Compass Mining’s New Operations Manager On Home Bitcoin Mining, Power Agreements And S9 Leasing

The new mining operations manager for Compass Mining discusses his experience, offers tips for mining at home and predicts the industry’s future.

This piece is part of a series that interviews Bitcoin miners about their experiences setting up and scaling mining operations as well as their view on the direction of the mining world. If you are mining Bitcoin and want to share your knowledge and story — the ups, downs and innovations‚ reach out to me on Twitter @CaptainSiddH.

For this episode in our series, BigCohooNah joined us to share the knowledge gained from his own home mining forays and his work at Braiins and Slush Pool. As of December 2021, he joined the Compass Mining team to work on its at-home mining product and help with its mining operations. You can find BigCohooNah on Twitter: https://twitter.com/BigCohoo

How and why did you get into Bitcoin mining?

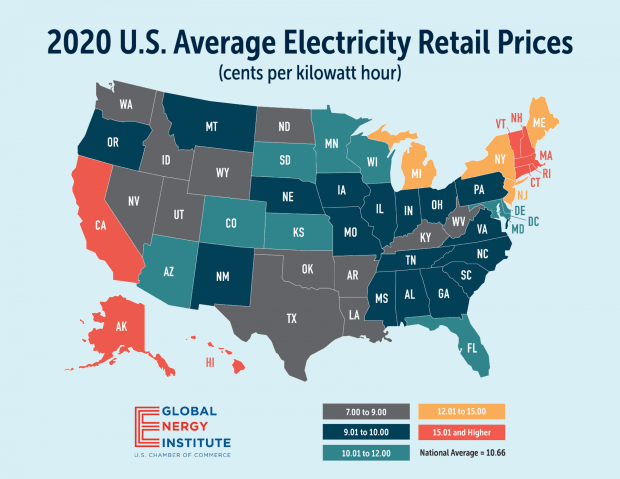

My first exposure to mining was when a friend of mine — an old roommate from college — bought an S9 in 2018. He got caught up in the hype of Bitcoin like everyone else did, but he fell down the mining portion of the rabbit hole. He paid a lot for that S9 — somewhere between $3,000 to $6,000. They live in Michigan, where the electricity rate is about $0.18 per kilowatt hour, so they were only able to run it for a little bit before they had to unplug it and just cut their losses.

I remembered that story while I was working at Ford. They sent me down to Kentucky for six months to support the Super Duty launch — the Ford F250s, 350s, etc. This is when I really started falling down the Bitcoin rabbit hole. I was all into crypto, but as I learned more and asked more questions I just started knocking off all the coins, so I sold everything and went all into bitcoin. I remembered that my friend had this miner, and since my place in Kentucky had free electricity, I asked my buddy if I could borrow that S9. So, sure enough, he let me borrow it and I set it up in my temporary place in Kentucky.

During that time in Kentucky away from my friends in Michigan I had very few distractions, so I played with Lightning, ran a node, just dove as deep as I could. I learned a lot about Bitcoin and mining during that time.

When I came back to Michigan, the S9 wasn’t profitable to run and was causing drama. Seeing the electricity bill then looking at the sats stacked — I’m a pretty frugal person. However, after the first run up in 2021 from the previous all-time high to around $30,000, I bought a Whatsminer M32 and ran that in a buddy’s garage for a while at Michigan electricity rates, eventually moving it to a warehouse where I now get commercial rates. We made a homebuilt version of Steve Barbour’s Black Box to run in that warehouse as well, and swapped out the M32 for an S19.

Outside of my personal endeavors into home mining, I also joined Braiins part-time to do marketing, content and support. In December, I started a new full-time role at Compass to help with their at-home and hosted mining.

Congratulations! I wanted to ask you about Compass, actually. Do you think hosted mining is worth it for someone who wants to get into mining?

