Collectors Are Bored of Apes and Don’t Want to Pay Royalties

This week, the floor price of the Bored Ape Yacht Club NFT collection dropped to its lowest price in nearly two years, leading to questions about the collection’s value. But floor price is just one metric used to value NFTs – experts explain that there are other important factors in assessing what an NFT is worth.

Meanwhile, NFT royalty payouts are down this month, as creators, platforms and collectors continue to butt heads over the matter. Plus, Tom Brady’s sports collectibles site Autograph is reportedly in trouble and changing its game plan.

You’re reading The Airdrop, our weekly newsletter where we discuss the biggest stories across Web3. Sign up here to get it in your inbox every Friday.

Monkey see, monkey don’t: Bored Ape Yacht Club (BAYC), one of the most popular NFT collections to date, is experiencing a decline in popularity. This week, the collection’s floor price – or a measurement of the lowest price a seller wants for an NFT in a given collection – dipped to a 20-month low of 27.4 ETH, or about $53,000, indicating waning public opinion in the collection at large. This trend has been across the NFT market, as formerly red-hot collections are seeing their floor prices drop. But what does this mean for the largest NFT collection by sales volume?

-

Overleveraged, underwhelming: My colleague David Z. Morris writes that BAYC’s steep decline is a reflection of how the project catered to an elite, insular community and marketed its NFTs aggressively during the bull market. As the market has cooled, many collectors traded in the community for cash, leaving the project to justify its cultural value add.

-

Is BAYC over? Far from it, though the floor price drop means that the most basic Apes in the collection cost less, shrinking the bar for entry into the community. There are many factors that contribute to the valuation of NFTs such as rarity traits and cultural significance. In fact, some of the Apes with the rarest traits in the collection (like gold fur) are still valued above 300 ETH, or about $556,000. We dug into what that means for Justin Bieber’s Ape and others.

Royal pain: NFT creators are making less money from secondary sales than they have in two years, according to a report from data analytics platform Nansen. Royalty payments hit their peak in April 2022, reaching 28,000 ETH (nearly $76 million) for creators in one week. Meanwhile, June’s best week saw creators collectively earn 2,000 ETH, or about $3.8 million. As competition amongst NFT marketplaces has heated up, many of the most popular platforms changed their policies on enforcing royalty payments to stay afloat. Two of the largest NFT marketplaces, Blur and OpenSea, went tit-for-tat earlier this year but settled on enforcing a minimum royalty payment of 0.5%. In both cases, collectors have the option to pay more royalties, though it appears that the practice is uncommon.

-

Blur to blame? Nansen analysts Javier Cerdan and Edward Wilson told CoinDesk that royalties have been declining since February, though the sharp drop has been made worse by the rise of optional royalties popularized by Blur.

-

Blue-chip stockpile: Despite declining payouts, blue-chip collections have received millions in royalties so far. Yuga Labs, for example, has raked in nearly $166 million in collective royalties across its collections, including Bored Ape Yacht Club, Mutant Ape Yacht Club and Otherdeed for Otherside.

Autograph changes play: NFL star Tom Brady embraced NFTs in 2021, and launched his sports-themed collectibles Autograph platform. According to The New York Times, Brady raised over $200 million from investors and even had FTX’s Sam Bankman-Fried join its board. But in the wake of FTX’s crash, a source told The Times that Autograph’s revenue shrunk, leading it to shift its strategy away from crypto and more towards generic celebrity loyalty programs.

-

Financial fumble: Autograph has reportedly laid off over 50 employees, signaling financial woes.

Sports not done with Web3 plays: Despite Autograph’s troubles, major brands and teams have continued to release sports NFTs. This week, Swiss investment bank Credit Suisse announced that it would be teaming up with the Swiss Football Association to release a collection supporting women’s football. And this weekend the MLB will debut its virtual ballpark, which will include a commemorative digital ticket by Digital Candy.

