Crypto Is the Solution to Bank Runs, Not the Cause

Many current issues and regulations involve transparency, or lack thereof. One of the purposes of registering with the state, Fed and SEC is to make the books public and visible to us all, so we can feel comfortable making risk-based decisions. However, that transparency is usually quarterly, not up to the second.

Related Posts

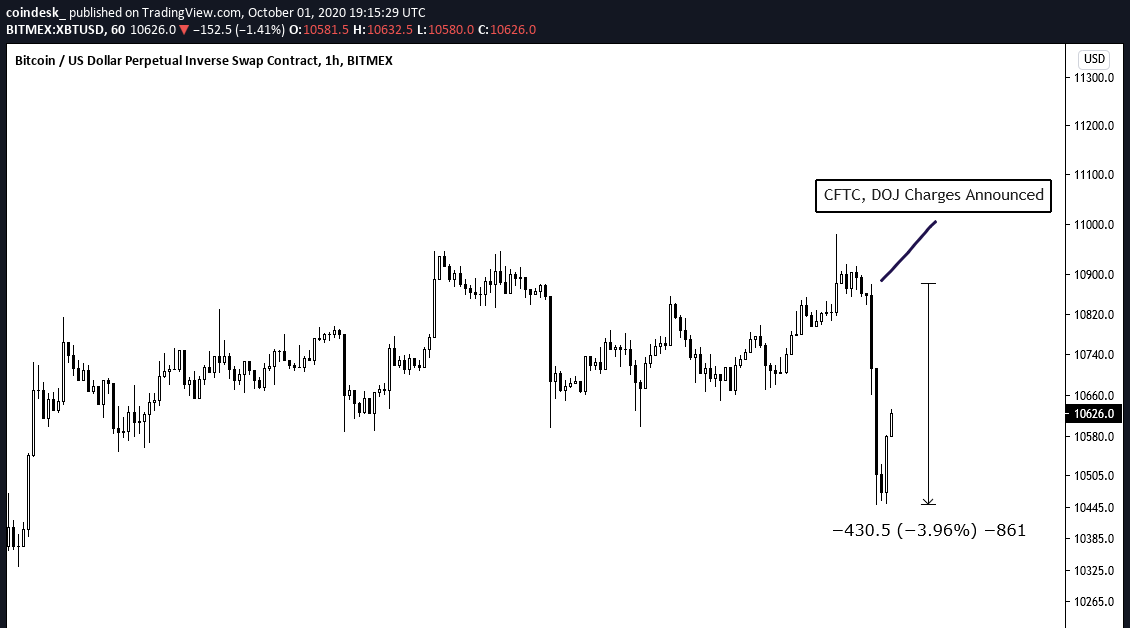

Bitcoin Starts Shrugging Off BitMEX Bombshell, Recoups Nearly Half of 4% Price Dip

Oct 1, 2020 at 19:55 UTCUpdated Oct 1, 2020 at 20:42 UTCBitcoin hourly price candles annotated with BitMEX newsBitcoin traders have begun recovering from Thursday’s bombshell indictments from the U.S. Commodity Futures Trading Commission and Department of Justice against BitMEX and the exchange’s co-founders Arthur Hayes, Benjamin Delo and Samuel Reed, and Business Development Lead…

Hacker Returns Ethereum Domains Lost in Bug Exploit

news The domain names stolen from the Ethereum Name Service’s (ENS) auction have been returned. As CoinDesk reported at the time, the ENS bidding process managed by digital-collectibles marketplace OpenSea was exploited, allowing a hacker to nab 17 domain names for lower bids than other users placed. ENS and OpenSea asked the hacker to return…

UK Launches Consultation on Implementing OECD Crypto Reporting Framework

The U.K. launched a consultation on its plans to implement the Organization for Economic Co-operation and Development's (OECD) crypto reporting framework on Wednesday following its spring budget speech.The Treasury, the government's finance arm, projected in its budget that implementing the crypto reporting framework could draw in £35 million ($45 million) between 2026 and 2027 and