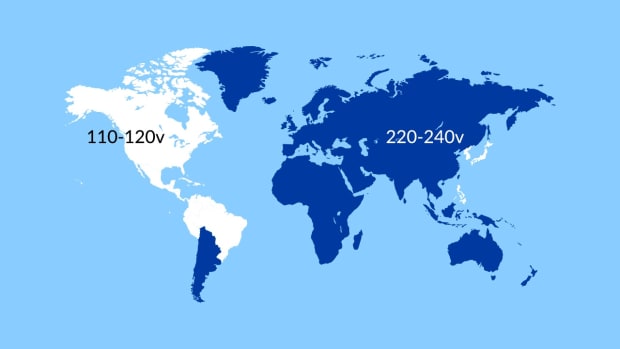

I think it just depends on your risk tolerance. For a lot of people — maybe you and I — we live, breathe, eat and sleep Bitcoin — so if we’re hosting our miners, we’re probably getting in trouble with the Bitcoiners because we don’t own the hardware. We’re not plugging it in and doing our due diligence. But in reality, while running a machine is easy, it’s not fun to manage. They’re hot, they’re loud and they require unique electricity setups. For example, they require 220 volt plugs, but in the United States most household plugs are only 110 volts. Higher volt plugs are reserved for special appliances like electric dryers and ovens. So, to run a miner you’ll either have to unplug your dryer or wire up a 220 volt plug. You have to run like new circuits and make sure everything’s rated for 220 volts so you don’t burn your house down.

It’s important to understand the risks if you use a hosted product such as Compass — you’re trusting us to manage your miners, there may be delays, miners could go offline from time to time and there is hardware risk. If you are OK with these tradeoffs, then hosting makes perfect sense. It’s clearly proving to be something that people want. Compass is doing it in a way where you can actually mine with them and not dox yourself in any way, which is kind of cool. So, hosting versus home mining depends on how hands-on you want to get. I think the only people critical of the hosted mining version are the Bitcoiners that are going to yell at you for not hosting everything yourself.

Part of my responsibilities in my new role at Compass are to streamline the hosting process — reducing those risks and making it easier for new miners to get onboard.

Do you think hosted mining will last as a business model?

As for whether hosting will last as a business — I think so. You’ll likely remember all the cloud mining scams in 2017 and 2018 — I think Compass does it right in that you own the miner and they are hosting it on your behalf. You have miners tied to your name, so if you ever want those miners and you’re not locked into a contract, you can get physical delivery of that miner.

There’s a hole in the market right now, because a lot of people who would be home miners are getting burned by electricity rates, and that just puts a bad taste in your mouth for Bitcoin in general. Compass could have made a ton of money starting up their own farm, but instead they followed a broker model, matching capacity and hardware. They don’t own the capacity or the hardware, but they match it up and make it easy for anyone to get even just a few miners into a secure facility with low costs.

In your experience at Braiins, where do you see new miners stumbling the most?

There are a lot of people that are trying to get into mining without any guidance. Mainly, they very much don’t understand the electrical requirements. The level of heat and noise are often unexpected as well. In the worst cases I see people just don’t get how Bitcoin works — don’t understand how the difficulty works, or don’t understand how profitability directly impacts the price of the hardware. So, they just think they’re going to be making $50 a day forever.

The electrical requirements are probably the biggest issue — you can plug in an S19 and that’ll use more electricity than your entire house. No other appliance really exposes you to that. You normally pay someone to just install an outlet for your electric dryer or oven, and that’s the most you ever think about it — you just use your oven. Also, when you’re dealing with that much electricity, it gets a little spooky — especially because a lot of people want to do all this mining stuff by themselves and there are very few resources out there for people.

You mentioned hardware pricing as tied to profitability. What have you seen in the hardware market this year?

