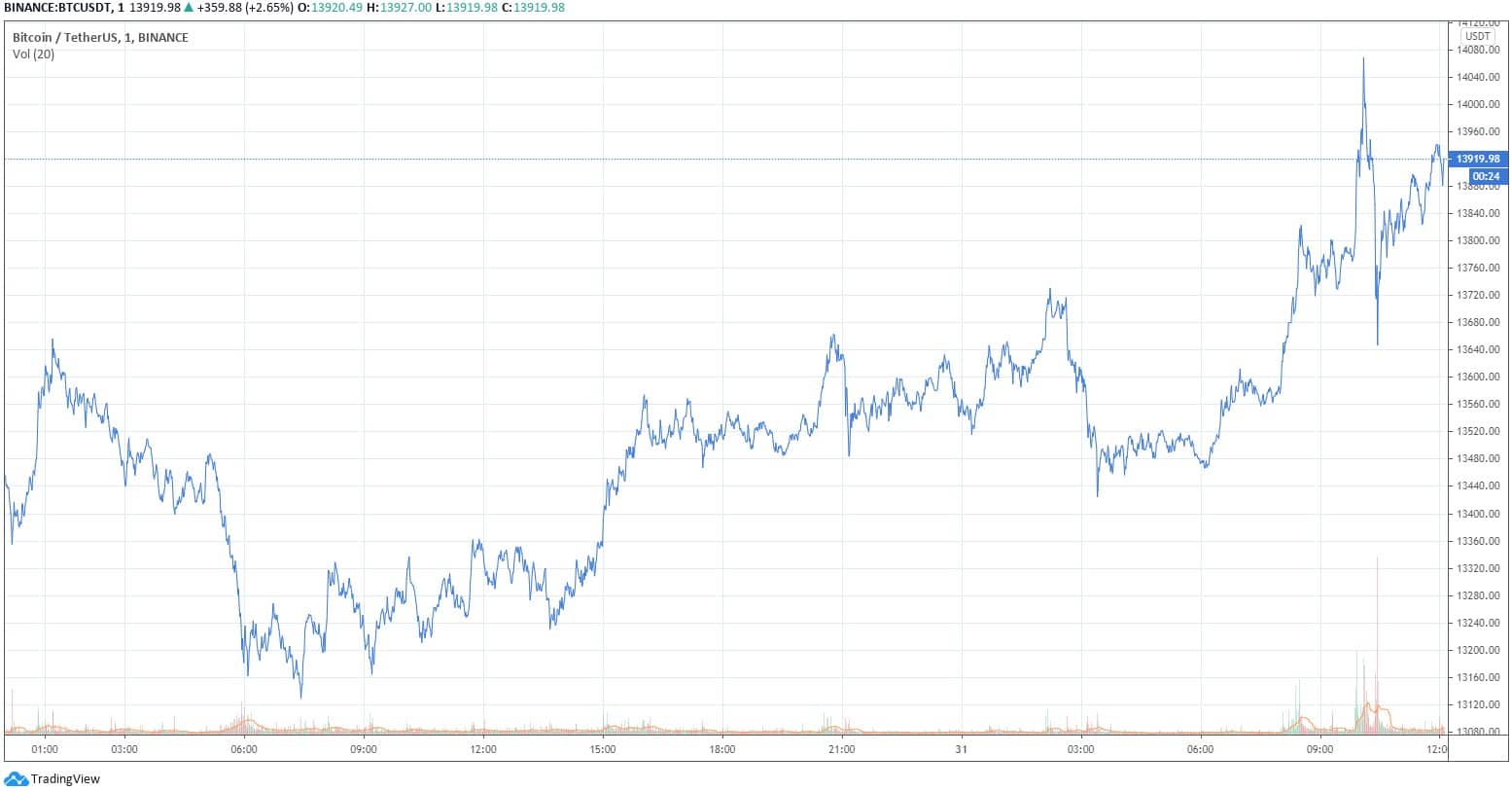

Bitcoin’s roller-coaster continued in the past 24 hours with significant fluctuations resulting in a few $500 moves and it finally breaking the previous 2019 high. The altcoins have taken a breather with some green charted, and the market capitalization has increased by around $15 billion.

Bitcoin Goes On A Wild 24H Ride

It’s safe to say that Bitcoin’s dull days are behind the cryptocurrency. As CryptoPotato reported yesterday, ECB’s announcement drove the asset to nearly $13,700 before losing about $450 rather rapidly.

The price drop resulted in BTC’s intraday low of about $13,150. Since then, though, the primary cryptocurrency has been gradually increasing.

Just a few hours ago, this materialized in a daily high of about $14,100 on Binance, which is a price point that we haven’t seen since January 2018. Since then the cryptocurrency retraced to about $13,900 where it currently trades. It’s interesting to see whether BTC will be able to keep up with its bullish momentum.

In any case, Bitcoin’s dominance also increased slightly to where it’s currently sitting at 63.7%. This shows that altcoins have still been unable to break serious grounds, though most of them are in green dollar-wise.

A Breath Of Fresh Green For The Altcoins

The alternative coins didn’t enjoy the past few days. However, most have been recovering since yesterday.

Ethereum managed to sustain its price above $380 yesterday, and a 4% increase has driven it near $392. Ripple (2.1%), Binance Coin (1.6%), Chainlink (3.7%), Polkadot (5%), Cardano (2.6%), and Litecoin (5%) are also in the green.

As it typically happens, more fluctuations are evident among lower and mid-cap altcoins. Blockstack leads the way with a 17% price jump, and ABBC Coin follows with a 16% increase.

Ren (11%), Ocean Protocol (10.5%), Yearn.Finance (10%), and Reserve Rights (10%) are the other representatives of the double-digit price pump club.

Overall, the total market capitalization has increased from yesterday’s low of $390 billion to $405 billion.