Crypto for Advisors: The Investment Case of Bitcoin vs. Ether

We continue to watch the unprecedented inflows into the spot bitcoin ETFs, as AUM exceeded $55 billion and bitcoin reached “larger than silver” status. Alex Tapscott, author of Web3: Charting the Internet’s Next Economic and Cultural Frontier, outlines that while bitcoin is getting all the attention, Ether, the second-largest cryptocurrency by market cap, is evolving and has different investment criteria.

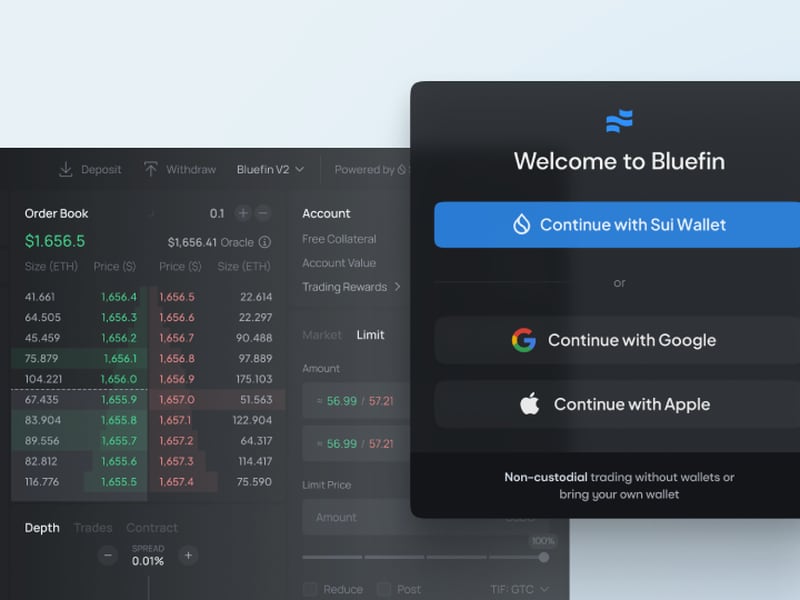

With talk of a possible ETH ETF approval in May and renewed interest in bitcoin and crypto, Adam Blumberg from Interaxis addresses the different investment questions he receives in Ask an Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

The Investment Case for Bitcoin is Strong and Getting Stronger, but so is the Case for Ethereum

Bitcoin sailed past $70,000 this week, hitting new all-time highs, driven by the massive (and seemingly insatiable) investor interest in the new U.S.-listed spot bitcoin ETFs, which by all accounts have had one of the best launches in history. They’ve amassed more than $10 billion of net inflows in less than two months. By comparison, it took Gold ETFs two years and S&P 500 ETFs three years to hit the same mark.

With demand in overdrive, we stand on the brink of another supply shock, with the Bitcoin halving less than two months away. Every four years the amount of new bitcoin that gets periodically created by the network to pay miners for securing the Bitcoin blockchain gets halved. A new bitcoin all-time high has followed each prior halving.

So, with the dual tailwind of Bitcoin ETF flows and the upcoming halving, is Bitcoin the best bet? Not so fast. Ethereum, the next biggest crypto asset by market cap, has a case of its own to make. Whereas bitcoin is often described as a store of value, medium of exchange, or both – essentially cash for the internet – Ethereum is a platform for developers building over 4,500 applications in areas as diverse as art and collectibles (NFTs), stocks, bonds, and real estate (real-world assets or RWAs), fiat currencies (stablecoins) and internet-native organizations called DAOs, known collectively as Web3.

Wall Street is getting wise to Ethereum’s potential: just last week, Bernstein released a research report that forecasted a big comeback for DeFi, saying that they “expect a big bang DeFi recovery and the investor narrative to come back as the future of blockchain finance.” As I write in my new book, Web3: Charting the Internet’s Next Economic and Cultural Frontier, the adoption of Web3 is growing in stature among enterprises as well, with 52% of Fortune 100 companies having launched blockchain-related projects since 2020.

What’s more, three catalysts could propel ETH to all-time highs and help it to outpace bitcoin:

First, since September 2022, Ethereum’s supply has decreased by a total of 430,000 ETH, which is equivalent to $1.7 billion at today’s value. In that timeframe, Bitcoin’s supply has increased by 490,000 BTC ($35 billion). Why the difference in trajectories? Because a portion of fees paid by users for using Ethereum goes towards retiring or “burning” tokens, akin to a share buyback in traditional public markets. The more active the network the higher the burn and the greater the deflation, and network activity has been heating up recently.

