Crypto Market Cap at 6-Week High: Polkadot (DOT) Explodes 16% (Market Watch)

The bitcoin bulls continued their offensive in the past 24 hours as the asset reached yet another 2-month high of over $42,500. Most alternative coins have outperformed their leader, including ETH, BNB, and DOT, which has jumped by more than 16% in a day.

Green Altcoins; DOT Adds 16% of Value

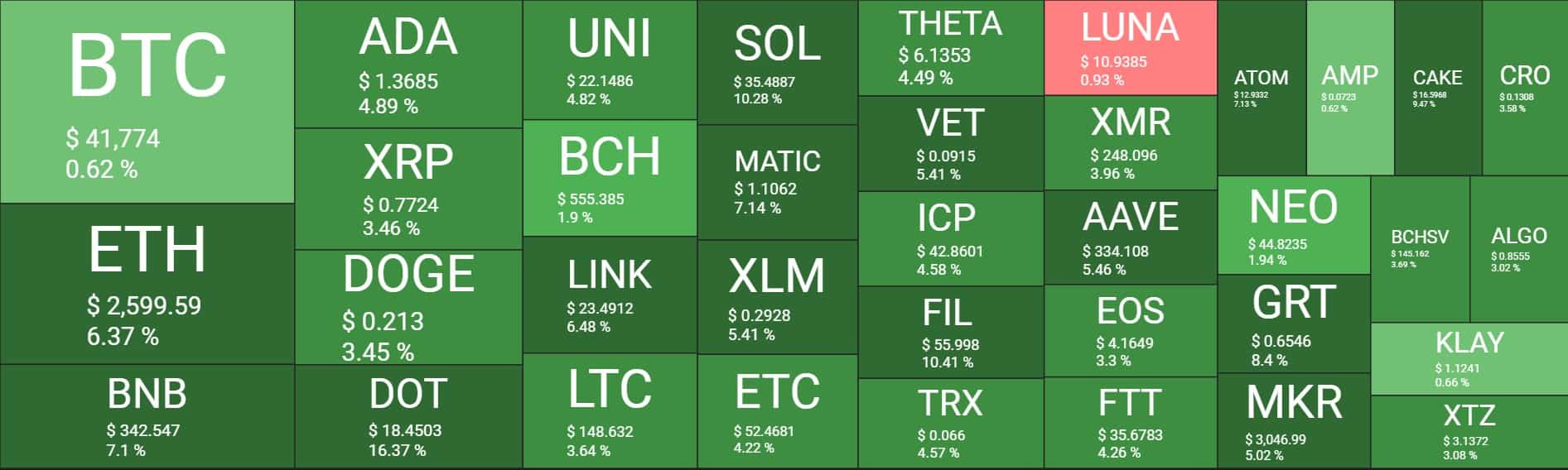

The altcoins were relatively stagnant yesterday, but the situation is significantly different today. Ethereum traded around $2,450, but a 6% increase has driven it to approximately $2,600. Moreover, ETH even reached $2,650 earlier today, which became its highest price tag since June 15th.

Binance Coin’s performance was somewhat sluggish recently, with all the regulatory concerns surrounding the leading cryptocurrency exchange. However, BNB has spiked by 7% in a day and exceeded $340 for the first time since June as well.

Cardano (5%), Ripple (3.5%), Dogecoin (3.5%), Uniswap (5%), Bitcoin Cash (2%), Chainlink (6.5%) and Litecoin (3.5%) are also well in the green. Polkadot is the most substantial gainer from the larger cap alts with a 16% surge. As a result, DOT trades well above $18.

Siacoin has added the most value from the top 100 coins. A 37% pump has driven SC to around $0.02. Quant (27%), IOTA (19%), Ankr (16%), Basic Attention Token (15%), DigiByte (13%), OKB (12%), Filecoin (11%), and Solana (10%) follow suit.

Consequently, the cumulative market cap of all crypto assets is up to $1.660 trillion. This means that the metric is up by $40 billion in a day and $140 billion in two days.

Bitcoin Touched $42.5K

The primary cryptocurrency has led the charge in the past week or so after it successfully bounced off from the sub-$30,000 price drop. It added more than $10,000 since then and kept climbing upwards, as reported yesterday.

It reached its highest price tag since the mid-May crash of $42,300 (on Bitstamp), but another leg up hours ago led to a new two-month high of $42,700.

As of now, BTC has retraced by about $1,000, and its market capitalization is just shy of $800 billion. Its market dominance, though, has dropped by about 1% in a day as the alternative coins have gone on a tear.