Could Fenbushi’s Protege, Sentinel Chain, Disrupt The Cattle Industry? Post ICO Analysis and Token Price Valuation

The recent ICO madness where ICO investing led to multiples of returns on investment immediately the token was listed on exchanges is over, at least for now. According to Coinschedule, more than 1,000 startups raised a total of ~ $24,000,000,000 through crowdfunding in the past two years.

Most of these startups had nothing but an idea at the time of their token launch. Obviously, it is impossible to create true market demand for your token if your business is in its early days. The price of a token that has no use is derived solely from speculation and market manipulation, and this is true for almost all of the tokens in the market.

It is estimated that more than 90% of high growth technology startups fail. The crypto startups not only need to fight the 90% failure statistics of new startups but also have to pave a new way for crypto businesses, a business where its utility token is a part of the business.

Though it is impossible to predict which of the thousands of tokens representing the new crypto startups will flourish, we are confident that a few will succeed. To distinguish those, the basis of the analysis must be on the fundamentals.

It has been 6 months since Sentinel Chain raised a total of $14,400,000. We have been following the project closely and also evaluated it pre-ICO.

Since their launch, InfoCorp, the company behind Sentinel Chain, has been on the right path for a full product launch in Q1 2019, led by the Myanmar Government Ministry of Finance and Ministry of Agriculture.

Prior to the launch, InfoCorp published a detailed token economic structure that strengthens the relationship between the success of their business and the rise in token price.

In the following article, we will estimate the progress of the project and the investment opportunity it brings.

Let’s go!

Recap of the article in bullets:

- Sentinel Chain concluded a successful ICO in March 2018 and raised $14.4 Million

- Backed by Fenbushi Capital, iGlobe partners, and BlockAsset

- Led by a dedicated and ambitious team

- Aim to unlock the value ‘locked’ in cattle. And to offer the unbanked affordable cattle insurance and collateralized loans

- Myanmar- the first country to penetrate with 17M head of cattle

- Successfully completed a joint pilot with the Ministry of Finance and Ministry of Agriculture from the Myanmar Government in 3 regions in Myanmar.

- By Q1 2019, led by the Myanmar Government: the beginning of cattle and identity registration and insurance offers via the Sentinel Chain network

- A high correlation between the success of Sentinel Chain and the rise in token price

- Long-term vision- Offer collateralized loans, expand to other countries, offer cross-border loans, bank the unbanked

- Curret market cap – ~ $2.5M, USD value cut by about 90% since ICO

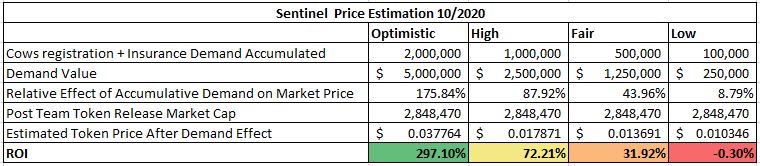

- Recap of our financial analysis, taking into consideration only near-term use cases for SENC:

Sentinel Chain is aiming to ease the lives of the unbanked farmers by unlocking the value locked in their most valuable asset- their cattle. Sentinel is to offer the farmers affordable insurance and affordable loans with their livestock serving as collateral. Sentinel Chain is a project by InfoCorp Technologies Pte. Ltd, a fintech company that provides the infrastructure to accelerate financial inclusion to unbanked and underserved communities through the use of blockchain technology.

The project is led by Roy Lay and a dedicated team of 14 members and is backed by Fenbushi Capital, iGlobe partners, and Block Asset.

The Sentinel Chain Ecosystem

The Sentinel Chain project seeks to introduce livestock as ‘capital’ in the formal financial economy, the transformation from ‘dead capital’ to a financial asset class will increase investment and participation substantially. The basis for such a solution lies in the creation of a physically tamper-proof and digitally-immutable system capable of livestock provenance – the origin of a livestock’s existence.

The Sentinel Chain Ecosystem is made up of 5 main components:

- Tamper-Proof Livestock Tag

- CrossPay Mobile Application

- CrossPay Blockchain

- Sentinel Chain

- Sentinel Chain Token

Livestock ID Tag is tamper-proof and theft-proof on both a material design as well as a data level.

- From a material design perspective, the tag has been designed to prevent physical tampering or theft. The tag has been designed for “single-use” and thus cannot be removed without being destroyed.

