Crypto Derivative Volumes Rose in March for Third Straight Month

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

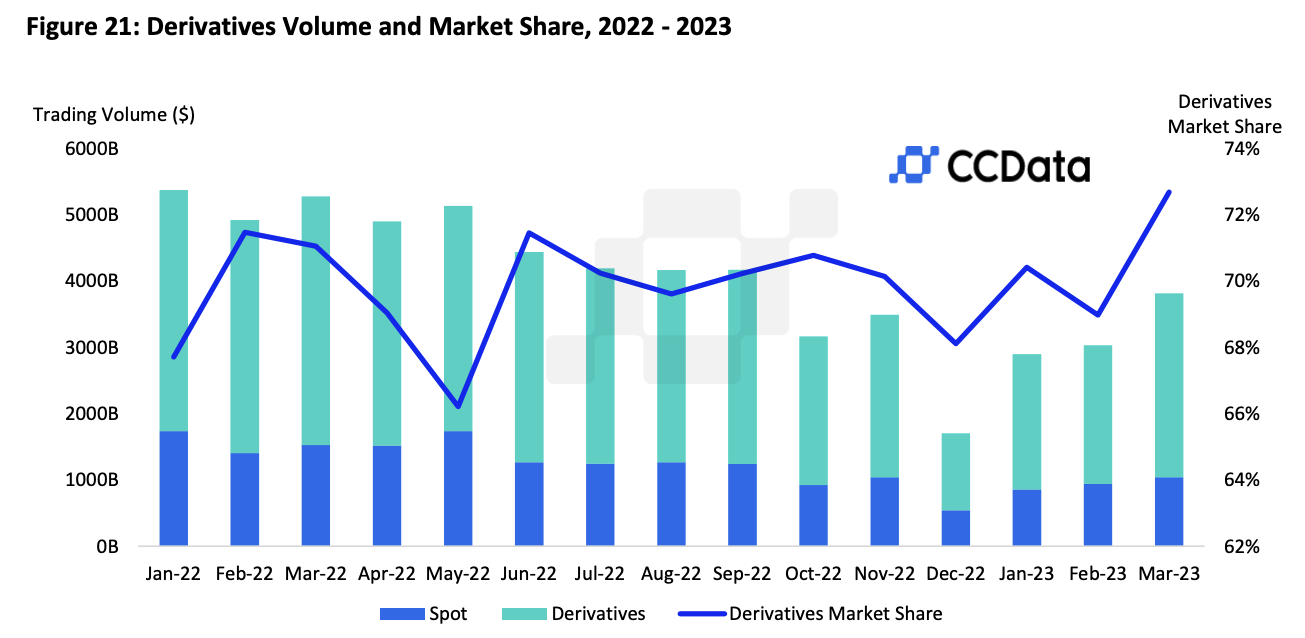

Crypto derivatives trading volumes across both centralized and decentralized exchanges rose for a third consecutive month in March, the first three-month streak since at least January 2022, according to figures from CCData.

Crypto derivatives are financial contracts such as futures and options that relate to cryptocurrencies. They are popular because they allow market participants to hedge their positions or to speculate on market direction.

(CCData)

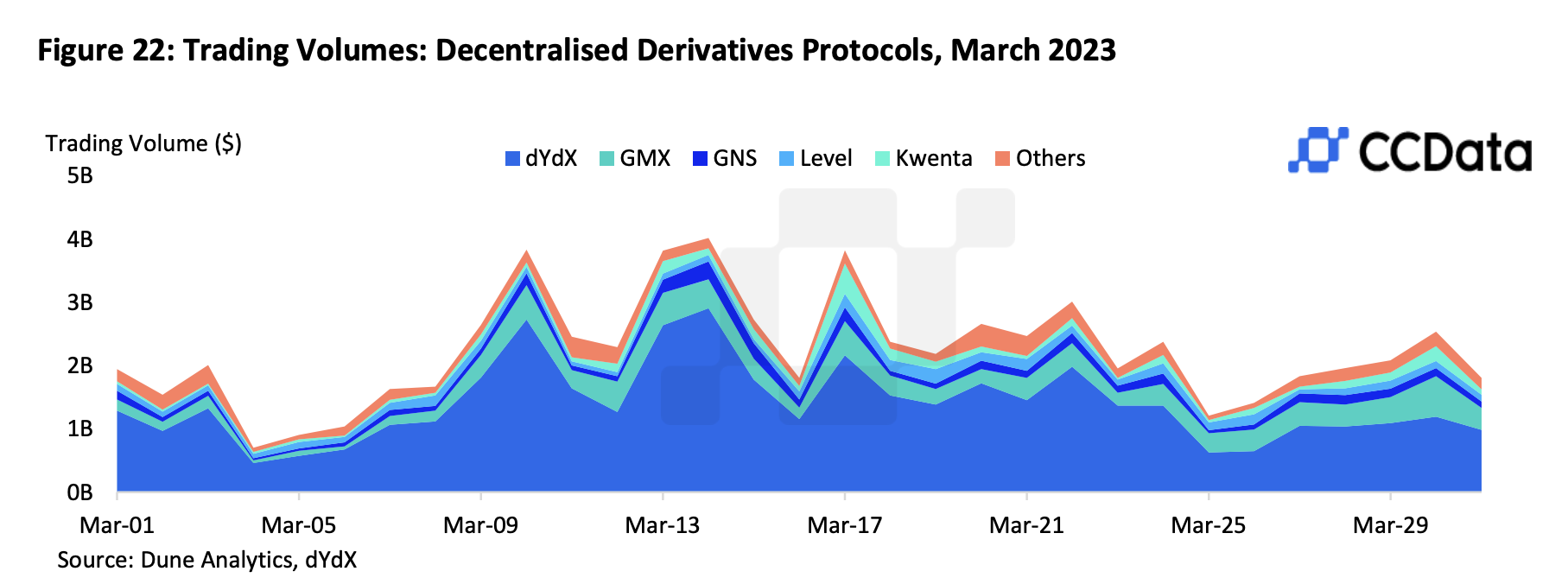

Derivatives trading accounted for about 74% of the roughly $4 trillion crypto market volume last month, the data show. While the bulk of derivatives trading took place on centralized exchanges (CEX), decentralized exchanges (DEX) accounted for $68.7 billion, with dYdX taking a 62.6% share.

(CCData)

“We expect decentralized derivatives protocols to continue performing well and gain market share in the next quarter,” said CCData in a report.

There has been an increasing trend of spot DEXs adding derivatives trading to their platforms as they notice the potential of derivative DEXs, according to CCData.

In March, DEX PancakeSwap announced it was partnering with ApolloX to introduce trading of perpetual swaps. Quickswap, a decentralized exchange built on Polygon, is also launching perpetual products soon, CCData said.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.