‘Congress Needs to Act’ on Crypto Regulations, CFTC Chair Behnam Tells Lawmakers

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

CFTC Chair Rostin Behnam said if Congress passes the FIT Act, he was “confident” that his agency could build a regulatory framework within 12 months.

-

“This notion of crypto going away, I think, is just a false narrative,” Behnam said.

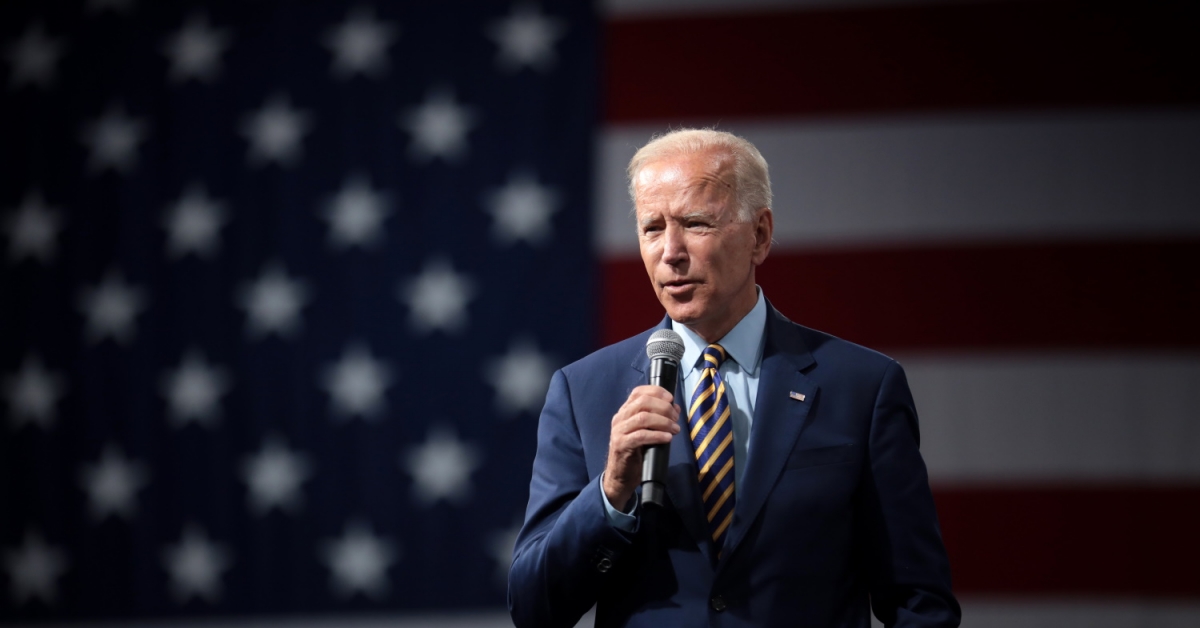

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam reiterated his longstanding call for Congress to pass legislation addressing regulators’ jurisdictions in the crypto industry during an annual appearance before the House Agriculture Committee.

“We need to fill the gap in crypto regulation,” Behnam said Wednesday, pointing to bitcoin’s (BTC) recent price action. He added that expecting “another period of irrational exuberance” would be an understatement. “This notion of crypto going away, I think, is just a false narrative.”

“We need to act, Congress needs to act to fill this gap, specifically around bitcoin which clearly is a commodity,” he said. “Here are two of the largest tokens, making up approximately 60 to 70% of the whole market capitalization [of crypto],” he added, referring to BTC and ether (ETH)

Behnam was answering lawmaker questions about the Financial Innovation and Technology Act for the 21st Century (FIT Act), a bill that passed through the House Agriculture and Financial Services Committees last year but never made it to a floor vote. Wednesday’s hearing is focused on the CFTC more broadly, including its budget requests for the upcoming fiscal year. Earlier in the hearing, Behnam said the agency needed more certainty around its budget.

If Congress does pass the FIT Act, Behnam said he was “confident” that the CFTC could build a regulatory framework within 12 months.

Later in the hearing, another lawmaker – Rep. John Duarte (R-Calif.) – asked Behnam to explain how bitcoin or other cryptocurrencies were commodities, pointing to physical commodities as a possible example.

Behnam said the classification of bitcoin as a commodity “is mostly used in the counter-negative.”

“If it’s not a security, then it’s a commodity,” he said, adding, “in which case, the analysis has to take place to make a determination that it’s not a security, which is frequently how we test whether it’s an investment contract, and answer that question in the affirmative, that it’s not a security, that it becomes a commodity.”

Edited by Aoyon Ashraf.