- From a data perspective, the tag stores the geolocation and time stamp information on to the CrossPay Blockchain. Immutability and non-repudiation ensures the authenticity and secure traceability of certifications, i.e. a digital ‘passport’ that proves its existence and ownership to an identified entity and origin.

- From both a material design and data perspective, in the event that the tag has been forcibly removed, the information which resides in the tag will be invalidated, thus rendering the tag useless.

CrossPay Blockchains (Backend) The CrossPay Blockchain is a B2C financial ecosystem. Managed and operated within a local geographic area, it is accessible via the CrossPay Mobile application – a simple mobile interface built for Android.

The Assets on the cross-pay blockchains will be the livestock identity, and the “Local CrossPay Token” (or LCT). LCT will be pegged to the value of the country’s native currency.

CrossPay Mobile Application (Frontend) The CrossPay Mobile application (Android) is a mobile financial delivery mechanism for use with the CrossPay Blockchain. It is also designed to be a mobile wallet that provides the unbanked with quick access to their balances and allows for transactions with other users and merchants.

CrossPay app demo of registration and insurance of a cow in Myanmar:

https://youtu.be/FH5U9oVu2Xw

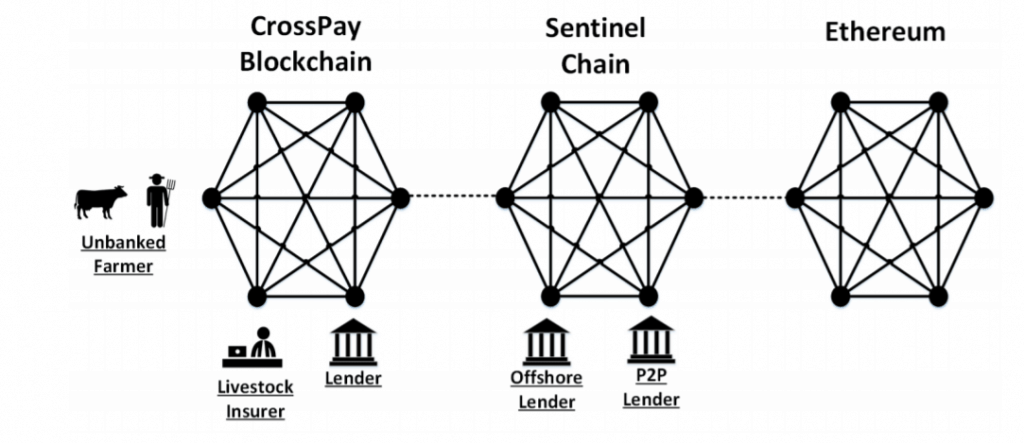

Sentinel Chain – a global B2B marketplace

The Sentinel Chain is a consortium blockchain that operates within decentralized governance and is connected to multiple CrossPay Blockchains. In doing so, the Sentinel Chain and the CrossPay Blockchains create a hub-and-spoke ecosystem specifically designed to provide a low-cost cross-border financial infrastructure. Such an infrastructure will provide liquidity to the local unbanked population via an international network of financial providers.

SENC and LCT

SENC is a medium of exchange for cross-border livestock- backed financing and also used as a collateral for the creation of local stablecoins called Local Currency Token (LCT).

LCT is a local stable coin that is used to pay fees to the CrossPay network by the service providers (insurance and loans).

Myanmar- The First County to Penetrate – Starting Q1 2019

InfoCorp is well positioned in Myanmar to enroll cattle and their owners into the CrossPay network successfully. It has strategically collaborated with the Ministry of finance (Myanma Insurance or MI) and the Ministry of Agriculture, Livestock, and Irrigation (Livestock Breeding and Veterinary Department or LBVD).

Aligned Interests

It seems all parties involved in the collaboration and the cattle owners have their own interest in enrolling cattle to the CrossPay Network, we will review each parties’ own interest.

Myanmar Insurance, under the Ministry of Finance at Myanmar Government

Myanmar insurance recently announced that it will publish an insurance policy for cattle by the end of 2018, the first in 30 years. The insurance of cattle will be through the ecosystem provided by InfoCorp, via the CrossPay app.

It is estimated that in Myanmar there are 17 million head of cattle, each one costs $365-$1,460, meaning a market value of $6,205,000,000 to $24,820,000,000. Obviously, Myanmar Insurance has a strong interest to make a profit by offering insurance to the cattle owners.

