Crypto Exchange FTX Could Reopen, Its Attorney Says; Firm’s FTT Token Surges

Featured SpeakerBrett Harrison

Founder and CEOArchitect

Don’t miss “FTX: What Happened” with the former president of FTX’s U.S. arm and Anthony Scaramucci.

:format(jpg)/www.coindesk.com/resizer/Wp_9JBk78AmIs8_Yu11cdVp5OZk=/arc-photo-coindesk/arc2-prod/public/SGJ5I72WCZGERM6ZC74CJCQCZQ.png)

Cheyenne Ligon is a CoinDesk news reporter with a focus on crypto regulation and policy. She has no significant crypto holdings.

Featured SpeakerBrett Harrison

Founder and CEOArchitect

Don’t miss “FTX: What Happened” with the former president of FTX’s U.S. arm and Anthony Scaramucci.

FTX, the cryptocurrency exchange that collapsed spectacularly in November, is considering reopening at some point in the future as it navigates bankruptcy, its attorneys from Sullivan & Cromwell said in a court hearing on Wednesday.

One potential option discussed was to let FTX’s creditors convert a portion of their holdings to a stake in a reopened exchange.

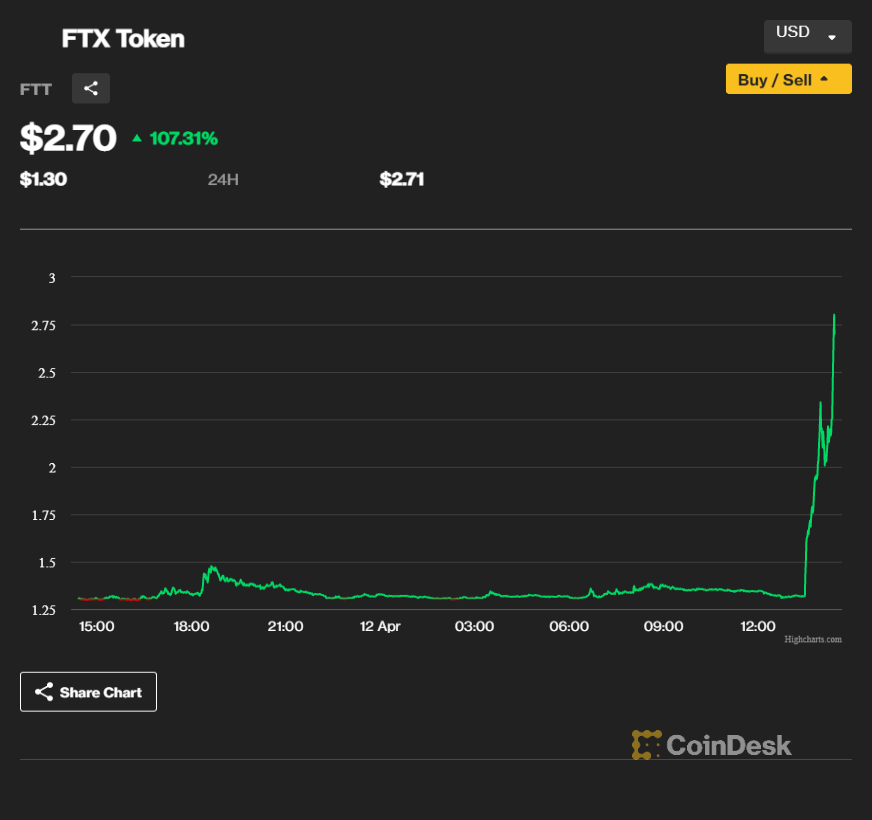

FTT surges (CoinDesk)

The FTX attorneys also told the court they’ve recovered $7.3 billion in liquid assets from the defunct exchange, up from January’s $1.9 billion tally. However, they added, FTX is still “far away from an equity distribution.”

UPDATE (April 12, 2023, 17:55 UTC): Adds the amount FTX has recovered and updates size of FTT’s surge.

UPDATE (April 12, 2023, 18:27 UTC): Updates size of FTT’s surge.

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Wp_9JBk78AmIs8_Yu11cdVp5OZk=/arc-photo-coindesk/arc2-prod/public/SGJ5I72WCZGERM6ZC74CJCQCZQ.png)

Cheyenne Ligon is a CoinDesk news reporter with a focus on crypto regulation and policy. She has no significant crypto holdings.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Wp_9JBk78AmIs8_Yu11cdVp5OZk=/arc-photo-coindesk/arc2-prod/public/SGJ5I72WCZGERM6ZC74CJCQCZQ.png)

Cheyenne Ligon is a CoinDesk news reporter with a focus on crypto regulation and policy. She has no significant crypto holdings.