‘Crushing’ regulations could drive Ripple out of US

Ripple co-founder Chris Larsen said the firm is considering moving to the U.K., Switzerland, Singapore, or Japan.

Ripple is considering relocating to Europe or Asia amid growing frustration at the lack of regulatory clarity in the United States.

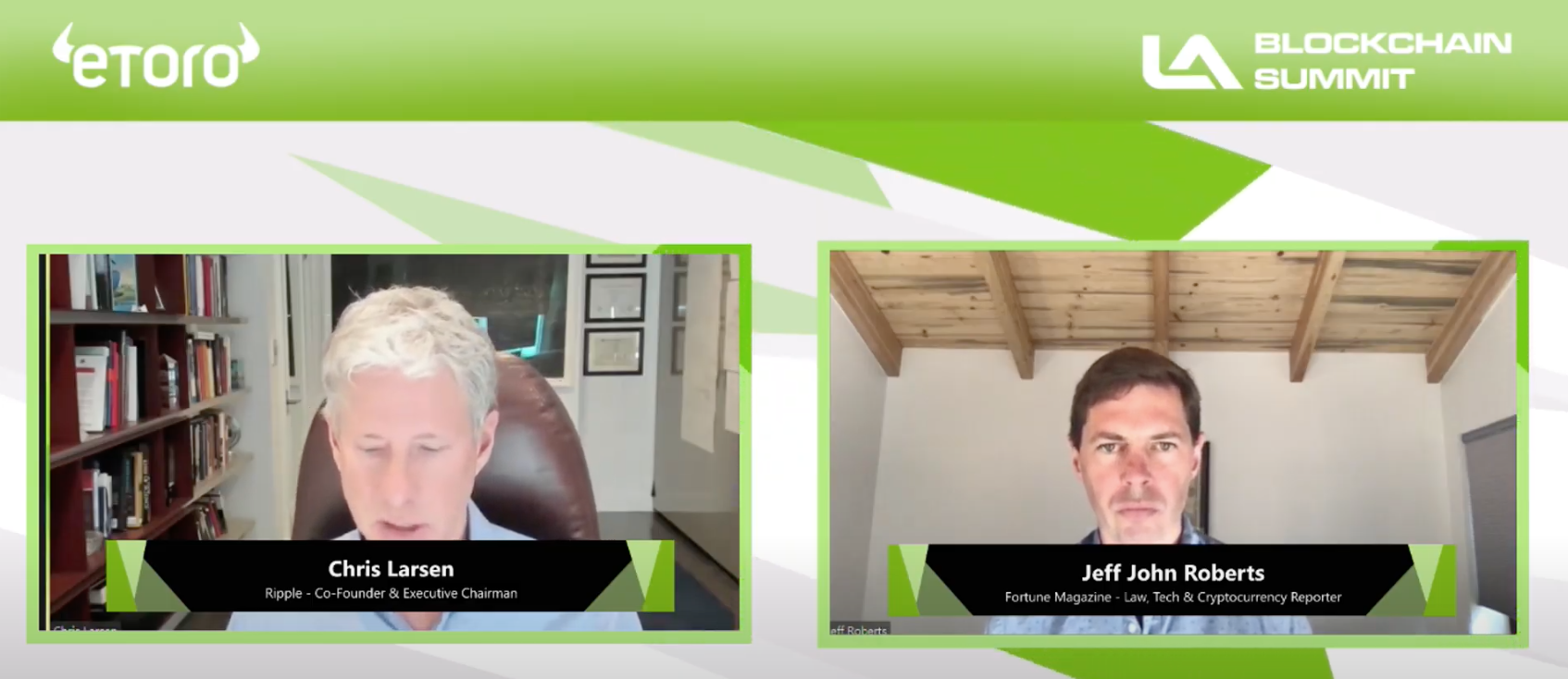

Speaking to Fortune Magazine’s Jeff John Roberts at the Oct. 6 LA Blockchain Summit, Ripple co-founder Chris Larsen said the United States was “woefully behind” in preparing for the cryptocurrency-based next generation of a global financial system. Coupled with U.S. authorities’ policy on “regulation through enforcement” and Ripple may consider leaving the country behind entirely.

“The message is blockchain and digital currencies are not welcome in the U.S.,” Larsen said. “You want to be in this business, you probably should be going somewhere else. To be honest with you, we’re even looking at relocating our headquarters to a much more friendly jurisdiction.”

Larsen stated the firm was considering moving to countries like the U.K., Switzerland, Singapore, or Japan, because in the U.S., “all things blockchain and digital currency start and end” with regulatory bodies like the Securities and Exchange Commission (SEC).

“I don’t think that the posture at the SEC today can possibly get worse for [the crypto and blockchain] industry. It’s just ‘crush it and push it away.’”

Ripple CEO Brad Garlinghouse explained further in a Tweet. “Responsible players like Ripple aren’t looking to avoid rules, we just want to operate in a jurisdiction where the rules are clear,” he said.

Ripple faces a number of class-action lawsuits alleging the firm sold its XRP token in an unregistered securities offering. The SEC has not released any official statement on the matter following its 2019 publication on a regulatory framework for digital assets.

As a result, the crypto firm continues to be called to court partly over an apparent lack of regulatory clarity from the government agency. A federal judge recently denied a motion by Ripple to dismiss a lawsuit filed by investor Vladi Zakinov in 2018 alleging the XRP token is a security under California law.