Hardware pricing fluctuates with profitability of the units, but also with exogenous factors — like the China ban. A year ago, you could buy an S19 for probably $3,000, but now they’re selling for $10,000 to even $15,000. The China ban was totally fascinating, though — a year ago, you could buy an S9 for $50, even $20 a piece in bulk. Now, an S9 is selling for $500. It’s such an old machine — like a dinosaur that’s somehow surviving, yet they’re going for $500 today.

Efficiency adds a huge premium for the new units, however. A $500 S9 running at six cents per kilowatt hour will ROI in just nine months. An S19 that costs $12,000 today running at the same power rate will take 21 months to ROI — keeping price and difficulty constant, which of course could vary wildly. So, that increased efficiency and lifespan comes at a big premium.

Speaking of power costs, a couple of weeks ago you tweeted some thoughts on how miners can use power purchase agreements and business entities to get lower power rates. Can you talk through what you learned there?

This has been a fun one for me. My wife and I are building a house right now, and doing about half of the work ourselves — including all the electrical. While working on that, I just wanted to understand the electrical regulations and see how things were in my region. I dug up a lot of information that I’ve never seen anybody post about, and it has been really cool to share it and see people really enjoy that information and utilize it.

What I found out is that in the United States, you have regulated areas and unregulated areas of energy. In Michigan, electricity prices are regulated and set by the government. When you go down one state to Ohio, it’s unregulated. And what you get is a difference of about $0.18 per kilowatt hour in Michigan versus just about $0.06 per kilowatt hour to a resident in Ohio. Natural gas in Michigan, however, is unregulated — which I can cover if you want.

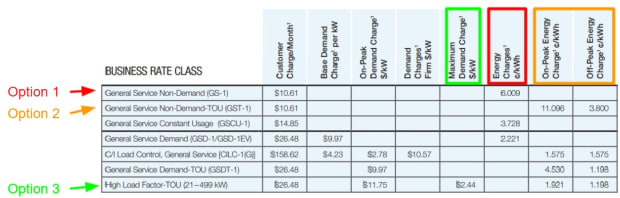

So, my power bill lists a kilowatt hour at $0.18, but when I went online I saw official sources listing the price as $0.12. I called the power company and asked them to explain the discrepancy. The difference ended up being due to delivery costs and other things not included in the $0.12 figure, but on that call I also discovered that there are other options — both residential and commercial — for purchasing power, many of which are far cheaper than $0.18 per kilowatt hour. The best option I found in Michigan was a commercial rate in a peak power-style power purchase agreement (PPA), which fits perfectly with a mining operation that is always on, pulling a constant load. So, I might be installing a separate box for that commercial power with the new house.

You mentioned natural gas — what have you found out about natural gas in Michigan as it relates to mining?

So, while I was talking with the power company about PPAs, I also discovered that Michigan has a lot of shale gas and it’s an unregulated market. I tried my hand at the calculations to figure out how much it would cost to run a miner off a natural gas powered generator in Michigan, and I got the equivalent of $0.02 to $0.03 per kilowatt hour at 100% efficiency. I am slightly skeptical of these numbers because they seem too good to be true, but more knowledgeable people on natural gas have confirmed that this seems accurate.

Part of me wants to buy a big generator that runs on natural gas, and point that energy at miners just like Upstream Data and others do. The generator could serve as a backup for home electricity too, so if we have an outage we can just run on natural gas. The big issue is you’ve got these screaming miners and screaming engines that might ruin your nice peaceful property.

Where do you see the whole home mining space evolving over the next couple of years?

Home mining has been blowing up this year and I think it’s mostly because of the China ban. It seems like people don’t care that they’re spending $10,000 on a metal box with a computer in it. They’re earning $500 a month right now, and that’s all they care about. They’re FOMOing in without understanding the risks. However, through this cycle, it seems a lot of people are also getting really smart with repurposing the heat, and that will have lasting impacts.

The potential of repurposing heat is endless. I think that will make home miners, despite their electricity cost, still very attractive. You can heat swimming pools, hot tubs, general home water heaters or pump heat back into a duct system. You can basically sell that massive amount of heat to your water heater and get two for one.

