Crypto Bank Hopeful Bitcoin Suisse Raises $48M in First-Ever Round

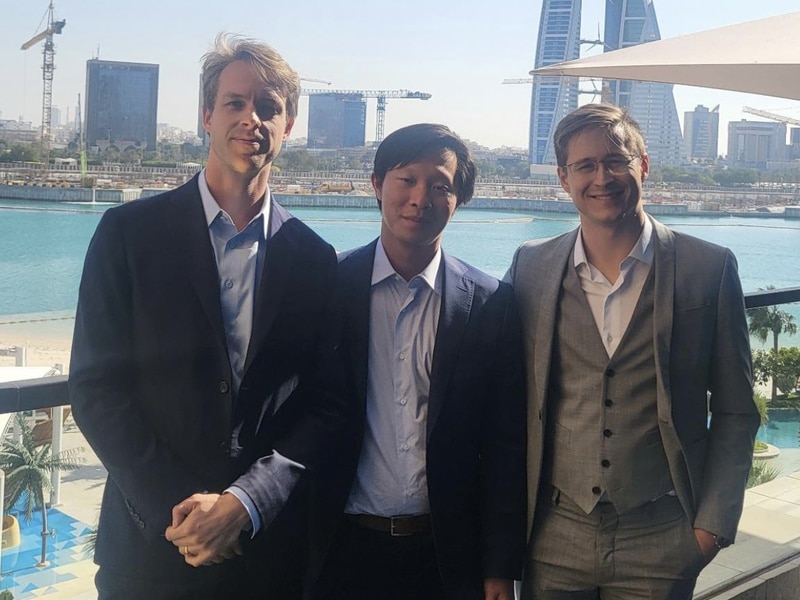

Zug, Switzerland (Shutterstock)

Bitcoin Suisse has raised more than CHF 45 million (~$48 million) in its first-ever funding round.

- The Series A was for 16.4% of total equity – 10% newly-created – and completed in four months.

- It was led by Roger Studer, the former investment head of Vontobel, a private bank that held approximately $215 billion in assets under management at the end of 2019.

- A Zug-based financial services provider for the digital asset industry, Bitcoin Suisse said the funding round pushed its valuation to CHF 302.5 million (~$327 million).

- Some of the funding will expand the company’s lending business and staking services, as well as the custodial solution.

- Bitcoin Suisse is applying for a Swiss banking and securities dealer license, as well as a banking license in neighboring Liechtenstein.

- A spokesperson told CoinDesk it had set aside funding for new product offerings, should the license applications be successful.

- In a statement, Bitcoin Suisse said H1 2020 performance had been strong, with strong growth across its product and service range – the Series A satisfied capital needs for the foreseeable future.

- The spokesperson previously told CoinDesk that Bitcoin Suisse had started initial preparations for a public listing – either an IPO or direct listing – for some time in the next few years.

- A security token offering (STO) might also be in the works, but this will depend on market demand and Bitcoin Suisse’s capital requirements.

- The spokesperson told CoinDesk Friday that the Series A put the bank hopeful in a “good position” to move ahead with its listing plans.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.