Crypto Analysts React to Bitcoin’s 19-Month Peak at Almost $42K

Crypto markets have marched higher during the weekend and into the Monday morning Asian trading session.

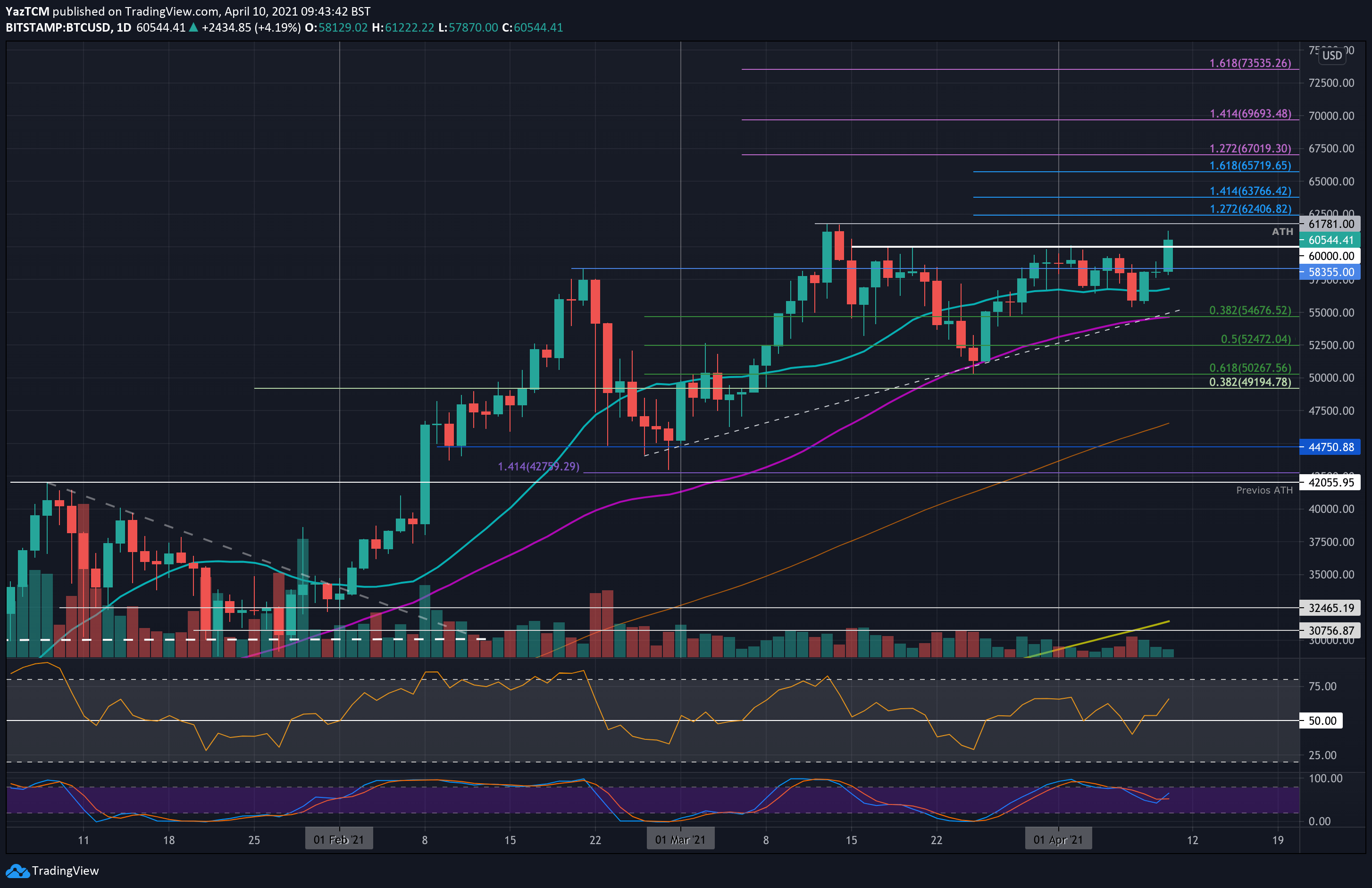

They have been dominated by Bitcoin, which has surged to its highest price in 19 months, reaching $41,750 on December 4, according to CoinGecko.

At the time of writing, the asset was trading close to $41,500 following a 5.2% gain on the day and 11% over the past week.

#Bitcoin $40k

pic.twitter.com/EKRFSmHmhd

— PlanB (@100trillionUSD) December 3, 2023

Bitcoin in The Driving Seat

Analysts and investors have been lauding the move. BTC educator and pioneer Samson Mow made a big prediction should spot ETFs get approved:

“Most people couldn’t see $40k ever happening again when we dropped to $15k. Most people can’t see $1M Bitcoin happening post ETF approvals.”

The majority of analysts have given high odds of as much as 90% on the SEC approving several Bitcoin funds by January 10. This appears to be the primary driver of market momentum at the moment.

ETF Store President Nate Geraci posted a collection of FUD headlines predicting a Bitcoin price crash in 2023.

Remember…

Nobody. Knows. Anything. pic.twitter.com/zkz1T4yUrM

— Nate Geraci (@NateGeraci) December 4, 2023

Analyst “CrediBULL Crypto” said, “This time is different,” predicting that prices would blast through $40K easily.

