Criminals In Latin America Launder Money With Cryptocurrency, Report Says

A recent report claims that criminals primarily use cryptocurrencies for money-laundering in Latin America. Most countries in the region lack serious security measures leading to exuberant thefts executed by organized criminal groups.

LATAM’s Dark Side

Compiled by the cyber intelligence company IntSights, the report went in-depth on Latin America’s involvement with illegal financial activities. More specifically, it outlined numerous sophisticated organized crime groups acting in the region. Yet, enterprise security teams are neglecting the issue. Therefore, illicit financial transactions in LATAM are continuously increasing.

In fact, the document noted that Latin American countries top the list of the world’s worst money laundering nations. It referred to a new operational method used by criminals – cryptocurrencies:

“Threat finance is evolving in Latin America as organized crime groups turn to cryptocurrency to launder large amounts of money and dive into the dark web to find hackers to hire.”

According to the first-ever blockchain forensics team, CipherTrace, criminals use several main tools for money laundering with cryptocurrencies. Those include unregulated exchanges that don’t require extensive know-your-customer (KYC) and anti-money laundering (AML) policies and “mixers.”

Interestingly enough, a former Microsoft employee was recently found guilty for stealing over $10 million and laundering it with such mixers.

As per the document, Colombia and Brazil lead in terms of illicit financial transactions.

Cryptocurrency Interest In LATAM

The report admitted the increased interest towards Bitcoin and some alternative coins in the region. It referred to peer-to-peer exchanges as the preferred method of buying or selling digital assets.

“While there are a host of cryptocurrency exchanges available to serve Latin American customers, the P2P platforms are typically the preferred method of Fiat currency to/from cryptocurrency exchange throughout the region.

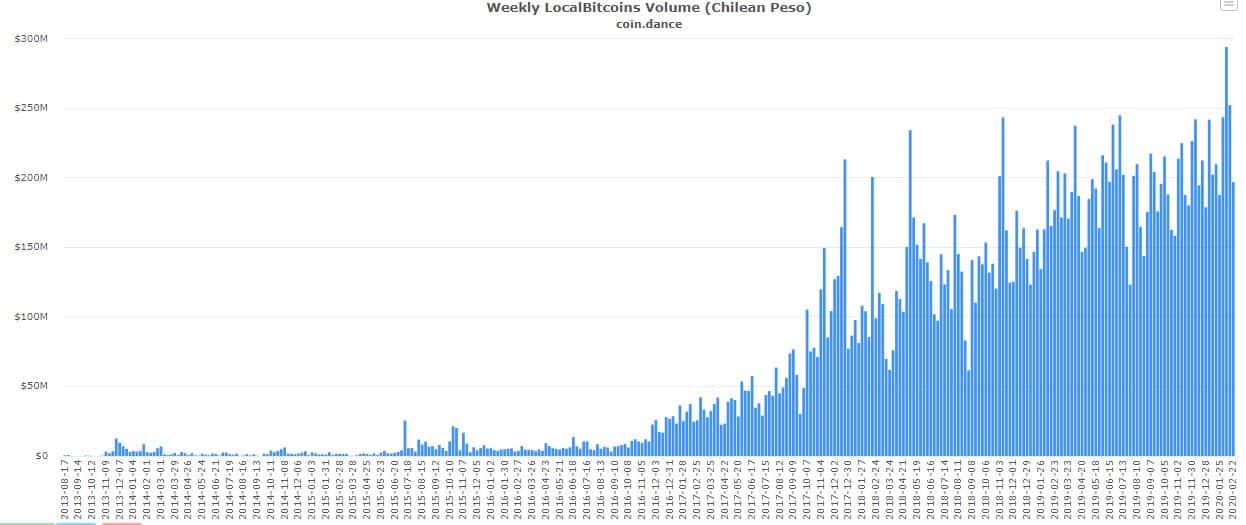

Throughout 2019 and on into 2020, the well-known P2P platform LocalBitcoins experienced record growth in transaction volume across many Latin American countries.”

At 2019’s end, Cryptopotato reported the record-breaking Bitcoin trading volume in Argentina and Venezuela. Both countries are continuously recording high volumes, and Chile is not far behind. The latter reached a new ATH at the start of February 2020.

While some people imply the tough political situations in those countries as the primary reason for the high volume, the report brought up another possibility:

“P2P exchanges typically lack AML programs and perform little to no KYC due diligence, which entices criminal actors to utilize P2P versus traditional cryptocurrency exchanges.”

The post Criminals In Latin America Launder Money With Cryptocurrency, Report Says appeared first on CryptoPotato.