Crypto for Advisors: Bitcoin’s 4th Halving Is Approaching

Roughly every four years, the creation of bitcoin reduces by 50% during what’s known as the halving. Bitcoin’s fourth halving is on the horizon, set to occur in late April. What implications could reduced production have on the market value of the asset? Haan Palcu-Chang from Purpose Investments provides his perspective on this event and the spot bitcoin ETF market considerations.

Leo Mindyuk of ML Tech answers questions about the halving in Ask an Expert.

In this article, we reference both Bitcoin and bitcoin – for clarity, Bitcoin refers to the blockchain network while bitcoin refers to the cryptocurrency.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Sometime in April of this year, we are likely to see Bitcoin’s fourth halving event occur. This event significantly changes the supply dynamics of bitcoin and, historically, has been tied to price increases for bitcoin and the broader crypto space. Below, we will explain what a Bitcoin halving is and what its potential implications are for investors.

What is a Bitcoin halving?

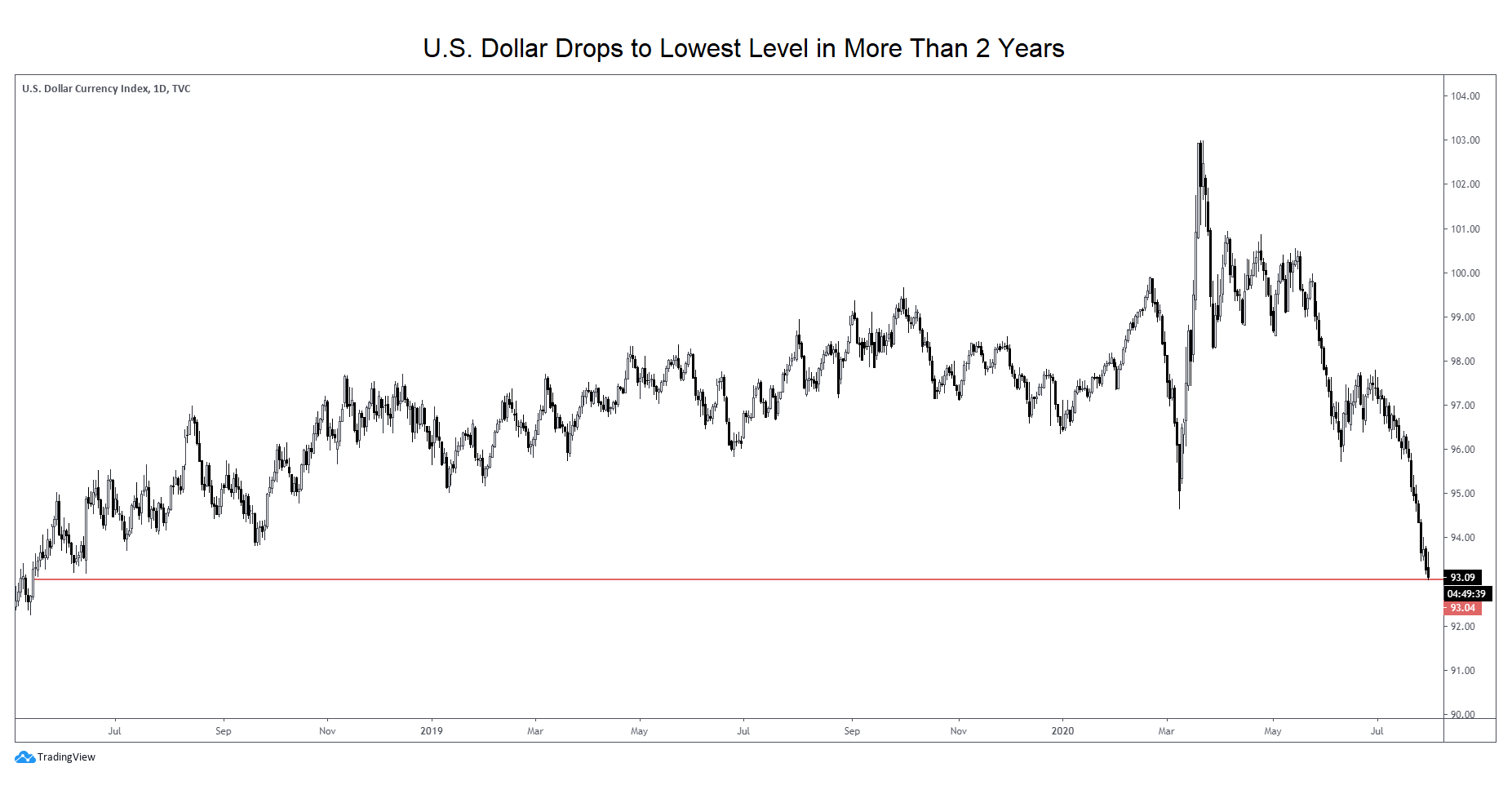

At a high level, a Bitcoin halving is when the introduction of new bitcoins into circulation is reduced by half. This happens roughly every four years, and this schedule will continue until the last bitcoin is mined sometime around 2140. The supply is capped at 21 million BTC. This mechanism was devised by Bitcoin’s creator(s) as a way to enforce scarcity and deflationary properties of bitcoin. The idea is that, so long as the adoption of the Bitcoin network grows over time, a mechanism like this will ensure that the laws of supply and demand will consistently increase the value of the asset. In this sense, the monetary policy of Bitcoin can be viewed as having been designed to be a counterweight or alternative to fiat money, which historically devalues over time. That is, what you can buy with a U.S. dollar today is a lot less than what you could buy with a dollar 100 years ago.

The Significance of the 4th Bitcoin Halving for Investors

Historically, halving events have been precursors to significant price rallies in bitcoin. The reality is that since its inception a decade and a half ago, bitcoin has been continually growing in adoption. And the deflationary nature of bitcoin circulation has meant that these supply and demand dynamics have resulted in bitcoin’s price increasing after each of its previous halvings. While past performance can never be fully indicative of future results, understanding the potential implications of a disinflationary asset that is only growing in adoption is very important.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/W63FM7IRXFGWTBKVSZG5NX35QE.png)

Market sentiment and speculation

The anticipation of the halving event can also lead to increased interest in bitcoin, and this comes with the inevitable rise in speculation and the potential for a “sell the news” event. As we saw in the buildup to the greenlighting of U.S. spot bitcoin ETFs in January – another event which placed a large spotlight on bitcoin – prices increased in anticipation of an SEC approval. When the funds were approved, a large short-term self-off occurred, causing the price to fall steeply. Bitcoin’s price has since recovered from the sell-off; however, the point remains that investors need to be wary of market sentiment and speculative trends leading up to the halving in order to position themselves in a way that best supports their bitcoin investment thesis.