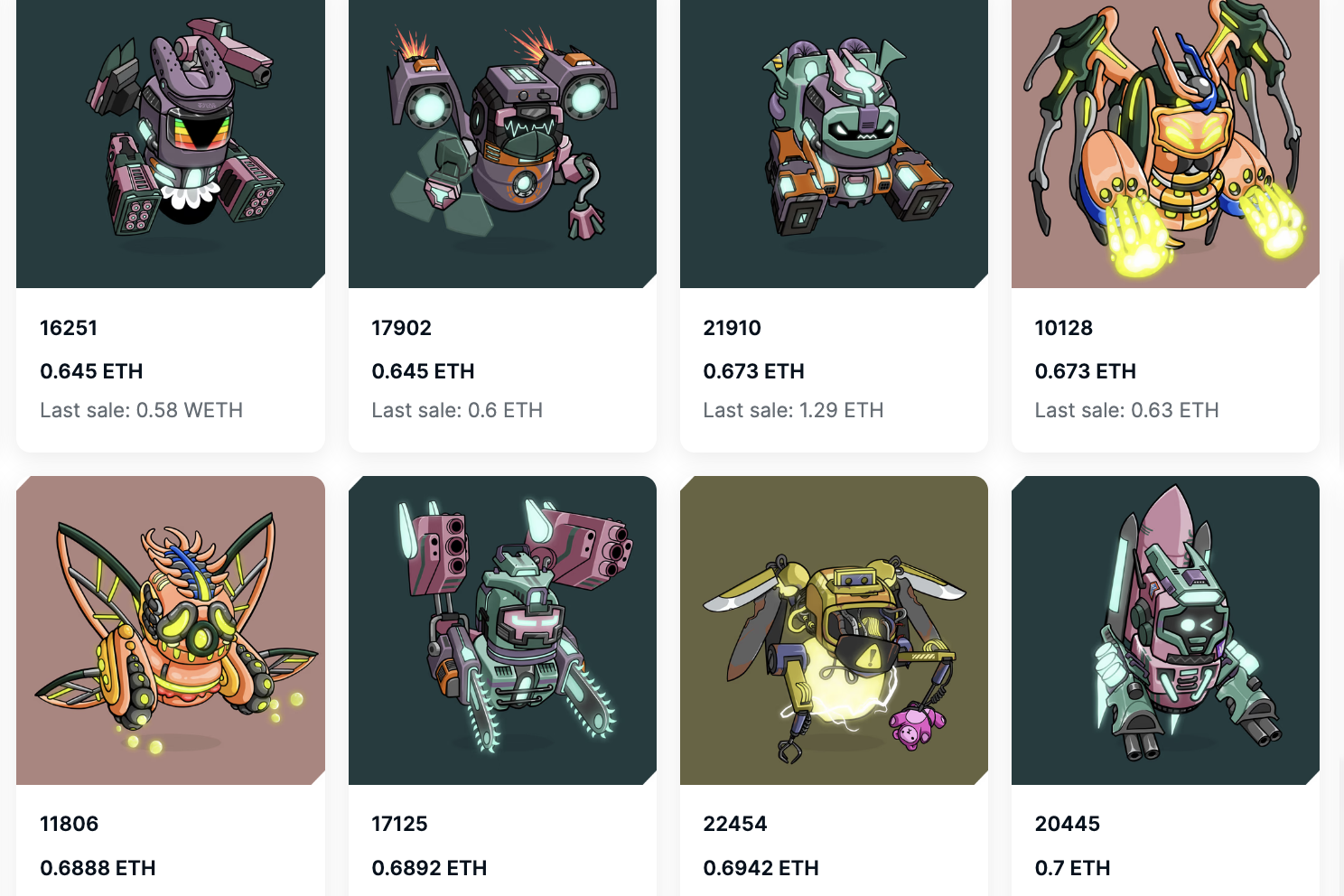

What: HV-MTL, pronounced “heavy metal,” is a new crafting game for holders of HV-MTL NFTs, which were released in March. Users are tasked with “creating a forge” for their HV characters, and the community votes on their favorite plot, earning rewards for its creator. As the game evolves in the coming month, new challenges will be introduced to test a user’s skill.

How: The “forge” experience for HV-MTL opened last week and will last for six seasons lasting three weeks each. The full experience is currently only available to HV-MTL NFT holders, though non-holders will soon be able to try a limited version of the game. Unfortunately, this news has not helped boost HV-MTLs price or the overall vibe for Yuga Labs. To date, the HV-MTL collection has done 34,196 ETH (about $63.5 million) in trading volume, and its floor price sits at 0.64 ETH (about $1,180) at the time of writing, which is far from its peak of around 2 ETH when it debuted.

b: The estate of legendary Hollywood star Steve McQueen is releasing a motorcycle-themed NFT collection linked to token-gated content, events and games.

Twitter JPEGs: Crypto degens can now buy crypto and NFTs on Twitter using Inspect’s new Chrome browser extension.

Hong Kong is all in on Web3: The city has set up a task force for promoting Web3 development, which includes Animoca Brands chairman Yat Siu.

One kind of attack on the rise is ‘ice phishing,’ which tricks a victim into signing a malicious blockchain transaction that opens access to the victim’s wallet so the attacker can steal all the money.

More commonly, people who get hacked aren’t the target of sophisticated exploits but instead fall prey to scammer’s use of social engineering. Scammers sniff around for user’s personal information or use tricks to get crypto users to reveal their passwords or seed phrases.

Here’s what you need to know to protect yourself from these and other scams.

Edited by Toby Leah Bochan.