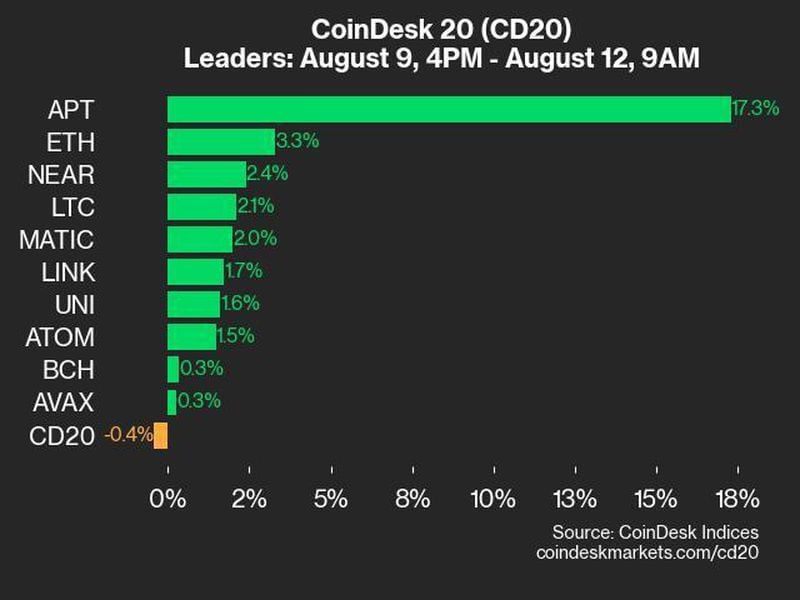

Crypto Funds Attract Largest Weekly Inflow in 2023 as Bitcoin ‘Short-Sellers Capitulate’: CoinShares

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

Digital asset funds attracted net inflows of $346 million last week fueled by anticipation for a spot bitcoin ETF, CoinShares reported.

-

Bitcoin fund inflows surpassed $1.5 billion this year amid signs of short-seller capitulation.

-

Ether and Solana led among altcoins fund inflows.

Crypto investment funds last week attracted their largest net inflows this year, extending their strongest run since the 2021 bull market as anticipation for a spot bitcoin (BTC) exchange-traded fund (ETF) continued to entice investors, digital asset fund management firm CoinShares reported Monday.

Digital asset-focused investment vehicles saw net inflows of $346 million in the week ended Nov. 24, the largest amount in what’s now been nine consecutive weeks of inflows, according to the report.

“This run, spurred by anticipation of a spot-based ETF launch in the US, is the largest since the bull market in late-2021,” CoinShares head of research James Butterfill said.

Bitcoin funds enjoyed most of the inflows ($312 million), similar to the previous weeks’ trend and bringing yearly net inflows to over $1.5 billion.

Meanwhile, short BTC funds – which seek to profit from declining prices – saw their third week of outflows in a sign of “short-sellers continuing to capitulate,” the report said. Assets under management (AUM) of short funds are now down 61% from their peak in April 2023.

Turnaround for ether (ETH) funds

Funds holding ether (ETH) experienced $34 million of net inflows last week, extending the positive trend to four consecutive weeks and surpassing $100 million of net inflows during this period. ETH funds now have almost nullified their dismal run of outflows earlier this year, which marks “a decisive turnaround in sentiment” towards the second largest cryptocurrency, CoinShares added.

Solana (SOL) funds attracted the largest inflows among the rest of the altcoins with a $3.5 million influx.

Polkadot (DOT) and Chainlink (LINK) investment products also enjoyed $0.8 million and $0.6 million inflows, respectively.

Edited by Stephen Alpher.