Exhibit A: Ethereum versus Bitcoin Net Supply Change Since the Merge

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TUAYGGLV4NGKRMTMHKX4QSAK6Q.png)

Second, this week, Ethereum underwent a major network upgrade that can help address its scalability concerns. One of the knocks against Ethereum is that the network is expensive to use, opening the door to competitors like Solana. This upgrade should help optimize its scalability potential and maximize its capacity. Higher throughput and lower fees will help Ethereum build a greater lead over competitors.

Finally, we may see an ETH ETF as early as May this year. May 23 is the final deadline for the SEC to decide on the VanEck and ARK 21Shares applications. As a sign of growing confidence in an ETF approval, Grayscale’s closed-end Ethereum Trust (ETHE) with $11.6 billion in assets is currently trading at an 8.17% discount. This time last year, ETHE was trading at a 59% discount to NAV. Senior Bloomberg ETF analysts Eric Balchunas and James Seyffart put the odds of a May 23 approval at only 35% but in my view, the market is giving the ETF little odds of approval by May. On a recent episode of my podcast DeFi Decoded, Seyffart said that even if the May deadline fails to yield approval, an ETH ETF is still a matter of when not if.

ETH and BTC have been the leaders for years. During past cycles, ETH has strengthened against bitcoin, hitting highs of 0.15 and 0.09 ETH per BTC in 2017 and 2021, respectively. The current ratio of 0.056 is only slightly above its 3-year low. Assuming a hypothetical target of $100,000 for bitcoin, Ethereum would hit $14,750 using the 2017 metric high and $8,800 using 2021’s high.

Exhibit B: ETH/BTC Ratio Since Ethereum Inception

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OAXHNL34G5EAVNUKTQPR4R5HFY.png)

Between bitcoin and ether, I don’t believe there is a bad option if you’re looking to gain exposure to the leading platforms and assets of Web3. But, with sound fundamentals and several upcoming catalysts, I believe Ethereum has the edge.

Ask an Expert:

Q. We’ve heard there is a fixed supply of bitcoin. Is there also a fixed supply of ETH?

A:

There is no fixed ETH supply, like with Bitcoin (21 million). Ether has a different issuance policy.

Just like with Bitcoin, new ETH is created with each new block (about every 12-13 seconds), and used as a reward for those who are processing transactions. However, this doesn’t mean the supply of ETH is infinite.

With each processed block, some ETH is also burned or taken out of existence forever. The amount burned is based on the number of transactions in that block. So, if there are more transactions, we often burn more ETH with each block than the new ETH created. This leads to a deflationary policy—we are currently seeing about 1.3% less ETH per year.

In summary: As the Ethereum network is adopted and used more, there should be fewer ETH available in the world.

Q. Is the investment thesis for ETH the same as for BTC?

A: We just discussed the issuance policy for ETH and how it differs from bitcoin.

Now to talk about why someone would invest in ETH or BTC, and how they’re different.

Most of the investment theses for bitcoin revolve around the verifiably scarce supply and bitcoin as a store-of-value and hedge against inflation. As more dollars, euros and yen are created, and bitcoin supply is very slowly moving up at a known rate, the value of the bitcoin relative to dollars should increase.

For ETH the demand generation is different. ETH is used to pay for transactions on the Ethereum network, or as we commonly refer to it, to pay for blockspace.

So, as we see more adoption of the Ethereum network – stablecoin usage, NFTs, tokenized assets – there will be a requisite demand for ETH to move those transactions forward.

With the issuance policy described above – more ETH being burned than created in each block – an increase in demand should raise the value.

Of course, ETH also comes with staking ability – the chance to lock up some of my ETH to receive rewards similar to a stock dividend. We see demand for ETH not just to pay for transactions but to stake and earn rewards as income.

If you do your research and determine that the adoption of the Ethereum network will increase, it makes sense to think that the value of ETH will increase, as will the price at which we bid up the price to use it to pay for transactions.

Keep Reading

Did the White House predict bitcoin’s price to reach $250,000 by 2035?

Spot Bitcoin ETFs now hold $55 billion AUM two months post-launch.

Edited by Bradley Keoun.