Crypto Isn’t Ready for Jack Bogle

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/4e5e54ad-fffe-46f2-8bb3-027bfaec7e4f.png)

Alex Botte, CFA, CAIA is the head of client and portfolio solutions at Runa Digital Assets, an investment firm specializing in digital asset portfolios.

Active versus passive investing is one of the oldest debates in traditional investment management. What is the best approach when investing in the liquid token market? We believe active management in this asset class is critical. Similar to the results observed in the stock market over decades, we anticipate a fat right tail in digital asset returns. Only a handful of assets may drive the majority of the wealth creation in this asset class.

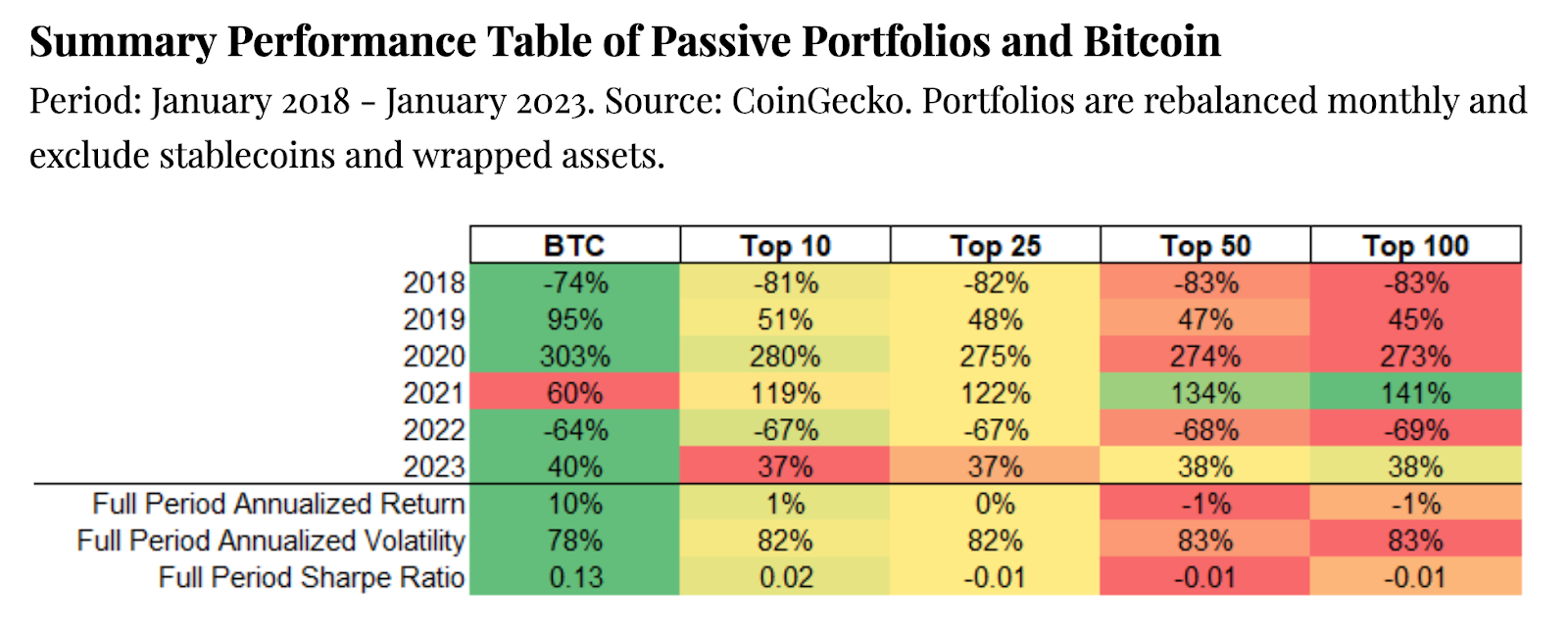

Historically speaking, bitcoin (BTC) has been the primary wealth creator in the asset class. Simple, passive portfolios have underperformed BTC over most calendar years and over a multiyear, full-market cycle.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

We compared BTC’s returns to passive, market-cap weighted portfolios of the top 10, 25, 50, and 100 tokens over the past five years. None of these passive portfolios were able to outperform BTC. And some of them lost money over this period. BTC is also one of the lowest volatility digital assets, so this outperformance is impressive on a risk-adjusted basis as well.

