Crypto Hacks, Rug Pulls Led to $473M Worth of Losses in 2024: Immunefi

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

In May, $52 million was stolen with the majority of that being attributed to the Gala Games and SonneFinance hacks.

-

Ethereum experienced the highest volume of hacks, with 43% of total losses.

-

Over $2 billion was lost to hacks last year and $4.2 billion in 2022.

02:07

Three Crypto Predictions in 2024

00:59

Running With Crypto: 5 Questions With TRM Labs’ Ari Redbord

09:43

Hacks Involving North Korea Are ‘Even Greater Problem’: Legal Experts

02:01

Breaking Down the State of Hacking in 2024

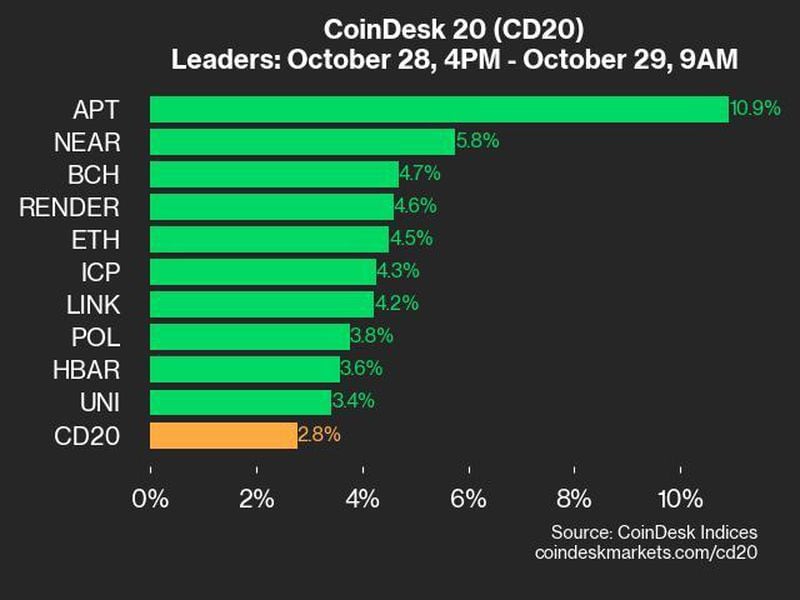

Over $473 million worth of cryptocurrency has been lost to hacks and rug pulls across 108 incidents in 2024, according to a report by security service provider Immunefi.

In May alone, $52 million was stolen, with the majority of that being siphoned out of Gala Games and SonneFinance, which were hacked for $21 million and $20 million, respectively. The total marks a 12% decrease compared to May 2023.

The decentralized finance (DeFi) market remains the key attack vector for hackers, whilst centralized finance companies did not witness a single attack in 2024, the report said.

Last year, over $2 billion was lost to hacks and exploits, which was roughly half the total from the previous year. North Korean hacking group Lazarus has been responsible for $3 billion worth of crypto losses over the past six years.

Ethereum experienced the highest volume of hacks, with 9 incidents representing 43% of the total losses. BNB Chain was in second with 19% of the total.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.