Crypto.com Overtakes Coinbase to Dominate North American Crypto Trading, Data Shows

-

Crypto.com has seen spot trading volume soar to $134 billion in September from $34 billion in July – The Block.

-

A report by Citigroup attributed crypto.com’s dominance partly due to the crypto ETFs.

02:21

Tether Denies U.S. Probe; MicroStrategy Premium is ‘Unsustainable’: Report

02:12

Why Polymarket Fails to Raise Polygon POL Price

02:32

Microsoft Urges Shareholders to Vote Against Bitcoin Proposal

12:56

Bitcoin Option Volumes Soar, Institutions Eye $100K BTC Post-U.S. Election: Kaiko

Digital asset trading on Crypto.com has exploded this year, pushing the crypto exchange’s volumes in North America well ahead of Coinbase (COIN).

Crypto.com’s monthly spot trading volume soared to $134 billion in September from $34 billion in July, according to data from The Block. Overall trading volumes on North American crypto exchanges was $183 billion in September, in which Coinbase handled $46 billion.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JMREDJ5UV5CTZJHIDFZSC4M37M.png)

Crypto.com first overtook Coinbase in July and continues to lead so far in October. So far this month, the exchange saw $112 billion trading volume out of the overall $173 billion traded on exchanges in the region, The Block data shows. Kraken, the third-largest exchange, way behind in October with just under $10 billion in trading activity.

A key reason for Crypto.com’s popularity could be the wide range of tokens on offer. It lists over 378, ranging from mainstays bitcoin (BTC) and ether (ETH) to memecoins, such as book of meme (BOME), to ecosystem tokens such as Jupiter’s JUP and deBridge. Coinbase and Kraken, in contrast, are more selective, offering fewer than 290 tokens each.

BTC and ETH trading dominate Crypto.com, accounting for more than 85% of all trading activity across Tether’s USDT stablecoin and U.S. dollar pairs, CoinGecko data shows.

Some 26% of the exchange’s web traffic comes from the U.S., Kaiko Research said earlier this month, with most users active during U.S. trading hours.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UGXYZ2J3ZRANXH7PO6CRMYD2RA.png)

A Citigroup report earlier this month partly attributed this dominance to the crypto ETFs that have been extremely successful in 2024.

Matthew Sigel, head of digital assets research at VanEck, said in an X post in September that Crypto.com’s “average BTC trade size on Crypto dot com has 3x YTD” coinciding with Cboe Global Markets, a U.S.-based exchange, closing its spot crypto division.

“Liquidity has kept pace with trade volumes, suggesting market makers are also more active on the platform,” Sigel said at the time.

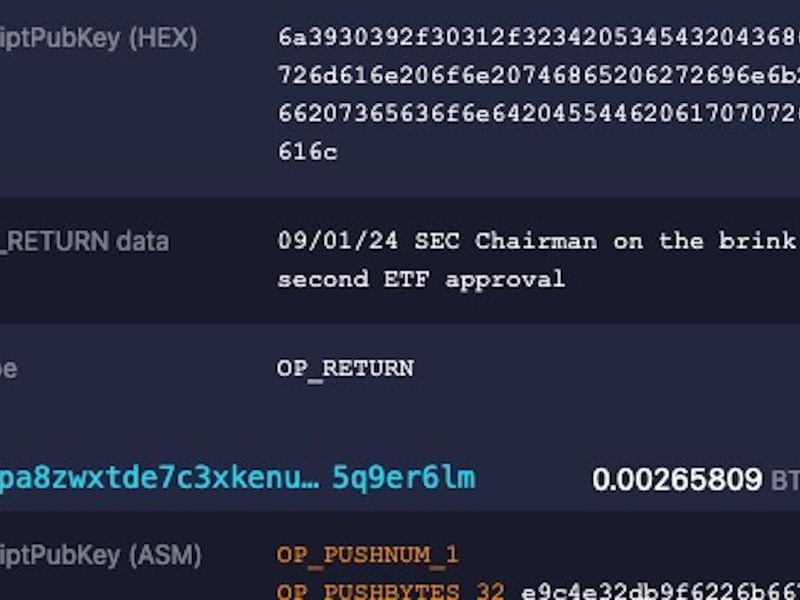

Meanwhile, the bump in volumes comes amid ongoing legal drama for Crypto.com. Earlier this month, the exchange filed suit against the U.S. Securities and Exchange Commission to “protect the future of the crypto industry in the U.S.,” shortly after it received a Wells notice from SEC staff.

Crypto.com CEO Kris Marszalek said the firm brought the case to limit the SEC’s “unauthorized overreach and unlawful rulemaking,” as CoinDesk reported.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/coindesk/7fe88428-ae49-4453-ab19-5cfbf125689b.png)

As the senior analyst at CoinDesk, James specializes in Bitcoin and the macro environment. Previously, his role as a research analyst at Swiss hedge fund Saidler & Co. introduced him to on-chain analytics. He monitors ETFs, spot and futures volumes, and flows to understand Bitcoin.

Follow @btcjvs on Twitter

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter