Crypto Long & Short: What Investors Get Wrong About Volatility (and Not Just for Crypto)

(Spencer Platt/Getty Images)

Crypto Long & Short: What Investors Get Wrong About Volatility (and Not Just for Crypto)

In a week in which we are yet again reminded how sharply sentiment can shift in crypto asset markets, it’s appropriate to look at the role volatility plays in our narratives, our portfolios and our psyches.

I also want to examine what volatility is not, as its specter takes on a disproportionate influence in times of turmoil.

This confusion is not unique to crypto markets – volatility is misunderstood across all asset groups. As with virtually all market metrics, however, it has particular nuances when applied to our industry.

Setting the table

First, let’s review what we mean by volatility. Technically, it is the degree to which an asset price can swing in either direction. Generally, by “volatility” we mean realized volatility, which is derived from historical prices. This can be measured in several ways – at CoinDesk we take the annualized rolling 30-day standard deviation of daily natural log returns.

Implied volatility represents market expectations of future volatility, as inferred from options prices. More on this later.

The volatility of an asset is an important part of its narrative, especially in crypto markets, which are associated with volatility in the minds of many investors. A survey of institutional investors, carried out earlier this year by Fidelity Digital Assets, singled out volatility as one of the main barriers to investment.

This is because many investors conflate volatility with risk. This is a fundamental investment error that says more about our psychological makeup than it does about our portfolio management insight.

Look inward

We are, as a species, risk-averse, and have needed to be for survival. This extends to our vocabulary – higher risk also means the possibility of higher rewards, but you don’t hear anyone claim to be reward-averse. “Risk” will forever be associated with something bad, especially when it comes to investments. Investment advisors don’t warn about “upside risk.”

Our aversion to risk when it comes to finance is understandable. Risk implies irredeemable loss, which can mean total ruin for some. Yet the degree of our aversion is generally not compensated by the actual possible loss, especially in mature markets where downside can be managed. In other words, our fear of risk may be prudent but it is usually not rational.

Conflating volatility with risk makes the former also something to be avoided, in the minds of most investors. Yet volatility is not the same as risk. Volatility is a metric, a number, a measurement. Risk is an ambiguous concept.

A high volatility implies that the price can experience a handsome rise. It also means that it can come down sharply, and that possibility of doing us harm is what leads us to conflate it with risk and instinctively avoid it.

The fact that the CBOE Volatility Index (VIX), which measures the S&P 500 implied volatility, is also known as the “Fear Index” gives an idea of what a bad rap volatility has.

Conflating the two concepts leads us to another potentially dangerous disconnect: If we equate volatility with risk, then we are implying that we can measure risk. We can’t. Risk is based on the unknown. Bad things can happen from any direction, at any time, at any speed, in an infinite array of forms and configurations.

Volatility, on the other hand, is knowable. Implying that risk is knowable could lead us to underappreciate the potential damage.

Telling a story

Not only is volatility knowable; it can also tell us much about any given asset. Generally, the higher the volatility, the higher the return – but not always. When constructing a portfolio, the relative volatilities should be compared to the relative historical returns to evaluate whether the additional “risk” is worth it.

For instance, the 30-day volatilities of ether (ETH) and Litecoin (LTC) have been similar, while the returns over the same period have been notably different. (Note that historical performance does not guarantee future performance, and none of this is investment advice.)

Not only can we glean stories from recent (“realized”) volatility, we can also calculate investors’ expectations of volatility looking forward, through options prices. If this “implied” volatility is higher than realized volatility, that tells us that investors expect volatility to increase. The implied-realized differential has been positive in the past, but earlier this week it reached its widest point in over a year. That’s the market saying “buckle up.”

Crypto is different

Bitcoin (BTC) is the benchmark crypto asset, the oldest and the most liquid, and easily the one with the most developed derivatives market. Traditionally, the introduction of derivatives mitigates an asset’s volatility, as it adds liquidity and hedging opportunities. Not surprisingly, for this reason bitcoin’s volatility is among the lowest of the crypto assets.

What is surprising is that bitcoin’s volatility often moves in the same direction as the price. That is, when the price comes down, so usually does the volatility.