Myanmar Government

Recently announced, China is to legally buy one million head of Cattle from Myanmar. Trading of cattle between China and Myanmar is not news, though lately there is a surge in demand from China, which might be due to the trade war between China and the USA.

To export cattle from Myanmar, a Veterinary checkup must be done by the Livestock Breeding & Veterinary Department of the Ministry of Agriculture. This is the same department that strategically collaborated with InfoCorp and Myanma Insurance. One can assume that Myanmar Government has a strong interest in launching the enrollment of cows to the CrossPay private blockchain so they can legally track the cattle population of their country and be ready for the high Chinese demand for cattle.

Farmers, owners of cattle

The most valuable asset of most farmers in Myanmar is their livestock and specifically their cattle. By agreeing to enroll their cattle with the help of an agent to the CrossPay app, they are able to apply for affordable insurance and later loans with their cattle as collateral.

Insurance of one’s assets is extremely important especially when one does not have the means to restore a valuable asset if it is suddenly lost or dies. Only recently we heard news of the tragic floods in Myanmar leading to loss of lives and cattle.

It is only reasonable to think that if the Myanmar farmers were offered affordable insurance, they would apply for it. Just like houses and cars are insured in the western world.

Business Scalability

The enrollment of cattle to the CrossPay network is done by a field agent (yes- a real person : ) ). Obviously, InfoCorp does not have the necessary manpower to reach millions of farmers in a reasonable timeframe.

The enrollment of cattle and their owners to the CrossPay app will be led by the relevant departments of the Government of Myanmar. InfoCorp technology and ecosystem will be used for that purpose.

Accomplished a Major milestone

Government-backed pilot recently completed in 3 regions of Myanmar

A joint pilot was launched in Myanmar with the Ministry of Finance (Myanma Insurance or MI) and Ministry of Agriculture, Livestock, and Irrigation (Livestock Breeding and Veterinary Department or LBVD) on the 8th of May 2018.

In-country support comprised of a team of thirty (30) veterinary field officers from LBVD and a team of nine (9) insurance officers from MI. The pilot had 4 phases — translation, localization, adoption, and field deployment. It has been successfully completed.

The pilot covered 3 regions and the key purposes are:

- to carry out operational readiness testing of CrossPay on the ground

- to ascertain the risk of infection by government authorities regarding the use of a physical livestock identification RFID tag.

The three areas selected for the pilot were:

- Lewe in Nay Pyi Taw

- Kanbalu in Sagaing

- Sin Phyu Kyun in Magway

Product development

Tamper Proof Tag: completed.

CrossPay mobile app and Sentinel Chain: In progress, will be completed in Q1 2019.

Financial Analysis

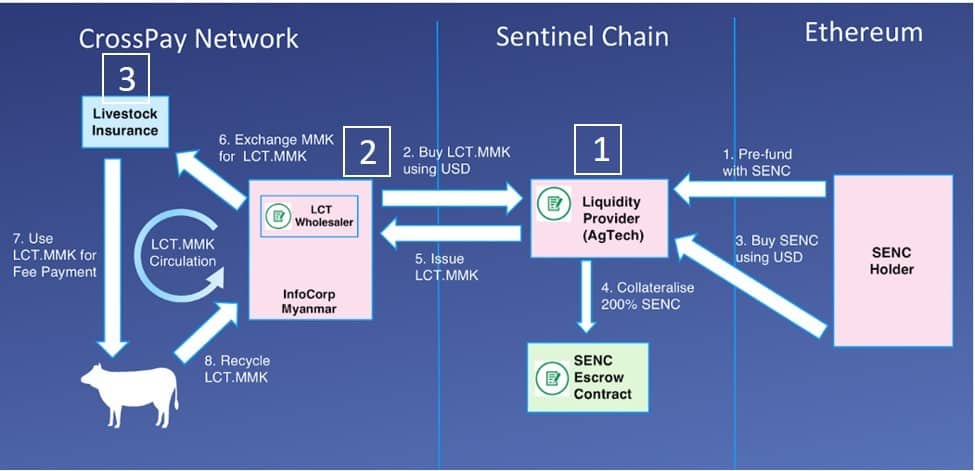

The Circulation of LCT and SENC

In order to understand what creates demand for SENC, one must understand the token circulation in the CrossPay ecosystem.

