U.S. Representative Tom Emmer has reintroduced a bill that benefits taxpayers who hold forked cryptocurrencies. The bill is called the “Safe Harbor for Taxpayers with Forked Assets” and it seeks to create clarity around the taxation of assets that results from hard forks.

“Taxpayers suffering from the uncertainty of tax guidance are being unfairly punished for investing in an emerging technology. This safe harbor will protect the taxpayers until the IRS addresses this important issue,” the press release explains.

Earlier this month, the Republican lawmaker from Minnesota released a document which outlined the provisions of his reintroduced bill.

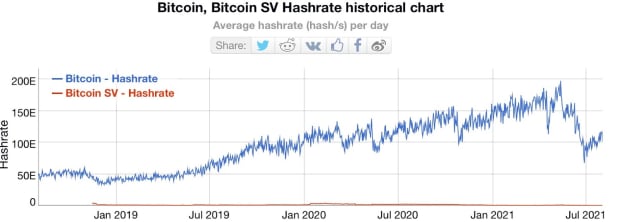

A hard fork occurs when a blockchain’s path is split into two different chains. One path follows the original operating protocol, while the other follows the new and upgraded blockchain. For instance, when Bitcoin Cash (BCH) forked, those who held BCH automatically got the same amount of BCH ABC and BCH SV on the forked chains 1:1.

Emmer’s bill will address the tax implications of having a whole new batch of crypto as a result of a network split. The bill will let taxpayers off the hook if they don’t accurately account for hard fork assets when filing their tax returns.

The senator first announced plans for the Forked Assets Bill in September 2018. At the time, his press release cited the prospective development of three bills, namely the “Resolution Supporting Digital Currencies and Blockchain Technology,” the “Blockchain Regulatory Certainty Act,” and the “Safe Harbor for Taxpayers with Forked Assets Act.”

While little was known about the bills at the time, Emmer’s objectives were obvious; providing clarity to the legal classification of digital assets and blockchain technology, as well as providing tax protection for holders of forked assets.

Crypto taxation in the U.S. is still fuzzy. On April 11, 2019, Emmer, along with other lawmakers, sent a letter to the Internal Revenue Service (IRS) Commissioner Charles Rettig, urging him to make crypto tax rules clearer to Americans.

“There is still substantial ambiguity on a number of important questions about the federal taxation of virtual currencies,” the letter reads.Emmer is currently the co-chairman of the Congressional Blockchain Caucus, a platform through which Congress and the American government can examine the impact of digital assets and blockchain technology.

The post Congressman Reintroduces Hard Fork Tax Clarity Bill appeared first on Bitcoin Magazine.