Crypto Diversification Is Back in 2023

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

Todd Groth is Head of Index Research at CoinDesk Indices. . He has over 10 years of experience involving systematic multi-asset risk premia and alternative investment strategies.

:format(jpg)/www.coindesk.com/resizer/8HPMRxDsJDJuWOBfhd410sC-cXU=/arc-photo-coindesk/arc2-prod/public/TY2E5BZWNVBLRGJ7KTDL66QAEM.png)

Nick Baker is CoinDesk’s deputy editor-in-chief. He owns small amounts of BTC and ETH.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Throughout 2022, cryptocurrencies and stocks – specifically growth tech stocks – moved more in lockstep than they did in 2020-2021. That can be explained by similar, shared investor types and overlapping investment views that called for positioning toward future technology adoption despite the risk of uncertain and unpredictable future cash flows.

Whatever the case, the dramatic rise in interest rates in 2022 had a meaningful impact on growth-oriented portfolios. Investors’ time horizons collapsed from more than five years out to the near term. Today, investors are making current cash flows and profits a priority over potential growth prospects. Bull market buzzwords – fear of missing out, moon bags, laser eyes, stonks go up, and financial independence, retire early – are out of vogue, replaced by mundane things like holding on, dollar cost averaging and the collective hope for transitory inflation.

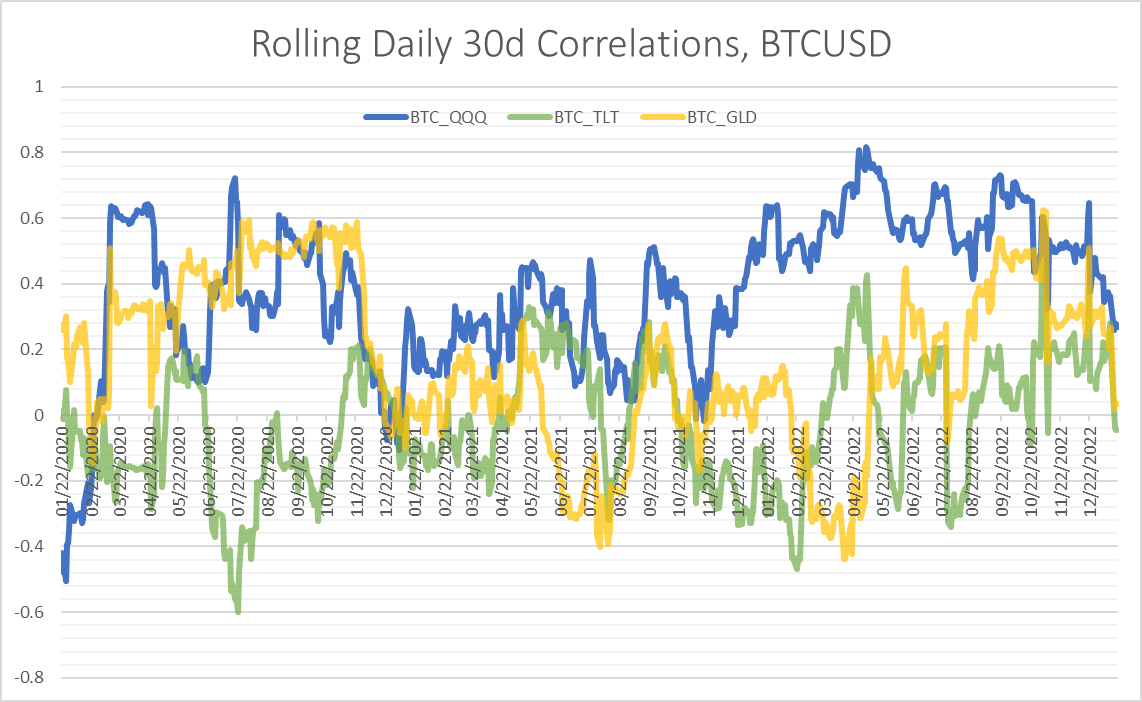

With this sudden change in mentality gripping crypto investors unaccustomed to inflation or a persistent bear market, crypto started trading interchangeably with other risky assets. (See rolling correlations to key exchange-traded funds in Figure 1):

Figure 1: Data Source: CoinDesk Indices Research, Yahoo Finance

Fortunately, crypto and other assets are going their own way in 2023, with the bitcoin/Nasdaq (QQQ) correlation down to levels last seen in 2021. Correlations to gold (as represented by the GLD ETF) and bonds (the TLT ETF) have slipped back to around zero, meaning no real relationship. Diversification is back.

A useful analogy for correlation changing under market stress would be to imagine yourself standing outside your house when it’s on fire. Amid shock and disbelief, you lose any semblance of nuance or long-term perspective. The only thing that matters is who’s inside the house and who’s safe outside. Few people ever plan for these circumstances, and for those who do, as Mike Tyson famously said, “Everybody has a plan until they get punched in the face.”

