CREAM Finance Burns 67% of Its Total Supply Today

The decentralized crypto exchange protocol C.R.E.A.M. Finance announced its decision to conduct a significant token burn today, September 20th, after a strong internal discussion.

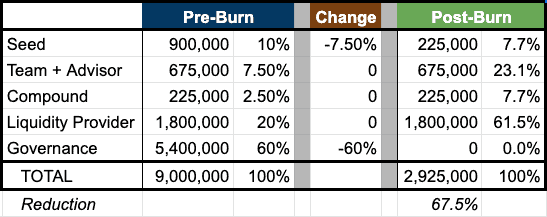

The official account of the protocol explained that following consideration of several possible reductions in supply, the alternative of burning 67% of all the $CREAM tokens was chosen as the best. This implies that more than 6 million $CREAM tokens will disappear forever once the burn is complete.

Goodbye, Governance Tokens

In an official blog post, the team at C.R.E.A.M. Finance explained that all governance tokens and 7.5% of the Seed Tokens would be destroyed.

This burn will include 100% of the “governance” tokens and 7.5% of the Seed tokens. We believe that this action will provide greater certainty to the current token holders while creating a stronger foundation for the long-term success of the project.

The tokens owned by liquidity providers and those destined to protocol development and Compound will not be affected by the measure.

Thus, the liquidity providers will now control 61.5% of the total $CREAM supply while the team would have 23.1%. This force redistribution is possible thanks to the absolute removal of governance tokens, which accounted for 60% of the total supply until now.

Thanks to our seed investors and their continued support and sacrifices for the project, they have agreed to a 75% burn in exchange for accelerated vesting of 1-year, monthly vesting. Specifically, seed tokens will now vest monthly starting September 24th.

The C.R.E.A.M team also had the opportunity to make the same decision as the seed investors. Still, they refused to go down that road, mostly for strategic reasons.

Less is More

A decline of this magnitude could have two implications: Either a substantial loss of market capitalization (in case of lack of fundamental value or confidence in the project) or the price of each token increases to match the current market cap with the new supply.

And in the case of C.R.E.A.M., the news seems to have yielded outstanding results, with the prices taking the optimistic route. The price of the token spiked almost immediately after the announcement before correcting today. It went from about $70 to $165, marking an increase of 134%.

The post CREAM Finance Burns 67% of Its Total Supply Today appeared first on CryptoPotato.