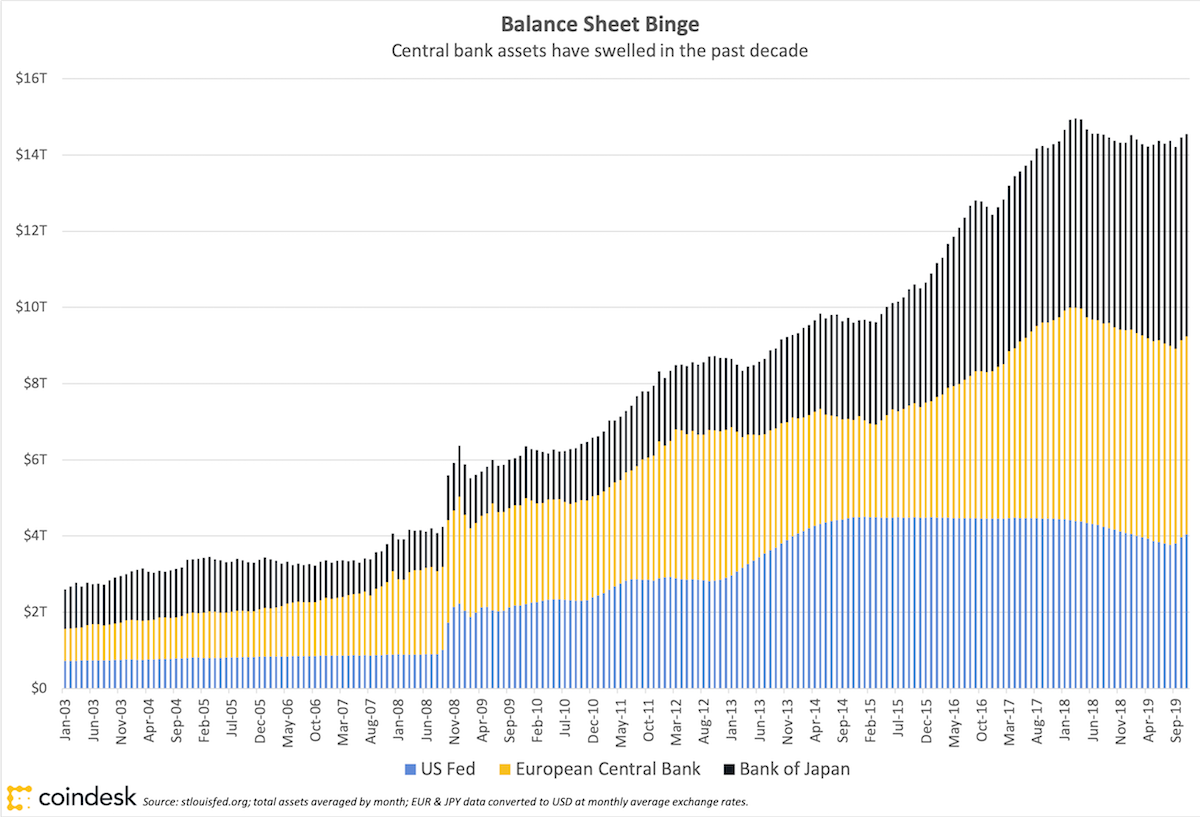

A Decade of Quantitative Easing Has Paved the Way for the Age of Digital Currency

Dec 20, 2019 at 19:00 UTCUpdated Dec 20, 2019 at 19:24 UTCThis post is part of CoinDesk's 2019 Year in Review, a collection of 100 op-eds, interviews and takes on the state of blockchain and the world. Michael J. Casey is CoinDesk’s chief content officer. The views expressed here are his own.Our social media-constrained attention…

SBF Dined With Eric Adams at NYC Mayor’s Go-To Italian Restaurant

NEW YORK — Sam Bankman-Fried tangled with New York’s top political and financial power brokers in the months preceding FTX’s collapse and his subsequent arrest. He even had one soiree at New York City Mayor Eric Adams’ favorite late-night haunt.Despite living in the Bahamas, the erstwhile crypto titan frequented the Big Apple in 2022, according

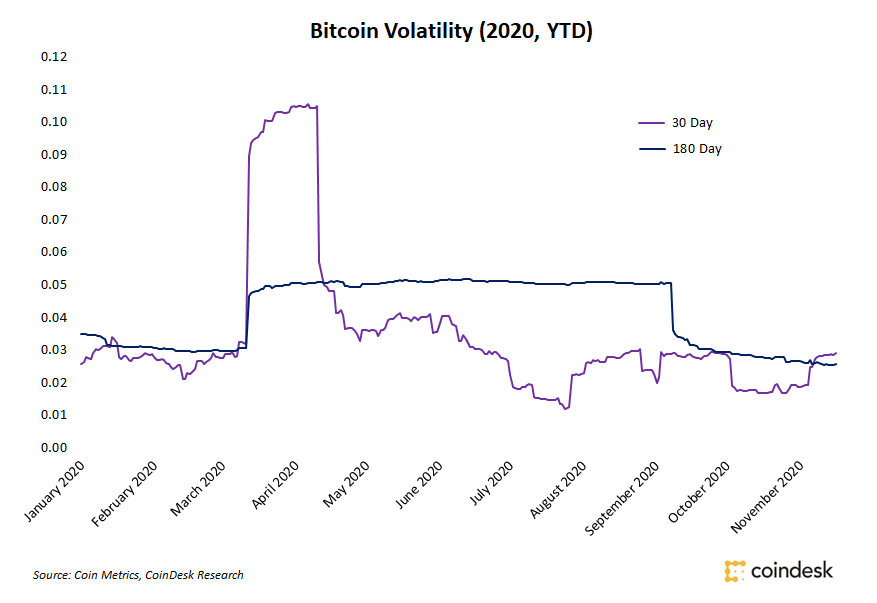

Traders Brace for Major Volatility as Bitcoin Price Nears Record Highs

Nov 17, 2020 at 6:06 p.m. UTCBitcoin 30-day and 180-day volatility in 2020Traders Brace for Major Volatility as Bitcoin Price Nears Record HighsBitcoin traders expect a significant increase in volatility as the leading cryptocurrency continues to recoup nearly all its losses since topping out just below $20,000 in late 2017. Whether the volatility comes from…

Sui Launches ‘Incubator’ Hub in Dubai for ‘On the Spot’ Solution Engineering

Layer 1 blockchain Sui has launched a hub in Dubai, a first in a global series of hubs, to support blockchain developers and entrepreneurs. "The vision is to be the heart of hackathons and implementation even in Dubai," said Kostas Chalkias, co-founder and chief cryptographer at Mysten Labs, which developed the Sui network. 02:26 Bitcoin

Stablecoin Lender Liquity’s Token Gains 80% in Month as Activity Increases

Liquity, a decentralized borrowing protocol, has seen its native token LQTY rally 80% over the last month, contrasting with sluggish performance in the broader cryptocurrency markets.Liquity is a borrowing and lending platform where users can take out loans denominated in Liquity’s U.S. dollar stablecoin, LUSD, after staking ether (ETH) as collateral.LQTY was trading at $0.75