The VIX, on the other hand, tends to move inversely to the S&P 500. The average 60-day correlation between the two for the month of August was -0.84, an almost perfect negative association. Using bitcoin’s 30-day realized volatility as a proxy for a bitcoin VIX, we get an average 60-day correlation for August of 0.45. A very different scenario.

Another peculiarity of crypto volatility is that crypto markets trade 24/7. Traditional markets don’t. So, measures of traditional asset volatilities are working off fewer data points than crypto assets. Theoretically, were stocks to trade on Saturdays and Sundays, we could have a wild swing up on one day followed by a wild swing down on the other, with the Friday-Monday measurement showing no volatility at all. These movements are captured in crypto asset volatility calculations.

In reality, this doesn’t seem to matter too much for the bitcoin narrative – the 30-day average volatility for BTC when you take weekend trading out of the equation is not that different from the full data set result. For August, for instance, the monthly average using daily standard deviations was 51.2%, while the monthly average using only S&P 500 trading days was 51.6%.

So, volatility is higher in the crypto asset markets. It is also more measurable, in that there are a greater number of data points from which to glean information.

Bring it

And finally, the relatively high volatility of crypto markets is a barrier for some but a magnet for others. Many professional traders have entered the crypto market because of the volatility. They bring with them liquidity which reduces spreads and further pushes market maturation forward. And as one asset’s volatility starts to settle down, another younger, more restive asset is but a couple of clicks away.

Volatility may not be for everyone, but it should be respected and harnessed, not avoided. Bitcoin has a lively derivatives market to help manage that volatility, and that of ether (the second largest cryptocurrency by market cap) is rapidly growing.

All portfolios aim to have a mix of volatilities, with the relative weightings determined by individual investor profiles and preferences. The high volatility of bitcoin should not be a reason to stay away. Just the opposite – it gives the asset group an even more compelling role in asset diversification. As investors of all types get more comfortable with the main fundamentals supporting the value case for bitcoin and other crypto assets, and as the volatilities become more manageable, we are likely to see this particular characteristic become less of a barrier and more as a quality to be embraced.

Anyone know what’s going on yet?

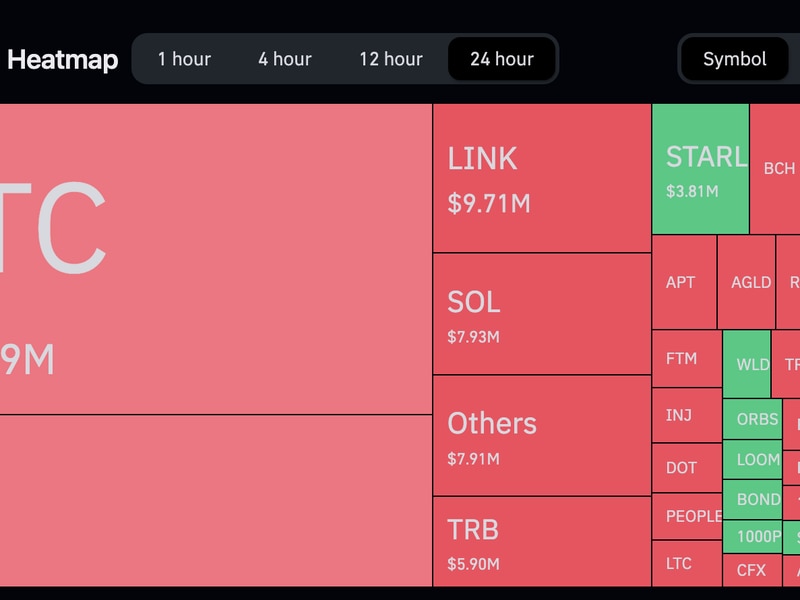

Just when there seems to be glimmers of vaccine-related hope, markets around the world lose their enthusiasm and head down. At time of writing on Friday afternoon, the board is a sea of red, with the Nasdaq leading the dip.

So far the moves are barely a blip on the charts, but the mood seems to have shifted. To highlight the shaky ground on which the tech stocks’ recent gains stand, the Cboe Nasdaq 100 Volatility index (VXN) reached its highest differential with the S&P 500’s VIX equivalent since 2004.

