Crypto Exchange OKX Goes Live With ‘Nitro Spreads,’ Allowing One-Click Basis Trading

OKX has launched “Nitro Spreads,” a feature on its over-the-counter (OTC) institutional liquid marketplace that allows traders to make complex basis trades in one-click.

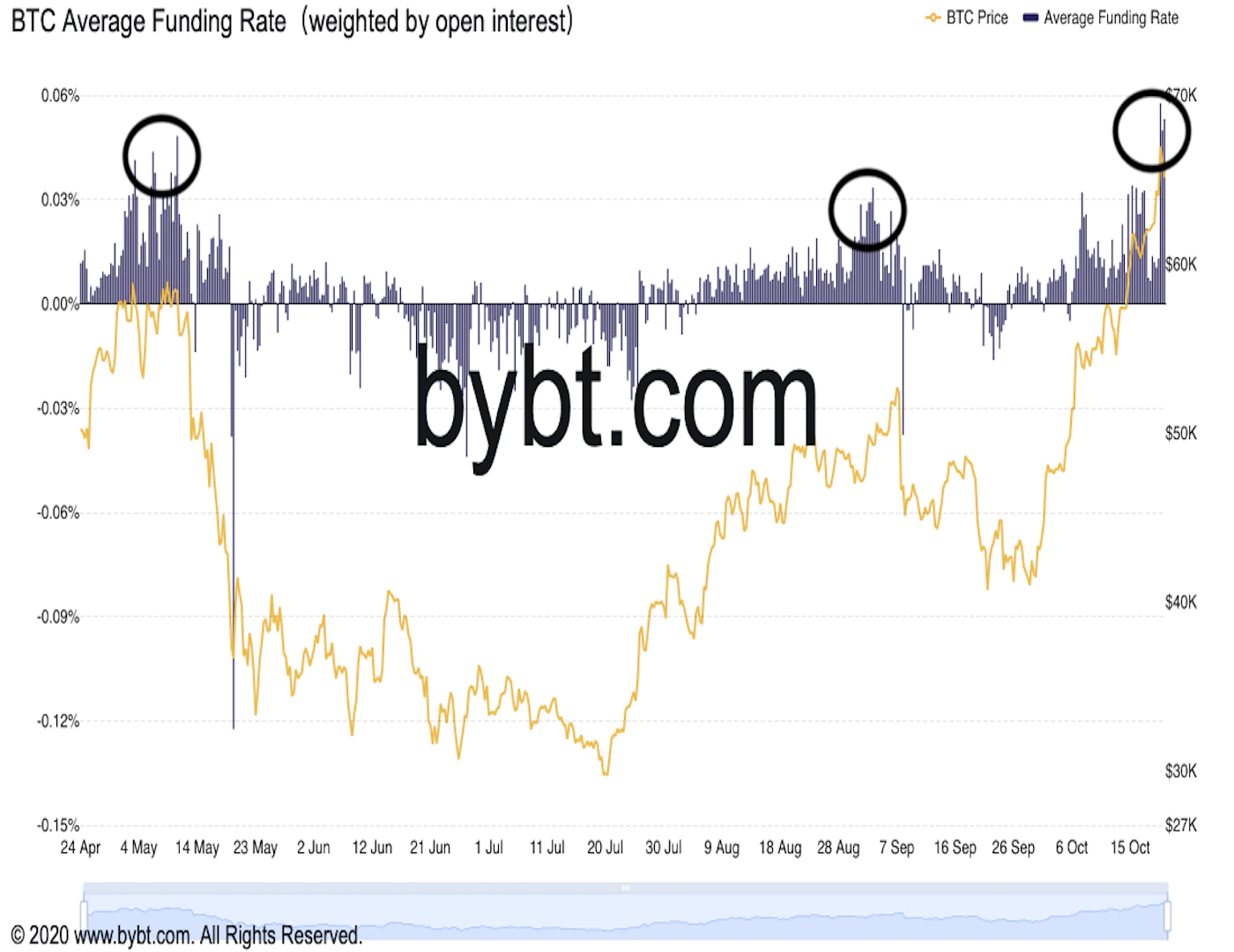

Basis trading refers to trading the difference between an asset’s price on two separate markets in an attempt to generate returns, for example, trading the difference of an asset on spot markets vs. futures markets. OKX’s Nitro Spread automates this kind of trade into one-click. Traders can apply this feature across any combination of spot, perpetual and futures contracts listed on the exchange, said the company.

“In the current complex market environment, institutions demand reliability, predictable returns and genuine innovation when choosing a trading venue,” said Lennix Lai, global chief commercial officer at OKX. “This is especially true in basis trading, where precision and flawless execution are paramount,” he added.

Nitro Spread is one of the only basis trading tools in crypto where two legs of the trade are executed via a central order book, according to the press release. Before making the trade, traders can select a guaranteed spread, reducing price slippage.

“Traders can place resting orders with a fixed spread – they do not need to worry about immediate execution,” said Lai. “If the actual spread moves against their chosen spread, their orders will remain passive and not be executed.”

“Spread order book prices are generally more stable than outright books as the instruments are delta neutral,” he continued. “We are working with a variety of liquidity providers to ensure that our users can trade effectively and take advantage of spreads.”

Traders can also execute popular delta one spread strategies like calendar spreads, future rolls and funding rate farming, all in order book format, said the press release.

The exchange’s Nitro Spreads product launched as a preview in May.

Edited by Stephen Alpher.