Crypto Hubs 2023: Where to Live Freely and Work Smart

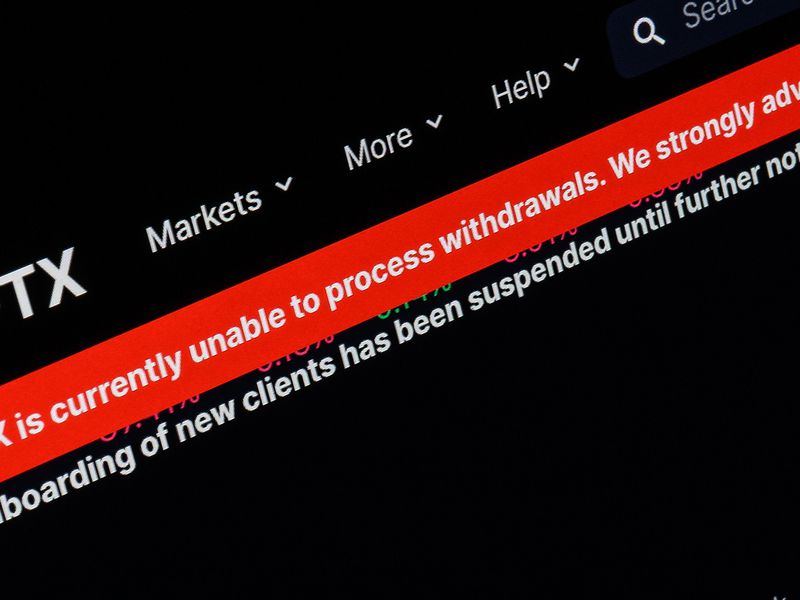

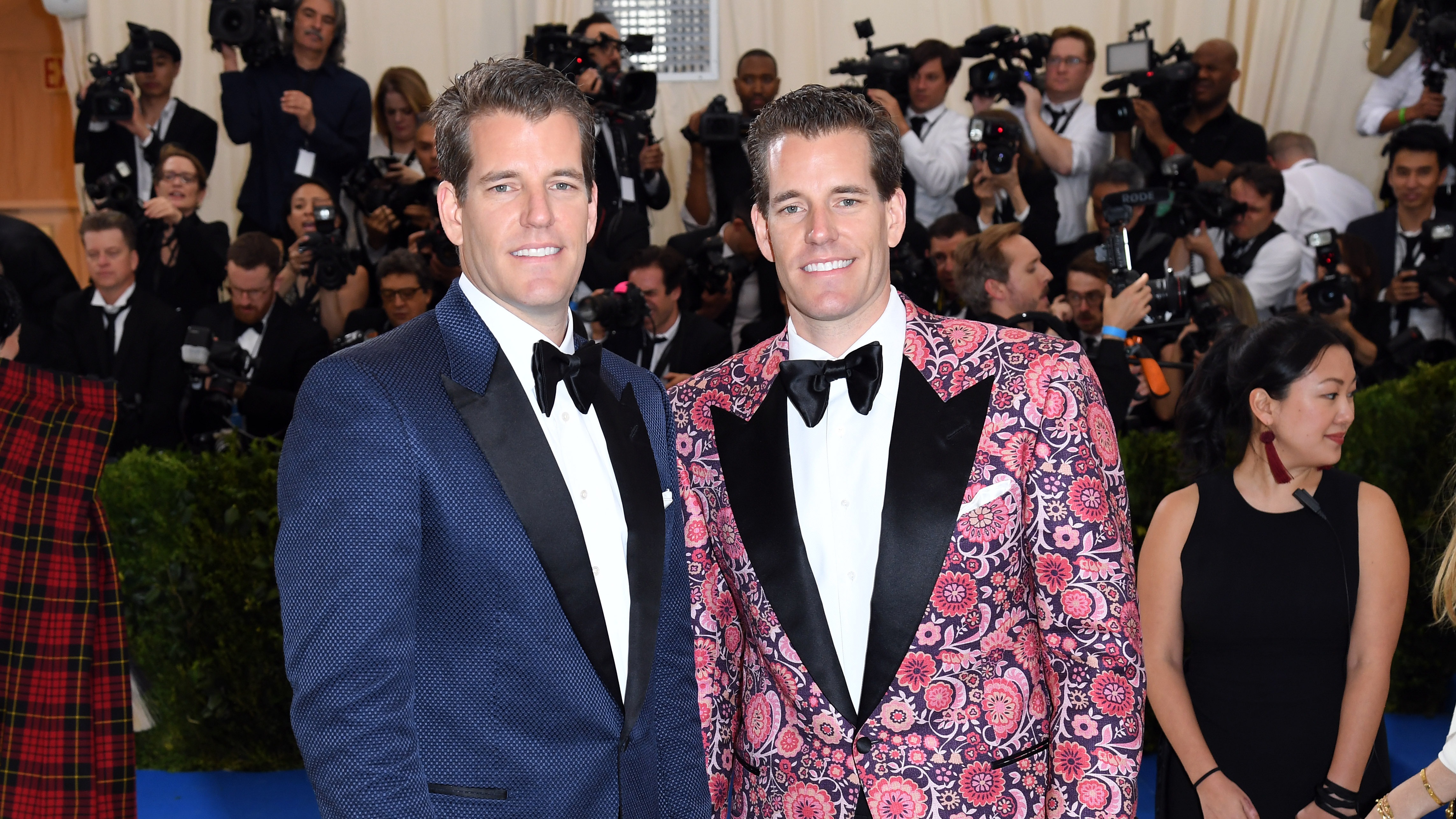

Crypto is on the move. In the last several weeks alone, three exchanges including Binance, Bybit and OKX, have exited Canada altogether. Gemini announced it would dramatically boost headcount and operations in Singapore. And venture capital firm Andreessen Horowitz (a16z) has named its first non-U.S. outpost – in London.

This is a fluid time for crypto companies as it seems the regulatory landscape is shifting eastward from North America, where both the U.S. and Canada are seen as unfriendly. In the past year or so, Dubai established the Virtual Asset Regulatory Authority (VARA), with neighboring city Abu Dhabi seeking to pass its own crypto-friendly regulatory framework this year, the European Union passed the Markets in Crypto-Assets regulation in April and just this month, and Hong Kong’s Securities and Futures Commission began accepting license applications for crypto exchanges.

The lack of a global regulatory framework for crypto has made it possible, if not imperative, to practice regulatory arbitrage. Last year, directors of the International Monetary Fund’s (IMF) Monetary and Capital Markets department called for a global framework to “bring order to the markets, help instill consumer confidence, lay out the limits of what is permissible, and provide a safe space for useful innovation to continue.”

The absence of such a coordinated worldwide effort would lead to national regulators “locked into differing regulatory frameworks.” Ultimately, crypto professionals would be compelled to “migrate to the friendliest jurisdictions.”

That is the reality of the crypto industry today. With the strong popularity of remote work, crypto companies really cannot ignore the possibility of relocating or at least expanding to more crypto friendly jurisdictions. The countries or regions where regulations are in place are attracting attention and interest from even the biggest companies.

It’s not a coincidence that after the U.S. Securities and Exchange Commission (SEC) sued Coinbase (COIN), the largest U.S. crypto exchange, for allegedly trading unregistered securities, a politician in Hong Kong then invited the company to apply for licensing in the city-state. Or that Coinbase has publicized its meetings with authorities in the United Arab Emirates to discuss establishing a hub there.

