Costly Mistake: Someone Paid $9,500 in Fees for an ETH Transaction Worth $120

A MetaMask user, attempting to swap Ethereum for a DeFi token, paid over $9,000 transaction fees while transferring only $120 worth of ETH. The user has reached out to the mining pool that processed the transaction for assistance but has yet to receive a response.

A Costly ETH-DeFi Swap

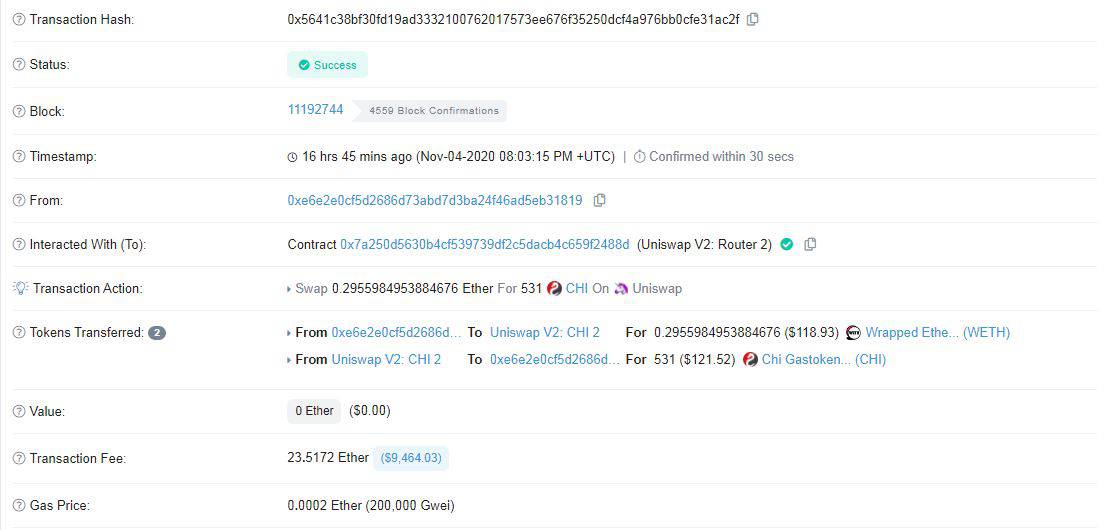

The user, going by the nickname ProudBitcoiner, explained his rather dire situation on Reddit. He was using the popular online wallet MetaMask to swap 0.2955 wrapped Ether (WETH) for 531 Chi Gastoken (CHI) worth about $120. The fee that he paid, though, was abnormal – 23.517 ETH. From a USD perspective, this amount is close to $9,500.

The mining pool Ethermine processed the transaction within 30 seconds and collected the fee. Miners tend to prioritize transactions in which users have offered to pay higher fees. However, this could lead to costly human errors, which seems to be the case in this situation, as the user explained:

“MetaMask didn’t populate the ‘Gas Limit’ field with the correct amount in my previous transaction, and that transaction failed, so I decided to change it manually in the next transaction (this one), but instead of typing 200,000 in ‘Gas Limit” input field, I wrote it on the ‘Gas Price’ input field, so I paid 200,000 GWEI for this transaction.”

The term “gas” refers to the cost necessary to perform a transaction on the Ethereum blockchain. It’s denoted in Gwei (sometimes called nanoeth), where one Gwei equals a billionth of one Ether. When initiating a transaction, the user can set up a maximum amount of gas he wants to spend through the “gas limit” field.

Not The Largest Fee This Year

While paying $9,500 transaction fees sounds a lot, it’s actually nowhere near the 2020 records. As reported by CryptoPotato during the summer, a cryptocurrency exchange sent two consecutive transactions for 0.55 ETH and 350 ETH.

Both times, though, another seemingly human error resulted in an enormous amount of fees paid – 10,668 ETH each time (or about $5.2 million).

Interestingly, the mining pool Ethermine also picked up the second transaction back then. The parent company Bitfly kept the funds after the exchange failed to contact them within four days. Moreover, Bitfly said that similar issues will not be subject to investigations or refunds in the future.

As such, it would be compelling to follow what will transpire in ProudBitcoin’s case. The user said he contacted Ethermine and its CEO on Twitter but hasn’t heard back.