Crypto Market Cap Drops Below $2T as Bitcoin Slides to 17-Day Low (Weekend Watch)

Bitcoin’s recent nosedives continued in the past 24 hours, and the asset slipped to a 17-day low of around $42,000. Most altcoins are also deep in the red, with the most losses coming from Terra, Solana, Avalanche, Cardano, and Dogecoin from the larger-cap ones.

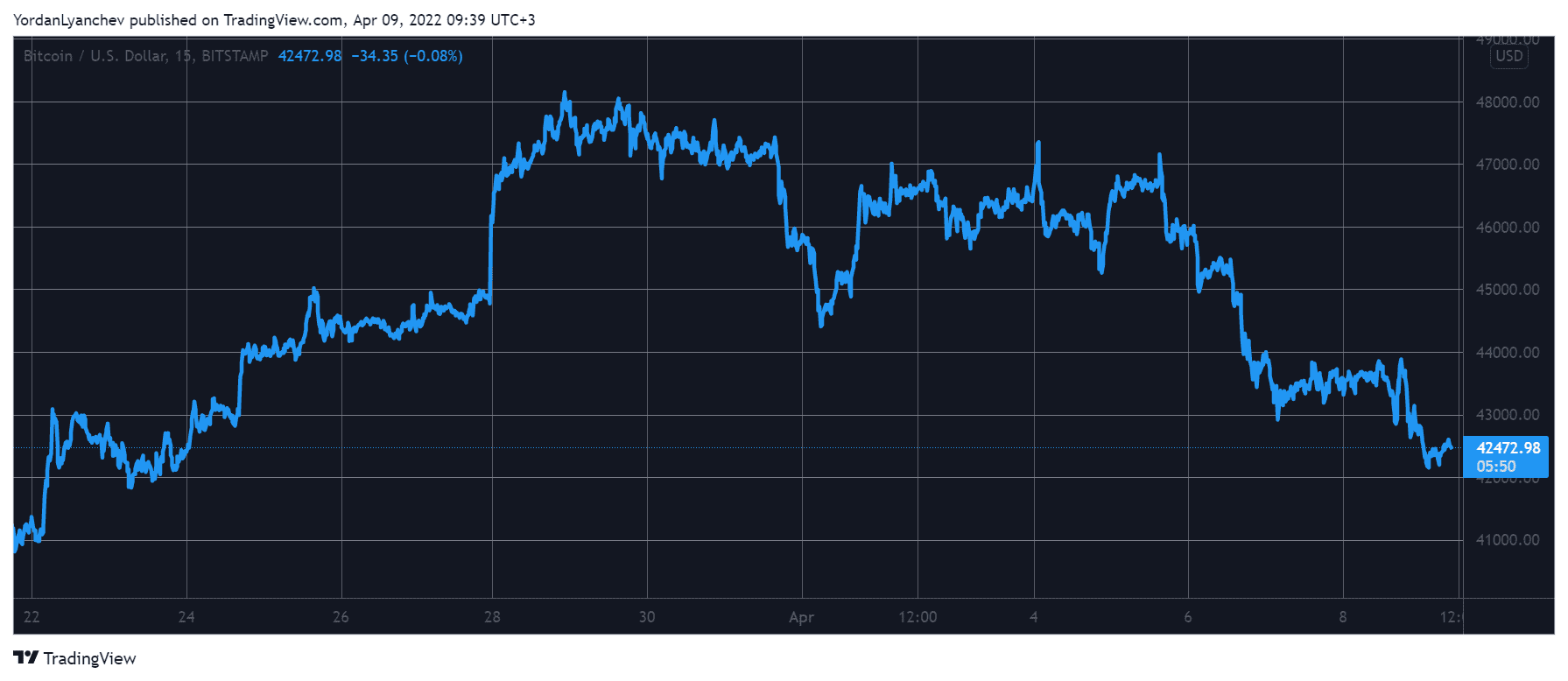

Bitcoin Tested $42K

It was just several days ago when bitcoin was fighting to reclaim $47,000 and spiked above that level twice within a 48-hour period. However, the bears came out from hiding and didn’t allow any further increases.

Both attempts were rejected rather rapidly, but the second one was met with a more violent correction. At first, BTC dumped to $45,000 before it went even further and slipped to $43,000, as reported yesterday.

It bounced off from that line and spiked to $44,000, but that turned out to be a fake breakout, and bitcoin went south once again. This culminated in a drop to just over $42,000 hours ago, which became BTC’s lowest price point since March 23.

As of now, the cryptocurrency stands a few hundred dollars above that particular line, but its market capitalization is down to $800 billion.

Altcoins Turn Red

Similar to bitcoin, the altcoin space has turned red today. Ethereum is among the more modest losers, with a 1.5% decline on a daily scale. As such, the second-largest cryptocurrency has declined to $3,200. It’s worth noting that ETH marked a three-month high above $3,500 just several days ago.

Binance Coin, Ripple, Polkadot, Shiba Inu, and CRO have slipped by less than 5%. In contrast, Cardano, Avalanche, and Dogecoin are down by more than 5% since yesterday.

Solana has dumped by 9% and struggles at $110 after failing at $130 earlier this week. Terra has lost the most – more than 10% in a day – and sits below $95. This comes after a $200 million token swap with Avalanche (AVAX).

The cryptocurrency market capitalization has lost $200 billion in four days. This means that the metric has dumped below the coveted $2 trillion line for the first time since late March.