Startup founders and digital nomads alike are surveying the landscape and developing a rubric for deciding where to put down roots, said Janina Pietrowska, an attorney at Rechtsanwälte Lennert Partners in Liechtenstein that advises crypto clients on choosing where to incorporate, especially security token offerings.

She said regulation, though important, should not be the entire consideration. Other important factors include a favorable investment environment, the ease of doing business and low taxes.

If you could relocate anywhere in the world, where would you go?

This is basically the question CoinDesk is answering in Crypto Hubs 2023 with a ranked list of the best places to live and work for crypto professionals.

We put ourselves in a crypto startup founder’s shoes and collected then weighted data for eight different criteria that range from regulatory friendliness, digital infrastructure to quality of life. Our results, a ranked list of 15 crypto hubs, may contain some surprises. And we hope it will spark discussion.

Crypto Hubs 2023: The 15 Best Places to Live Freely and Work Smart

- 01Zug: Where Ethereum Was Born and Crypto Goes to Grow Up

- 02Singapore: The Center for Asian Crypto Wealth Is Ready for a Reset

- 03London: The World’s Capital for Foreign Exchange Adds Cryptocurrencies to Its Ledger

- 04Seoul: Asia’s Retail Crypto Capital Tries to Move on After Do Kwon

- 05Dubai: Launching a Crypto Regulatory Arm to Become a Global Financial Power

- 06Abu Dhabi: A Wealthy Mideast Capital Creating a Bridge From TradFi to Crypto

- 07Wyoming: Regulatory Clarity and Crypto-Friendly Banks Fuel Blockchain Revolution

- 08Silicon Valley: The Mecca for Venture Capital May Be Cooling on Crypto

- 09Austin: Where Remote-Work Crypto Developers Actually Choose to Live

- 10Berlin: The Center for Decentralized Finance – and Techno Music

- 11Los Angeles: Where Hollywood Magic and Creativity Meet Web3

- 12New York City: A Crypto Sandbox in a Big Business Playground

- 13Vancouver: A Boutique Hub for Crypto Early Adopters

- 14Ljubjana: It’s a Beautiful Life in This Crypto Payments Hotbed

- 15Lisbon: A Buzzy, Affordable Mecca for Buy-and-Hold Crypto Nomads

Edited by Daniel Kuhn.