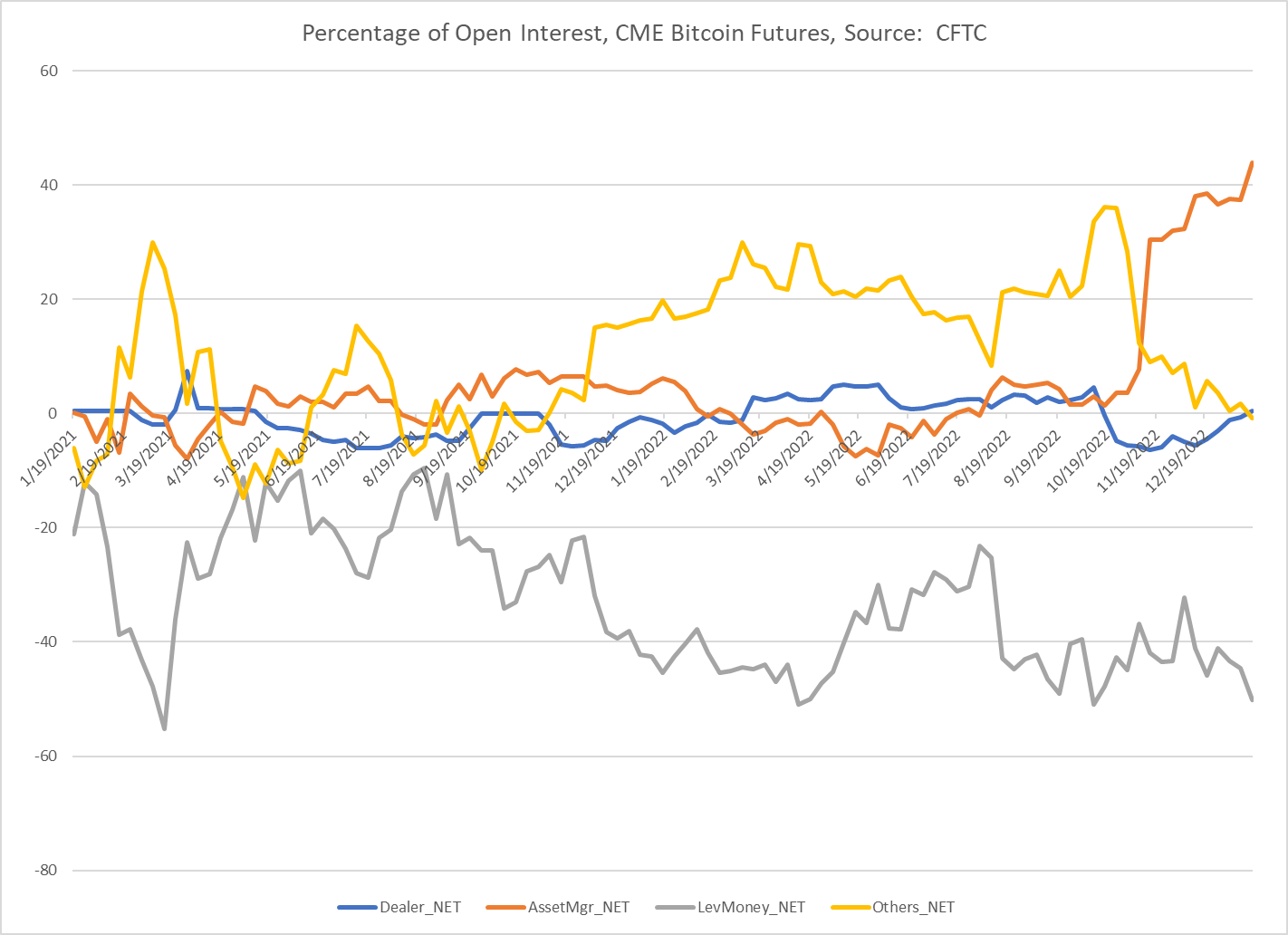

Only once the flames subside can we begin to make calm and reasoned decisions. That’s happening now as crypto prices surge. My inner contrarian initially wrote off this move higher as a bear market short squeeze, but futures positioning data from the Commodity Futures Trading Commission (see Figure 2) tells a different story. Over the past three weeks, there has been an uptick in open interest from the real-money crowd (i.e., asset managers), while the fast-money crowd (“leveraged funds” in CFTC parlance) doesn’t appear to be overstretched and therefore vulnerable to a short squeeze. That suggests the rally is durable.

Figure 2: Data Source: Commitment of Traders report, CFTC

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

Todd Groth is Head of Index Research at CoinDesk Indices. . He has over 10 years of experience involving systematic multi-asset risk premia and alternative investment strategies.

:format(jpg)/www.coindesk.com/resizer/8HPMRxDsJDJuWOBfhd410sC-cXU=/arc-photo-coindesk/arc2-prod/public/TY2E5BZWNVBLRGJ7KTDL66QAEM.png)

Nick Baker is CoinDesk’s deputy editor-in-chief. He owns small amounts of BTC and ETH.