Also, we’ve talked about the idea of managing a power grid by powering down miners to free up electricity instead of turning on peaker plants to provide more electricity during spikes. I think this can be done in households, too. You could make sure your house is always burning a fixed number of kilowatts, instead of having your power consumption vary throughout the day as you turn on the oven, dryer, TV or whatever. When you’re not using that full amount of power — like when you’re sleeping — your miners are soaking it all up. When you turn on appliances, the miners automatically underclock just enough to keep your load constant. Then you can purchase a fixed load from your power company, which may allow you to get a better rate and lead to overall savings on electricity, even if your miners are just breaking even.

So, when you ask where home mining is going, I think of people finding really creative ways to repurpose the heat and balance their household electricity draw.

What do you think is missing in the home mining ecosystem that someone should be building?

For that home power balancing idea, we need firmware that allows you to scale up and down. Braiins has the ability to easily underclock, but what I think that they’re missing is a feature where it tunes your miner, defining all the different power ratings it can run at and finding the optimum performance. Then, you can plug your miner into a smart meter or use a Raspberry Pi to manage your house and your miners, scaling your usage up and down as more or less load is needed.

Then, I think there’s much more that can be commercialized around heat repurposing. Will it be through immersion or air cooling? I think there’s a reason that we still heat our houses by just blowing hot air, but you can get induction flooring and heat water heaters via coils and liquids. A lot of research needs to be done before these products will be implemented into individual appliances or packaged into something you can buy off the shelf. The biggest thing, however, is that computer which will tell your miners how much power to use.

I want to ask you about another idea I saw you tweet about — an S9 leasing system. Can you walk me through that idea and why you think a leasing system would be valuable?

I think leasing out S9s would make a ton of sense for Bitcoin meetups. There are a lot of people coming to these meetups who are diving into the rabbit hole and learning more. However, if they go out and buy a $10,000 S19, there’s a decent chance they’re going to get wrecked in some way — it won’t be a great experience. Many people aren’t even willing to make that kind of investment up front, and that keeps them out of mining. That said, I think the biggest amount of knowledge you can gain is from running a miner. Once you plug it in and run it — even for a day — you’ll learn so much and you’ll truly understand if it’s worth it or not.

The moment you plug it in, you hear that thing scream and you see the heat it generates, that’s enough to figure out if you don’t want to deal with this thing or if you’re excited about it. So, personally, I have an S9 that’s just sitting in my house, not plugged in, because it’s not economical to run. I brought it to a local meetup — just six of us come regularly so far — and asked if anyone wanted to take it home to try it out. Someone took me up on it and learned a lot through the experience. Just borrowing an S9 is a great way to get your toes wet on mining before diving in headfirst.