In the following diagram, taken from a blog post published recently, an example of the future of Myanmar circulating supply of LCT.MMK (Myanmar local cryptocurrency), MMK (Myanmar local currency) and SENC. The diagram is relevant for every new local economy to join the Sentinel Chain ecosystem.

Description of the token circulation through the involvement of each party in the ecosystem (Represented by numbers 1,2,3 in the diagram):

- Liquidity Provider – InfoCorp AgTech.Identity: Subsidiary of InfoCorp. The only institution authorized to create LCT to all countries involved in the Sentinel-Chain ecosystem. Task: Supplies LCT to the Wholesaler in each country in return for fiat.LCT creation: SENC is bought from the market and sent to a smart contract that releases LCT. LCT is backed by SENC, the ratio is relative to the market volatility of SENC price and decided by InfoCorp.

- Wholesaler- In country supplier of LCTIdentity: A private company, not always related to InfoCorp. There will be at least one wholesaler in each country. Task: Supplies LCT to the in-country services against local currency in 1:1 ratio. In our example, LCT.MMK against MMK. Sends fiat to the liquidity provider and receives LCT.

- Services in CrossPay app:Identity: Private companies: Insurance companies, Financial institutions (Loans)Task: Offer services via CrossPay app, LCT is used to pay fees. In our example, Myanma Insurance will pay LCT.MMK for every signed contract it uploads to the CrossPay blockchain.

A few things to note:

- MMK is not traded in any market.

- The LCT paid by the service providers is sent to a smart contract and locked as long as the contract is valid. For example, a yearly contract will lock the LCT paid as fees for 1 year.

- Dual circulation– the wholesaler can send LCT to the liquidity provider. The liquidity provider will send the LCT to the smart contract, receive SENC and sell them in the market for fiat. The wholesaler will receive fiat in return for the LCT sent with a ratio of 1:1.

SENC Demand

In the following few sections, we will cover the relation between SENC token price and the enrolment of cattle for insurance contracts.

We will begin by evaluating what creates the demand for the SENC token:

- Creation of local currency token named LCT.

- A medium of exchange for cross-border livestock backed financing.

LCT demand creates demand for SENC

The following will create a demand for LCT:

- Businesses pay fees for providing services on the CrossPay application.

- Insurance Companies: 0.5% of the value of the cow will be paid to upload a signed insurance contract to the CrossPay blockchain.

- Financial Companies: The estimated price to upload a financial agreement to the CrossPay blockchain is yet to be announced.

- Livestock registration fee

- A lifetime fee of 0.5$will be paid for every cow registered on the CrossPay blockchain.

The price of fees stated above is a safe estimation we received from the InfoCorp team.

LCT and SENC relationship

The LCT paid as fees to the network are locked in a smart contract as long as the contract is valid (Insurance, loan, registration). Since LCT is backed by SENC at least 1:1 ration (USD price), we can conclude the following:

The sum of fees paid (USD) for all the valid contracts (Insurance, loans, registration) at a given time equals the sum of SENC (USD) taken out of market circulation.

COWS, INSURANCE and SENC Price

InfoCorp has a long-term vision for the Sentinel Chain ecosystem, though, in the near term, significant progress is happening in Myanmar. Starting at the beginning of 2019.

The registration of cows and the insurance program is launching. In our financial analysis, we will only take into consideration business progress in the near term, the registration of cows and the insurance contracts. We will ignore potential future demand derived from in-country and cross-border loans and CrossPay payments, described in more details here.

In the following section, we will use financial instruments in order to evaluate the correlation between the number of cows registered and enrolled for insurance via the CrossPay app and the price of SENC in the market.

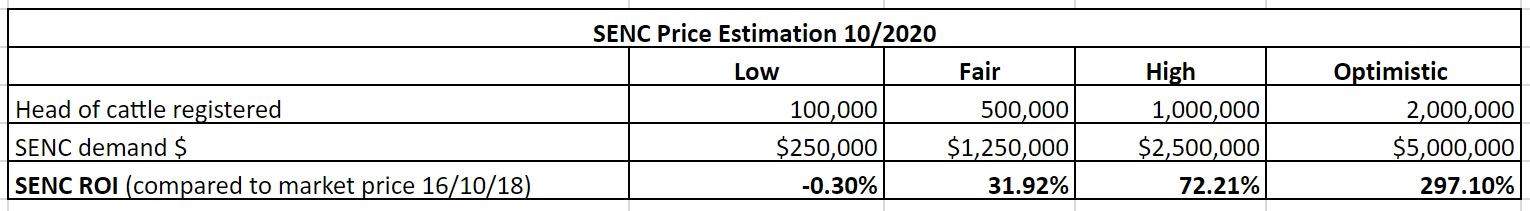

Business Estimation

Based on our analysis and with necessary consultations, we will assume the following scenarios by 10/2020 (2 years from the time of writing):

