Crypto Lender Abra Has Been Insolvent for Months, State Regulators Say

Crypto lender Abra has been insolvent since at least March 31, 2023, state securities regulators alleged on Thursday.

In an emergency cease-and-desist order, the Texas State Securities Board alleged that Abra (otherwise known as Plutus Financial), Abra Boost, Plutus Lending and Abra founder William Barhydt mislead the public, committed securities fraud and the company has been insolvent for months.

Abra offered investments in Abra Earn and Abra Boost, the regulator alleged, but these investments offerings contained statements that were misleading.

Abra “made offers of investments in Abra Earn in Texas containing statements that were materially misleading or otherwise likely to deceive the public,” the filing said, going on to add similar statements about other Abra products.

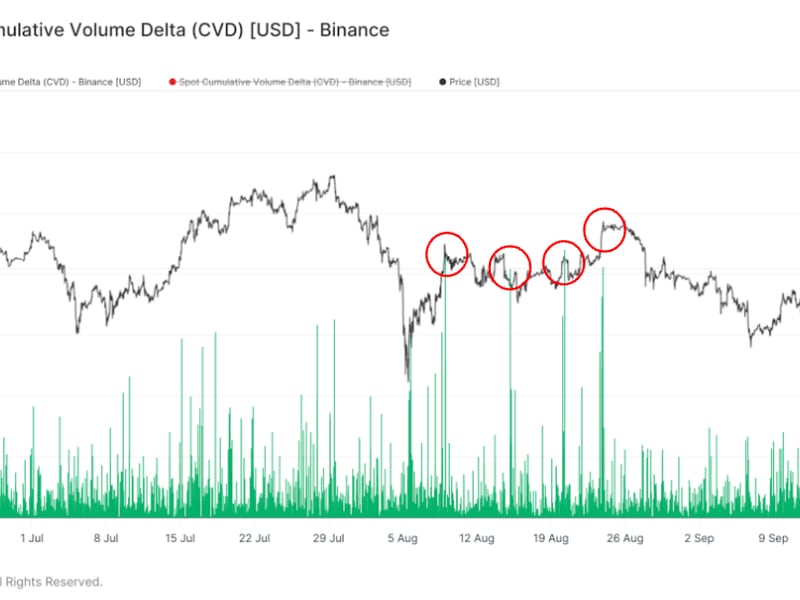

“Abra Trade and Respondent Plutus Lending have been secretly transferring assets to Binance Holdings Limited DBA Binance AKA Binance.com. As of February 2023, Abra Trade and Respondent Plutus Lending had assets valued at $118,581,732 at Binance.com,” the filing said, which noted that the U.S. Securities and Exchange Commission sued Binance this month.

Abra is a crypto lender that’s been around nearly 10 years. Last year, the company announced it would it would offer crypto rewards through a card offered with American Express, and Barhydt said it would try and launch a state-chartered bank sometime in 2023.

The regulators are hoping to hold a hearing on the matter, though one has not yet been scheduled.

Until then, Abra and its various entities are still allowed to let customers withdraw funds, the filing said.

According to the regulator, Abra has a hair under $30 million on Babel Fiannce, $8.8 million on Auros Tech Limited, $30 million on Genesis (which is owned by CoinDesk parent company Digital Currency Group) and $10 million on Three Arrows Capital. All of these companies are in various liquidation or bankruptcy processes.

On March 31, 2023, regulators interviewed Barhydt and shared information suggesting Abra was insolvent. “Barhydt did not contest the conclusion,” the filing said.

“At least as of the date of the interview, parties collectively operating as Abra were or were nearly insolvent,” the filing said. “Notwithstanding the forgoing, Plutus Financial Holdings, Inc., or an affiliate or subsidiary thereof, posted information in an official social media platform that represents: ‘There is no truth that Abra is bankrupt or about to be. It continues to operate normal like it always has throughout multiple bear markets since its launched [sic] back in 2014.'”