Understanding the long-term investment perspective

Looking long-term at a five or 10-year time horizon, understanding what Bitcoin halvings do to the supply of bitcoin becomes even more compelling. Yes, seeing a price spike within a few months or weeks of the halving is exciting. But the real takeaway here is what these halvings do for the scarcity of the asset. When we zoom out and look at the fact that broad retail and institutional access to bitcoin was only made possible in the U.S. a little over a month ago with the approval of spot bitcoin ETFs, we start to comprehend how much future demand over the next few years could possibly come into the asset class.

The upcoming Bitcoin halving is going to have a significant impact on the number of bitcoin entering circulation. Looking at this event from a historical perspective, it is not unreasonable to assume that there will be price appreciation that coincides with or follows this event. Looking long-term, though, is what is most compelling as bitcoin’s programmed scarcity collides with growing demand for the asset and greater use of the Bitcoin network.

– Haan Palcu-Chang, crypto content specialist, Purpose Investments

Ask an Expert:

Q: What is Bitcoin halving, and why is it important?

A: Bitcoin miners receive a set reward for validating a block. The Bitcoin halving is a significant event coded into Bitcoin protocol that occurs when the reward for mining new blocks is reduced in half. This result is that the miners receive 50% less bitcoin for verifying the transactions. The halving mechanism highlights the scarcity of bitcoin and contrasts inflationary fiat printing mechanisms.

Q: How the halving typically affects bitcoin market activity?

A. Bitcoin halving has a multitude of impacts on the market. Primarily through supply, miner activity and market sentiment.

-

Reduced supply with unchanged demand is likely to lead to increased upward pressure on the price, according to the basic economic principles of supply and demand.

-

The halving affects the reward that the miners will get, which depending on the operational cost of each miner can lead to unprofitable miners leaving the network and difficulty of mining a new block adjusting to find a new market equilibrium.

-

Historically, halving events have led to significant speculations, increased volumes and price volatility.

Q: Why might this halving be different?

A: With the recent spot ETFs approval and new inflows from institutional capital into the space through ETFs, the new daily demand significantly outweighs the current daily supply of new bitcoins. The demand for new BTC combined with the reduced supply from the halving can create even a stronger upward pressure on the price.

– Leo Mindyuk, CEO, ML Tech

Keep Reading

Mastercard and Swoo Pay announced a new crypto rewards loyalty program.

Bitcoin spot ETFs were a hot topic at the annual Exchange ETF conference recently held in Miami.

Crypto exchange Coinbase Q4 earnings report ‘exceeded’ expectations.

Edited by Bradley Keoun.