Low: 100,000 Cows registered and paying for insurance

Fair: 500,000 Cows registered and paying for insurance

High: 1,000,000 Cows registered and paying for insurance

Optimistic: 2,000,000 Cows registered and paying for insurance

Financial Assumptions

- LCT is locked as long as the insurance contracts are valid, as stated by Sentinel Chain.

- The effect created by the SENC-LCT insurance mechanism is similar to burning tokens – Hence, plans will go as planned and there will be no need to return SENC that was taken out by the liquidity provider to the market.

- The only new tokens that will be released to the market in the next 2 years are the team allocation- 50M SENC. We will assume that 50% of the total stake will be released to the market in the time phrase.

- We assume that tax payments should not affect the LCT-SENC circulation, and therefore it is exempted from the analysis

- 1 LCT.MMK is minted for 1 SENC in the value of 1 MMK

- No hyperinflation in Myanmar for the selected period

- There is no stocking of LCT by the Wholesaler in the time phrase

From future market demand to the ROI of SENC price

Token Fundamentals (based on SENC market stats on October 3rd, 2018)

Circulating supply= 299,000,000 SENC

Market cap= $2,500,000

Token price= $0.00836

Tokens released to the market (Team allocation) = 25,000,000

Supply

- Based on our research, we assume that the effect of the release of tokens to the market (Team’s allocation) on the token price will be an inversely proportional effect.

-

SENC price post team token release = SENC Mar – ((Released/SENC Circ) × SENC Mar))

- SENC Mar: SENC market price; Released: Team tokens released to the market; SENC Circ: SENC circulating supply.

Demand

- We will assume that the effect of the demand for SENC on the token price is the same effect as a buyback of stocks on a stock price in the stock market.

- Based on published financial research, the effect of stocks buyback on the stock price is a directly proportional effect.

-

Token price post demand= SENC NewPr + (DEMAND/SENC Newcap) × New SENC))

- SENC NewPr: SENC price post team token release; DEMAND: Demand in $from fees; SENC Newcap: SENC market cap post team token release.

An Excel sheet of all calculations done

Based on the following papers:

- The value of share buybacks: By Richard Dobbs and Werner Rehm, McKinsey April 2005

- Share Buybacks Work Better in Theory Than in Practice: Barry Ritholtz 2018

- CFI: Dividend vs Share Buyback/Repurchase

- The Case for Stocks Buyback by Alex Edmans- HBR, September 2017.

- Profits Without Prosperity by William Lazonick-HBR September 2014

- Market underreaction to open market share repurchases Journal of Financial Economics

Volume 39, Issues 2–3, October–November 1995, Pages 181-208

In order to conduct this section, we were helped by Ran Charag, a senior blockchain business analyst which helped us to have a better understanding of the complex business model and how to connect it’s success to the estimated value of the token.

Conclusion

Sentinel Chain is solving a real-life issue by using blockchain technology with a highly motivated team. If Sentinel Chain succeeds in Myanmar, they will move on to scale their service worldwide, as currently, there is no affordable insurance and loan ecosystem for livestock.

Sentinel Chain has completed to date all of their milestones published on their white paper pre-ICO. They strategically collaborated with the Myanmar government in order to launch their main product in Q1 2019.

Not only has the business been running according to plan, but the team behind Sentinel Chain is also highly dedicated to their community and the price of SENC token. Recently announced and described in our analysis, the expected ongoing buyback of SENC from the market, links the success of the business to the rise in the price of SENC.

The current market cap of SENC is very low, and this might just be one of the projects that will flourish in the following years, creating a great return on investment. Time will tell.

We will be very happy for the community’s feedback for this analysis, do feel free to comment!

The post Could Fenbushi’s Protege, Sentinel Chain, Disrupt The Cattle Industry? Post ICO Analysis and Token Price Valuation appeared first on CryptoPotato.