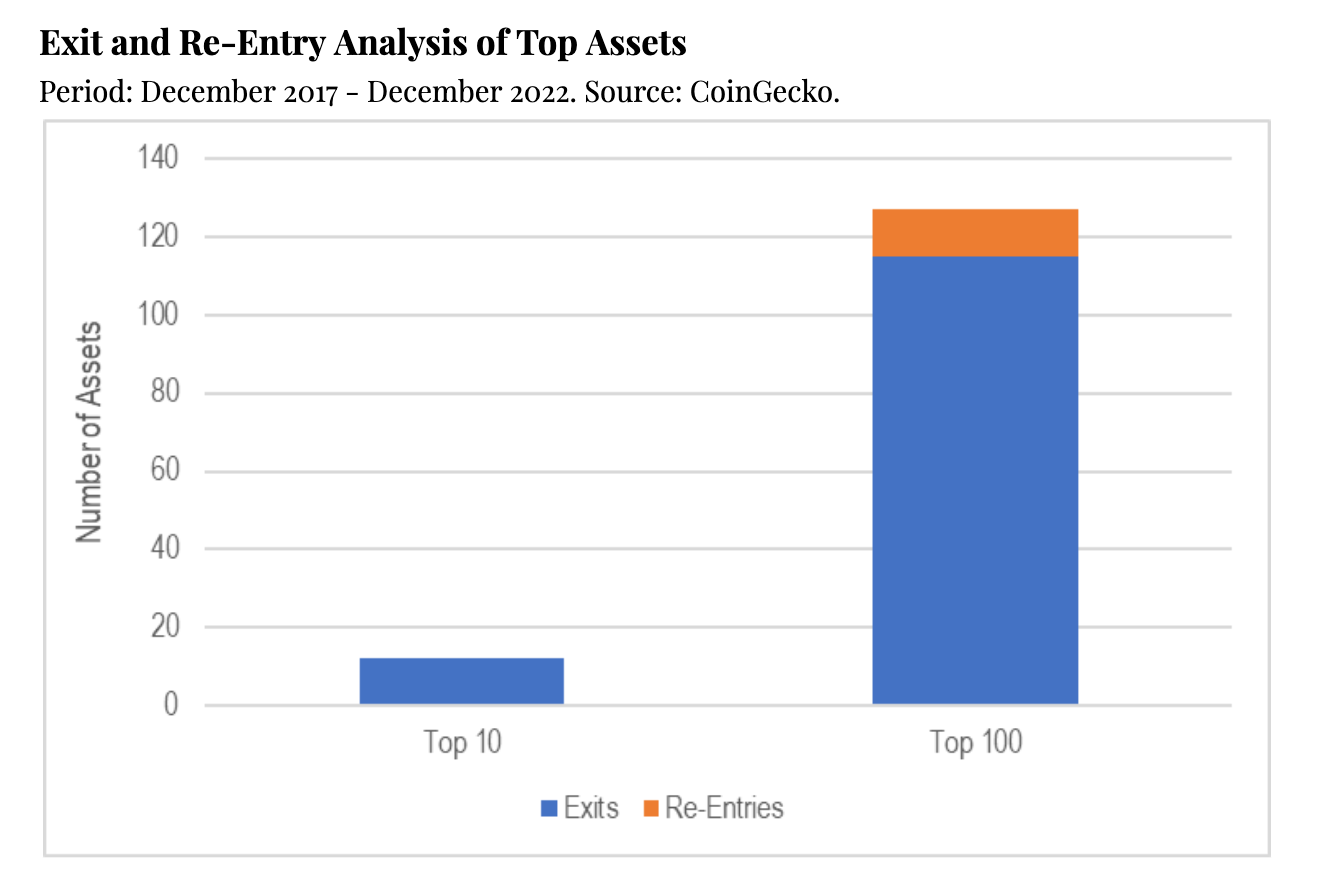

It’s not enough to simply hold the top assets and expect they will continue to outperform. Assets that fell out of the top ranks of the market have historically not been able to re-enter. We analyzed the annual rankings of the top digital assets by market cap. If a token fell out of the top 10 or top 100, how often were they able to re-enter? We found that there were 12 assets that fell out of the top 10 rankings, and none were able to re-establish their position in the top 10. There was more turnover in the top 100: 115 assets fell out of the ranking, and only 12, or 10%, were able to re-enter.

This analysis suggests that value investing in digital assets may be challenging. An asset that has fallen out of favor and may look cheap relative to others has historically had a difficult time outpacing the market to re-establish its highly ranked position.

If you’re going to invest in digital asset markets, we believe it’s best to either buy and HODL BTC or use active management to outperform by finding the tokens that have the fundamental momentum and potential to rise into the top ranks of the market. Contact us for more research on the case for active management in crypto.

Edited by Nick Baker.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/4e5e54ad-fffe-46f2-8bb3-027bfaec7e4f.png)

Alex Botte, CFA, CAIA is the head of client and portfolio solutions at Runa Digital Assets, an investment firm specializing in digital asset portfolios.