Costly Mistake? Someone Paid 3.5 BTC Worth $80K To Transfer $1 on Bitcoin’s Network

Although the average fees on the Bitcoin blockchain network have increased lately to above $10, one user recently paid a significantly higher amount. He spent more than $80,000 (nearly 3.5 BTC) when transferring bitcoin worth a little over $1.

$80K Fee For A $1.16 Transaction

Being established as an electronic peer-to-peer cash system, the Bitcoin blockchain allows users to send and receive transactions over the Internet regardless of the physical location. Moreover, transactions are typically very cheap, especially when compared to traditional financial institutions. After all, an anonymous user recently sent $1.15 billion in BTC and paid just $3.6 in fees.

However, another unknown user who made a transaction on December 19th paid a whopping fee of 3.4908950 bitcoins when trying to transfer 0.00005000 BTC to another wallet.

In USD terms, the transfer amount equals $1.16 with bitcoin’s price on December 19th, while the fee is north of $80,000.

CryptoPotato reached out to the popular developer and Bitcoin educator Jimmy Song for a plausible explanation about the unusually high fee.

He said that the mining pool might have done “something like a sophisticated coinjoin,” but it’s improbable. Coinjoin enables various parties to combine multiple bitcoin transactions from different spenders into a single transaction. All participants put in and get out the same amount of BTC as initially intended, but the addresses are mixed, making the origin of the coins harder to trace.

Song believes that the most probable reason is human error. He added that “the person who sent the transaction is frantically trying to figure out how to get the fees back.”

Not The First One

While the transaction from above indeed had an unusually high fee, there are other similar examples. In this one from early January 2017, the user paid 50 BTC in fees. With bitcoin’s price trading around $900 – $1,000 at the time, this meant $45,000-$50,000.

Song explained that there could be a way for people in such situations to retrieve the funds if they act fast:

“Generally, if it’s detected early enough and made public enough, there is a chance that they [mining pools] will give it back since they don’t pay out for a few days at least, so if you can catch the money before it’s paid out, the pool will try to do the right thing.”

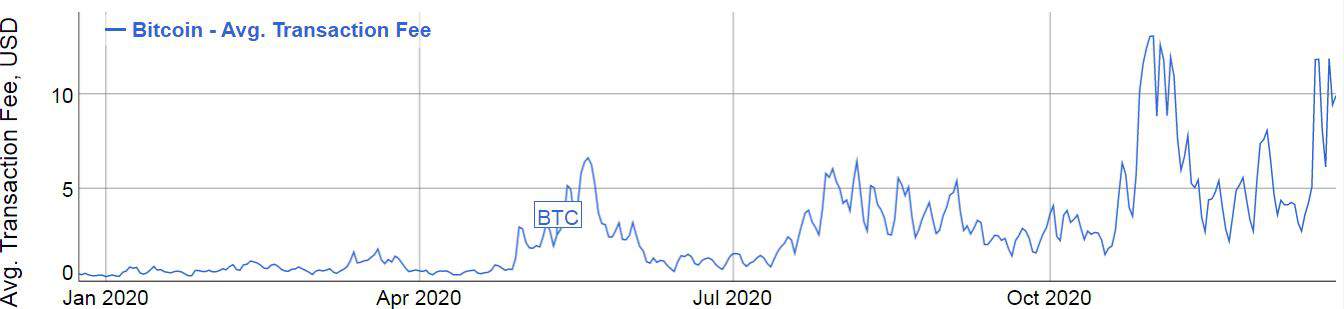

It’s worth noting that the average transaction fees on the BTC blockchain have spiked recently. For most of 2020, the average fees were beneath $5. However, bitinfocharts data indicates that they have increased to north of $10 lately.