If this is indeed the start of our next major leg to the upside (39.5k is local invalidation for this as explained in my latest video update) then we are gonna melt through the 40k’s like a hot knife through butter. https://t.co/PPQe66L59R

— CrediBULL Crypto (@CredibleCrypto) December 4, 2023

Moreover, Rekt Capital looked at previous cycles, predicting that the next bull market peak may occur 518 to 546 days after the halving. “That’s mid-September or mid-October 2025,” he said.

The Bitcoin “Fear and Greed” Index has jumped to its highest level for over a year, hitting 74 “greed” over the weekend. It was last higher in November 2021, when markets were at all-time highs.

Elsewhere on Crypto Markets

Total market capitalization has hit its highest level since May 2022 at $1.59 trillion bringing it to just 48% from its peak of $3 trillion two years ago.

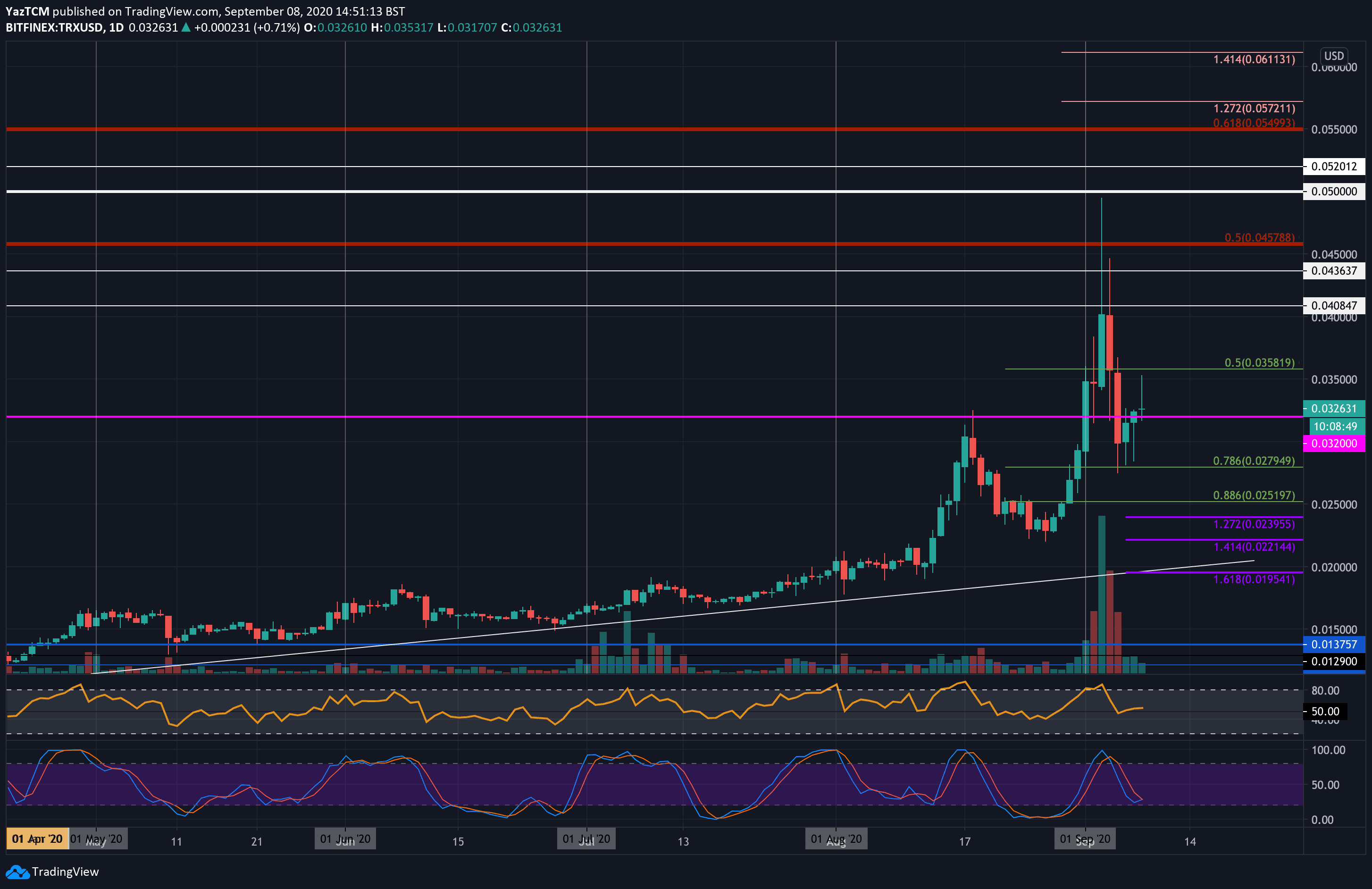

Bitcoin is the clear driver of momentum, but a few other altcoins are also making solid gains today.

Ethereum was up just over 3% to reach $2,227, its highest price since May 2022. The rest of the markets were showing minor gains aside from Shiba Inu making 6%, Bitcoin Cash pumping 10%, and Terra Luna Classic (LUNC) surging 52%.

The post Crypto Analysts React to Bitcoin’s 19-Month Peak at Almost $42K appeared first on CryptoPotato.