Crypto Analysts Split on Why Ether Outperformed Bitcoin During Last Week’s Slide

-

The ether-bitcoin (ETH/BTC) ratio rose last week even as the broader market cratered.

-

One analysts attributed ether’s uncanny outperformance with optimism from the potential launch of futures-based ETFs.

-

Others pointed to a lack of interest in altcoins and hedging activity of market makers.

Last week’s market crash saw ether (ETH), the native token of Ethereum’s blockchain, take smaller losses than industry leader bitcoin (BTC). Analysts are split on why, given bitcoin is usually the preferred asset during market slides.

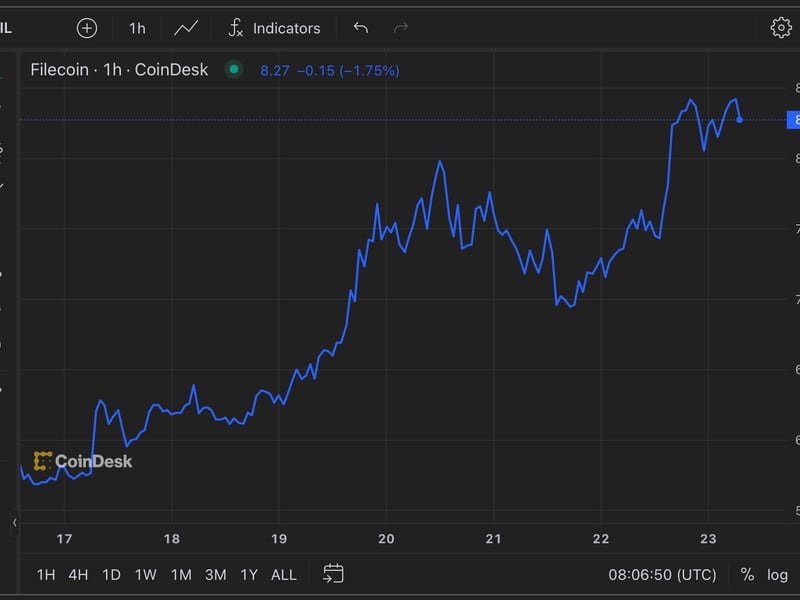

While bitcoin fell 10.5% last week, ether lost 8.3%, resulting in a more than 2% gain in the widely tracked ether-bitcoin (ETH) ratio, CoinDesk data show. The crypto market capitalization fell by 8.3% to $1.02 trillion.

The uptick in the ratio seems unusual because investors typically prefer bitcoin, the biggest and the most liquid cryptocurrency, during times of stress. Historically, the ratio has declined during market swoons and rallied during upswings.

This time, optimism about an impending U.S. launch of ether futures-based exchange-traded funds (ETFs) likely helped the No. 2 cryptocurrency, according to Noelle Acheson, the author of the Crypto Is Macro Now newsletter.

“It looks like the ETH market is finally starting to wake up to the likelihood of an ETH futures ETF come October. While this is not as good a product as a spot ETF would be, it is still a convenient way for retail and institutional investors to diversify their crypto exposure, and is likely to drive new inflows into the asset.” Acheson said, explaining the catalyst for ether’s outperformance.

Futures-based ETFs issue publicly traded securities that track the price movement of an asset’s futures contracts. An ether version would attempt to mimic the crypto’s performance just as ProShares’ Bitcoin Strategy ETF does for the largest cryptocurrency. Since its inception in October 2021, ProShares’ BTC futures-based ETF has closely tracked the spot price, attracting over $2 billion in investor money. Though its considered inferior to a spot-based ETF due to roll costs, it works for anyone looking to take exposure to the cryptocurrency without owning it.

As of now, at least 16 applications for ether futures ETFs or ether-bitcoin futures ETFs are awaiting regulatory approval in the U.S., according to Wall Street Journal.

“As awareness of the upcoming listings spread, we should start to see interest pick up further,” Acheson told CoinDesk, adding that more investment could boost Ethereum’s on-chain activity, increasing the amount of ETH burned each day. “This could add a further tailwind to the price, boosting the number of on-chain transactions even further, creating more transaction fees, more (ETH) burns, more supply reduction, and so on.”

Lack of interest in altcoins

Meanwhile, Markus Thielen, head of research and strategy at crypto services provider Matrixport, said bitcoin’s bigger decline mainly stems from a lack of interest in ether and other coins.

“As the crypto market has become rather illiquid, with several market makers stepping away from crypto and exchanges have removed zero-fee trading, the larger players have focused on bitcoin instead of trading the illiquid altcoins. This is why bitcoin underperformed when the market crashed last week,” Thielen told CoinDesk.

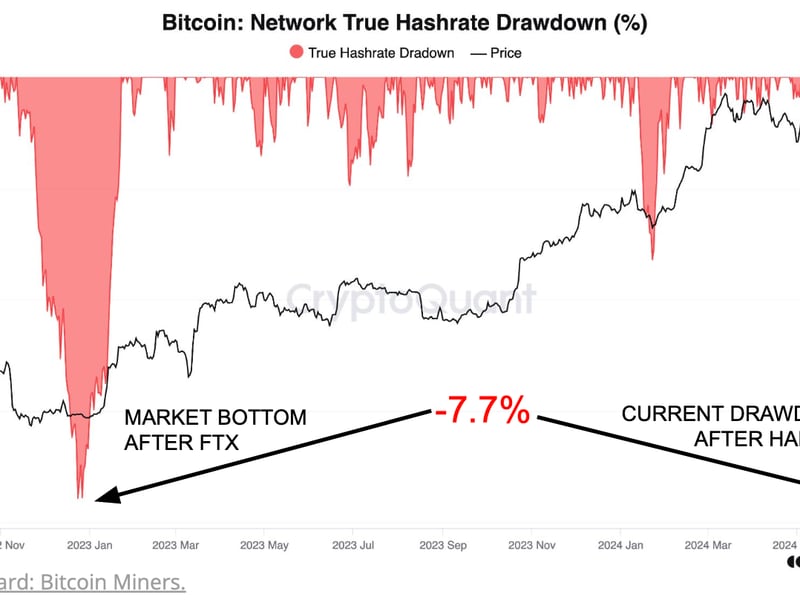

Liquidity, or the ability of the market to absorb large orders at stable prices, has deteriorated significantly since the collapse of Sam Bankman Fried’s FTX exchange last November. The situation has worsened since the U.S. Securities and Exchange Commission cited several altcoins as securities in its lawsuits against Binance and Coinbase. Altcoin liquidity on U.S.-based exchanges has declined to around $20 million from $32 million in November, according to Paris-based Kaiko.

Low liquidity means high slippage – the difference between the price at which a trading order is executed and the price at which it was requested. Therefore, big traders may have stayed away from altcoins this year.

Market makers arrested ETH’s drop

Lastly, according to Griffin Ardern, volatility trader from crypto asset management firm Blofin, the hedging activity of ETH options market makers was mainly responsible for ether’s outperformance.

“For BTC, I think market makers’ hedging contributed to the price drop, but for ETH, it was a key factor that prevented the price from falling sharply,” Ardern said. “ETH had solid positive gamma near the strike price of around $1,600, and its total gamma is still positive, which means that when the price falls, market makers are buyers rather than sellers.”

Market makers are entities responsible for creating order book liquidity. They trade against market direction when gamma is positive, thereby arresting price swings.

Edited by Sheldon Reback.