CRV Gets Plunge Protection on Binance as Market Makers Add Bid-Side Liquidity

Crypto market makers stepped in on Binance to support Curve’s native token CRV after the decentralized exchange’s late Sunday exploit sent the cryptocurrency crashing and threatened the liquidation of a large CRV-collateralized borrowing and market-wide contagion.

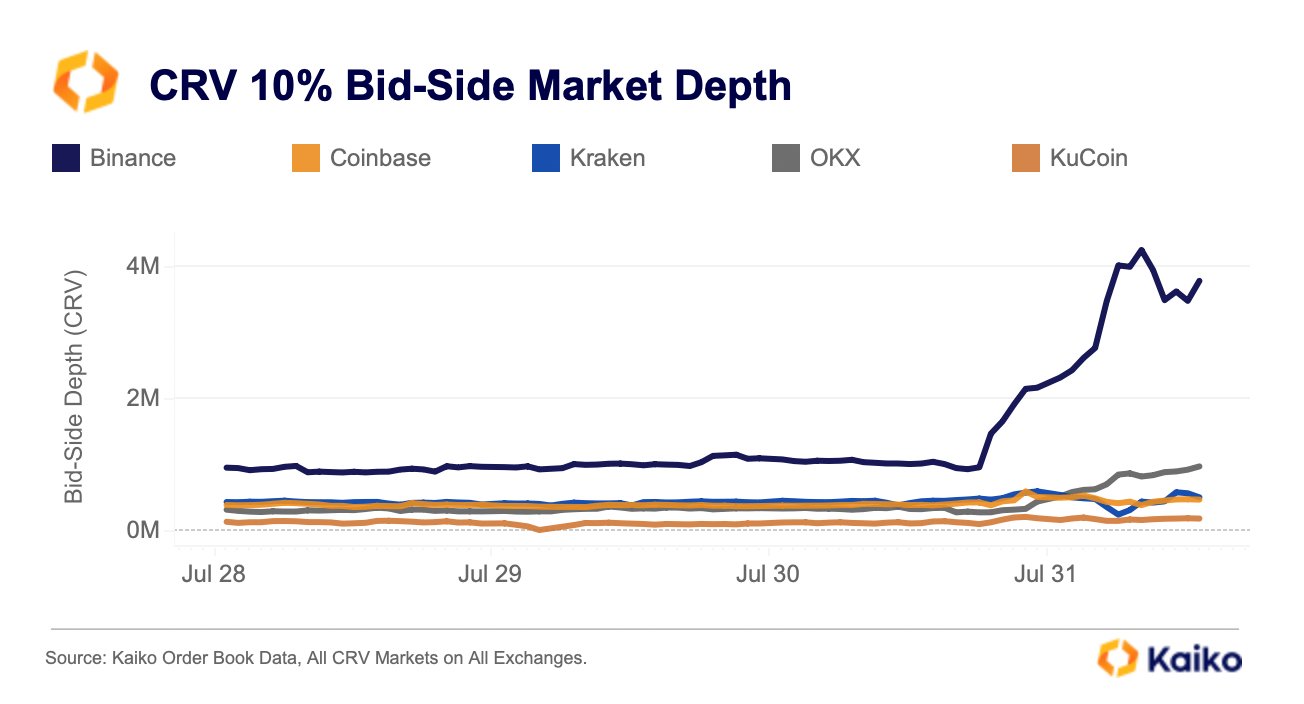

The 2% bid-side market depth, or the collection of buy orders within 2% of the mid-price, doubled from roughly 500,000 CRV to more than 1 million CRV following the exploit, according to Paris-based crypto data provider Kaiko.

In other words, the ability of the market to absorb large orders at stable prices doubled due to an influx of buy-side liquidity. The 10% bid-side depth on Binance also increased sharply.

The surge in the bid depth is surprising and is reflective of market makers offering plunge protection to the cryptocurrency, according to Clara Medalie, director of research at Kaiko.

“Market makers tend to pull orders to avoid getting caught in an unfavorable price swing,” Medalie told CoinDesk. “That is why liquidity disappeared on order books during big market events, such as the March banking crisis or FTX collapse,” she continued. “Right after the Curve exploit, we saw the opposite trend, with liquidity being added to the CRV order books, specifically on the bid side.”

CRV fell over 14% to 58 cents immediately following the late Sunday exploit. The quick drop raised fears of a potential liquidation of Curve founder Michael Egorov’s multi-million dollar worth of USDT and FRAX borrowings collateralized by CRV, and spurred more CRV selling. The negative feedback loop threatened to push prices down to Egorov’s then liquidation level of 37 cents.

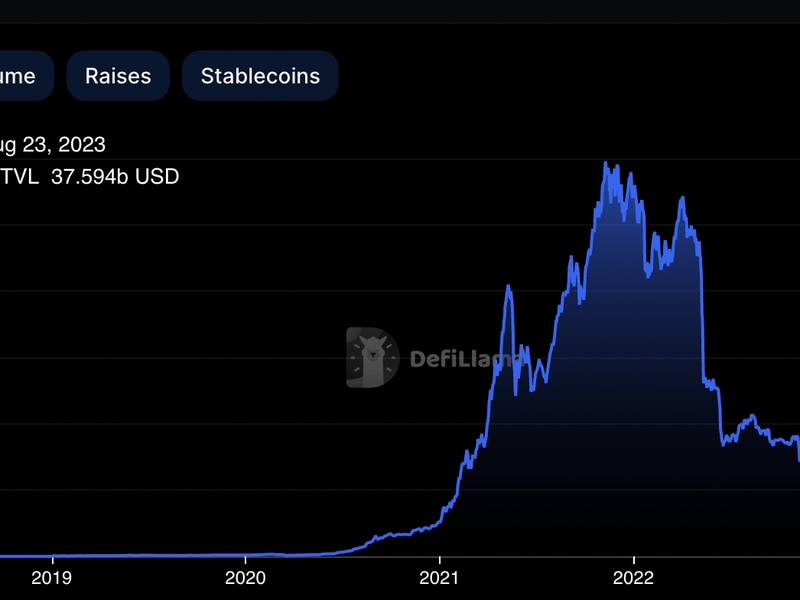

Potential liquidation could have destabilized the broader decentralized finance market. As of now, the panic has been averted.

“It’s clear that there are A LOT of incentives to not have CRV price drop below a certain level,” Medalie added.

While the bid side depth on Binance doubled, overall liquidity in native token terms across other exchanges did not see a notable change, Medalie added, echoing FalconX Research’s view.

Edited by Stephen Alpher.