Crypto is a Long-Running Ponzi Scheme, Says Nobel Prize Winner Paul Krugman

Prominent American economist Paul Krugman once again shared his negative stance towards cryptocurrencies. He compared a Ponzi scheme.

Taking Aim at Crypto

The most recent adverse price developments in the cryptocurrency market sparked many negative comments. Joining them was the Nobel Prize laureate – Paul Krugman.

In an interview for the New York Times, he described cryptocurrencies as a ”long-running Ponzi scheme.” He said that investing in digital assets is very similar to the infamous form of fraud from the last century that created the illusion of a sustainable business but, in the end, turned out to be a pyramid scheme.

However, he opined that this type of hoax would not disappear shortly soon, comparing it to Bernie Madoff’s notorious investment scam:

”But could a Ponzi scheme really go on for this long? Actually, yes: Bernie Madoff ran his scam for almost two decades and might have gone even longer if the financial crisis hadn’t intervened.”

Additionally, Krugman related cryptocurrencies to gold. He opined that some cryptocurrencies would be able to compete with the endurance of the precious metal:

”It’s conceivable that one or two cryptocurrencies will somehow achieve similar longevity.”

Furthermore, the Nobel Prize winner predicted that the American government might take severe measures against crypto just like they cracked down on gold in the 1930s.

Who Else Thinks The Same?

This is not the first time a prominent person refers to crypto as a ”Ponzi scheme”. Legacy market day trader Dave Portnoy, for example, shared the same opinion about Bitcoin last year. To him, the digital asset lacks accountability due to its anonymous founder.

His history with the primary cryptocurrency is quite controversial as first he revealed he is ”coming to Bitcoin” and reaffirmed that he purchased amounts from it. Shortly after, though, Portnoy claimed a loss of $25,000 and declared that he is out. In his turn, Portnoy explained the decision saying that Bitcoin is ”one big Ponzi scheme.” He further argued that ”you get in, and you just have to not be the one left holding the bag.”

He later admitted he was wrong about it.

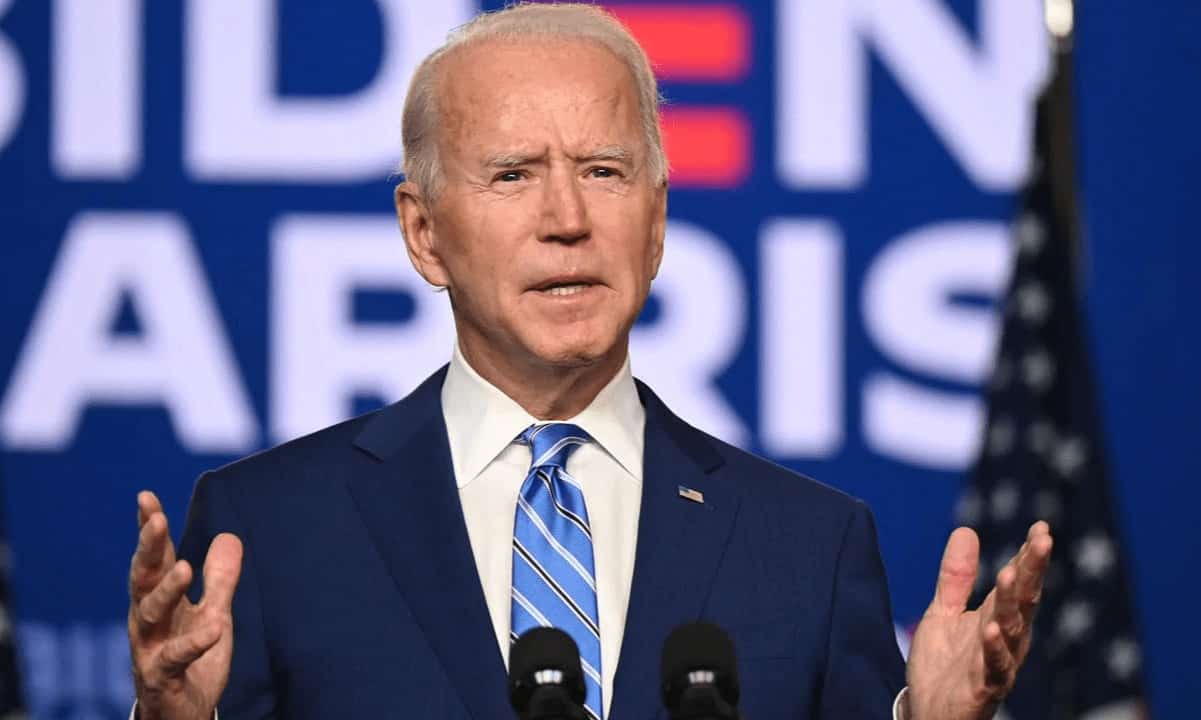

Featured image courtesy of The Nation