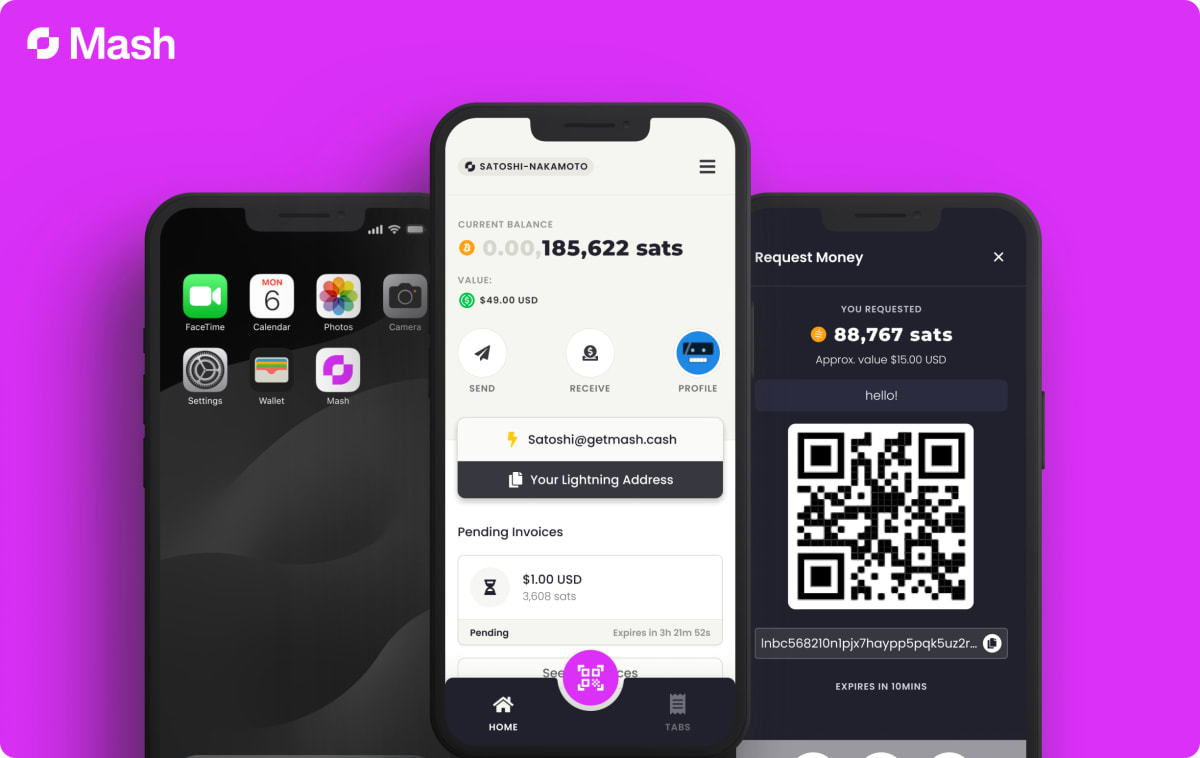

I think this could be done on a bigger scale using a multi-signature wallet to hold a deposit for the miner. Say I hand you an S9, you put $500 in a multisig wallet with someone we both trust holding the third key. A month later, you give me the miner back and get your $500. You learned a ton, got help along the way and now feel ready to buy a bigger rig and set it up yourself. If there was a way to do that at every meetup, I think that’d be super cool.

What advice do you have for people thinking about getting into mining?

Start with an S9. You’re going to underthink it and misunderstand it unless you plug a miner in, because you can’t tell how loud or hot these things are from a YouTube video. I also think it really has to be done with an ASIC — you cannot get the same experience from a GPU. Just repurposing a computer and mining with NiceHash will give you the same backend data — you’re getting rewards, you’re learning how mining works, but if you ever want to earn a meaningful amount you will need an ASIC. And that comes with a whole different level of power draw, noise and heat. So you’re fooling yourself if you only experience mining with a GPU.

Taking that advice a step further to de-risk this: you only need to mine for a day. If you plug this thing in for a day, you’ll get it. Mine your first block, get your first payout, and you are well on your way to understanding mining. You could buy an S9 for $500, run it for a week, then turn around and sell it for $500. The market is not going to change that much in a week. You’re not out any money on the experience.

I think the biggest advice I can give is just buy one, try it, resell it if you don’t like it. There’s almost no risk in that. Plus, you will have a lot of questions while trying it — ask them in home mining Telegram groups and on Twitter. There are a lot of resources online, but you’re not going to learn anything unless you try it.

Just begging for that S9 lease program! Well thank you for the time today, BigCohooNah. Really appreciate your insights on mining and I hope you’re able to build a mine in your home without keeping the neighborhood awake with a natural gas generator.

If you want to reach BigCohooNah, he’s on Twitter @BigCohoo. He has also authored some incredible explainers on Bitcoin basics — like mining — which are perfectly suited for your nocoiner friends.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.