Crypto for Advisors: Innovating Legacy Programs with Blockchain

Beyond just crypto, our focus with this newsletter is to provide information on all facets of the blockchain and crypto space. Today, Sam Ewen, Head of CoinDesk Studios & Web3, takes us through the evolution of loyalty programs leveraging blockchain and why that matters. Big brands are building in this space; we will look at some companies adapting new technology to improve systems. These are interesting use cases.

As advisors, how do you look at companies taking advantage of new technologies to improve legacy systems or gain further competitive advantages?

Also, we address some common NFT myths after the main article in the Ask an Expert section.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Evolving Loyalty

Why are some of the biggest brands and most successful entrepreneurs looking to reimagine loyalty programs utilizing blockchains

While rewards with purchase and other forms of loyalty plans have been around since the 1790s, American Airlines is often credited with jumpstarting the modern loyalty program when it introduced the AAdvantage frequent flier program in 1981. Since then, 80% of Americans are members of at least one membership or loyalty program, and the number for Gen Z is almost as strong with 70% of them participating in these types of programs in a desire to get exclusive rewards and perks. So with a model that seems to have been proven for over 40 years, why are some of the largest brands and most connected builders exploring blockchain solutions to supercharge their loyalty and rewards offering?

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHHEZ4ZURBG3BHI3REFERRGB6A.png)

In 2023 we have seen consumer backlash as brands try and extract more value from consumers in order to gain access to perks that had seemed standard. Just witness the mea culpa that Delta issued after a fierce response to them raising the minimum spend and number of flights needed to access even their lowest-level flier perks. Which leads us to a simple premise sparked by Salesforce’s Marc Mathieu, to paraphrase: “Brands should not try and extract the most value from their top customers, but figure out how to reward their best customers and make them feel special.” To take that one step further, what if there were systems in place that rewarded a variety of actions both owned and operated by the brand and those out in the social and experiential world? This is where the blockchain comes in.

One of the best use cases for blockchains is loyalty and rewards, for a few key reasons:

-

Transparency: All transactions on a blockchain can be transparently viewed by any party with permission, which can increase trust among users.

-

Security: Blockchain uses cryptographic techniques that ensure that once a transaction has been added to the ledger, it cannot be altered or deleted.

-

Interoperability: Blockchain can enable different loyalty programs to be interoperable. Customers can potentially transfer and consolidate rewards from different programs, enhancing the user experience.

There are other benefits but features like these start to unlock new consumer opportunities and grow loyalty into a multi-use ecosystem for forward thinking brands.

Let’s touch on a few brands exploring blockchain loyalty:

Lufthansa – Lufthansa, a large European airline, has introduced Uptrip, an application that lets fliers collect NFTs by doing actions like scanning boarding passes, which then can unlock perks such as flight upgrades and airport lounge access. While still in beta, the project already has seen over 20,000 signups.

Nike – Nike has introduced a new digital sneaker collection that grants holders a variety of new perks. The Our Force 1 digital kicks were less than $20 to collect. Holders not only have assets that will be seen on the feet of your favorite video game characters, but holders were able to unlock secret levels in Fortnite, and they have announced an EA Sports collaboration. Additionally, holders were able to purchase a physical shoe only available to them. Almost 100,000 digital shoes were sold upon launch.

Blackbird – Ben Leventhal, the entrepreneur behind Eater and RESY, has a new venture called Blackbird. Blackbird allows restaurants and their customers to build relationships together through a crypto-powered points system called $FLY. Being pilot tested in New York, Leventhal plans to expand and is hyper-focused on restaurants knowing who their best customers are again and being able to share that data with like minded eateries. They just raised $24M for their Series A from investors like American Express and a16z.

In addition to the above, we have seen brands from LVMH to Starbucks exploring how they can use blockchain based toolsets to connect deeper with their customers. We also have an industry evolving to meet the needs of legacy and start-up brands as proven operators and forward thinking entrepreneurs see an opportunity to help traditional business transform onchain. Service providers like Forum3, Co:Create, Mojito and Superlogic among others are creating the SASS layer of on-chain loyalty.

The question will be asked if this new decentralized paradigm is better at loyalty than the centralized databases of Web2, which seem to be showing wear. There are user experience challenges, adoption curves and frankly some larger crypto branding issues that need to be worked out for this new consumer technology to hit critical mass. The promise of better consumer data privacy, shared goals of both brands and consumers and permissionless cross brand collaboration would say there is something big to keep an eye on.

– Sam Ewen, Head of CoinDesk Studios & Web3

Ask an Expert: NFT Myths

Q: “An NFT is just a jpeg, why pay for it when I can just download it?”

An NFT (Non-Fungible Token) is a tokenized record of ownership that is distinct, indivisible and has its ownership and properties accounted for and verified using a blockchain.

They can be used to represent ownership of any digital or physical asset, intellectual property, or rights. Just like a masterpiece painting, the original work is much more valuable than any subsequent copies or prints. NFTs can ascribe uniqueness to a digital file and denote an “original” work; this originality is what makes many NFTs valuable. Copying a digital file or artwork does not convey ownership rights and in many cases is copyright infringement.

They can be used to represent ownership of any digital or physical asset, intellectual property, or rights and it needs to be considered how they are treated from a tax reporting and inheritance point of view just like the underlying assets they represent.

Q: Are NFTs a passing fad?

Despite market fluctuations and criticisms, NFTs have demonstrated the potential to reshape ownership, provenance, the creator economy and traditional markets. The core concept of owning unique digital assets in a decentralized and verifiable way is powerful.

NFTs will expand ownership rights and transaction capabilities of all new and existing asset classes and markets.

Keep Reading

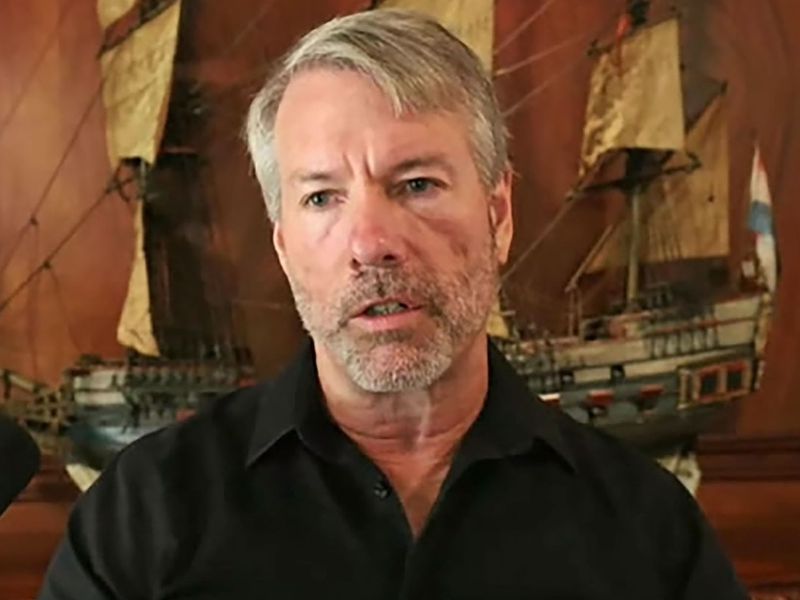

Michael Saylor from MicroStrategy discusses why current market conditions are favourable for investing in bitcoin.

The Securities and Exchange Commission may be facing challenges hiring crypto experts due to restrictions on employees holding crypto assets.

The next era of the internet has been coined “Web3” – listen to Alex Tapscott discuss why it’s going to be a “steamroller.”

Edited by Bradley Keoun.