This correction could be temporary, but it feels like election fear is muscling its way to the front of the queue of big-things-to-worry-about, understandable given the escalating mutterings about the possibility of no conclusive result. I imagine that if there’s one thing markets don’t like, it’s not knowing who the leader of the Free World is going to be.

Bitcoin, as usual, showed investors that it wins at volatility, with weekly losses several times greater than the main stock market indices. While analysts scramble to make sense of the move, bitcoin yet again has thrown its narrative up in the air – not quite a safe haven, not quite a correlated asset – and who knows where it will land.

Tyler and Cameron Winklevoss, founders of crypto exchange Gemini and investment firm Gemini Capital, have laid out their macroeconomic thesis on bitcoin and why they believe it could go to $500,000 (spoiler, it’s to do with the value of gold). TAKEAWAY: One criticism often labelled at tech people touting a new form of finance is that they are trying to fix a problem they don’t understand. That doesn’t mean we shouldn’t check out the potential solutions, though, as long as we are aware that every solution does bring with it new problems. And sometimes a view from outside an industry can highlight big-picture issues that are hard to see from within. The whirlwind of ideas is the key to understanding both the problems and the potential, so, whether you or agree or disagree, essays like this are worth a read.

Ark Invest has produced, in collaboration with Coin Metrics, an excellent treatise on the role of Bitcoin as an economic institution. It points out why the current financial system falls short of basic economic assurances, how Bitcoin can satisfy them, and some excellent charts that make it easy to understand some of Bitcoin’s thornier issues such as governance.

The open interest in options on ether (ETH), the native token for the Ethereum blockchain and the second-largest crypto asset in terms of market cap, has reached a record high on leading crypto options exchange Deribit. TAKEAWAY: This signals a growing maturity in the ether derivatives space which in turn should support greater trader interest in both the derivatives and the underlying asset. ETH is generally more volatile than bitcoin (BTC) – a more robust derivatives market might tame some of that volatility, which would also make it more attractive to longer-term investors.

Crypto lending firm BlockFi now offers yield on PAX Gold (PAXG, a gold-backed token issued by Paxos) and stablecoin tether (for non-U.S. accounts). TAKEAWAY: According to the company, the initial APY on PAXG will be 4%. This is interesting because yield on gold has been an elusive concept for centuries. There are traditional platforms that offer interest on gold deposits, but the custody angle is cumbersome. Here, BlockFi is offering yield not on gold itself but on a token issued by Paxos, backed by physical bullion. This sounds more liquid and more flexible. It also allows clients to use PAXG as collateral for loans. PAXG volume has shot up over the past couple of months after a slow start, so it will be worth keeping an eye on whether this propels it even further.

And speaking of tether (USDT), derivatives exchange Opium has introduced credit default swaps for the world’s largest stablecoin and the fifth largest cryptocurrency overall. TAKEAWAY: This pays out in the event of default by Tether, the issuer of USDT. The token has become the de facto base currency for most crypto trades, and the very idea of it breaking would send tremors through the market. Last year there was turmoil when Tether was having banking issues and it turned out that not all of the issued tokens were 1:1 backed with U.S. dollars. Since then, the market has settled into a new kind of trust, and for many, the idea of Tether folding is laughable. For others, it’s terrifying.

Huobi Futures, the crypto derivatives unit of Huobi Group, now offers trading in weekly, bi-weekly and quarterly bitcoin options. TAKEAWAY: Deribit is such a giant in the crypto options market that challenging it will be tough, but greater diversity and liquidity in options will be good for the market as a whole. A lively options market not only supports hedging strategies, it also encourages new investment by mitigating volatility, and it gives rise to new revenue opportunities for options writers.

Zero Hash, the crypto asset clearing organization spun out from former crypto exchange Seed CX, has closed a $4.75 million funding round led by tastyworks, the owner of the app-based brokerage tasytrade, with other participants including app-based broker-dealer Dough, retail-focused futures market Small Exchange, Bain Capital, TradeStation and others. TAKEAWAY: It’s not a large raise, but it is indicative of the growing interest in crypto market infrastructure. The settlement layer is arguably one of the most immature for now, and its development will be key for more mainstream platforms to enter the industry.

Podcast episodes worth listening to:

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.