CoinShares Reports Over $30 Million Worth of Crypto Stuck on FTX

Europe’s largest digital asset investment and trading group – CoinShares – revealed that approximately 11% of its total net asset value is situated on the crypto exchange FTX.

Another firm experiencing similar issues is Mike Novogratz’s Galaxy Digital, which holds more than $76 million worth of exposure to the troubled firm.

- In a recent interview for Bloomberg, CoinShares said nearly $26 million of its exposure to FTX consists of US dollars and Circle’s stablecoin USDC. Pending withdrawals of 190 BTC and 1,000 ETH account for the remaining over $4 million.

- The company’s CEO – Jean-Marie Mognetti – stated the assets were part of the capital markets division and accounted for proprietary trading operations.

- The boss added that potential losses had not affected CoinShares’ exchange-traded funds. The organization also has no exposure to FTX’s sister company Alameda Research.

- The problems for SBF’s trading venue started a few days ago when Binance decided to liquidate all its FTT tokens.

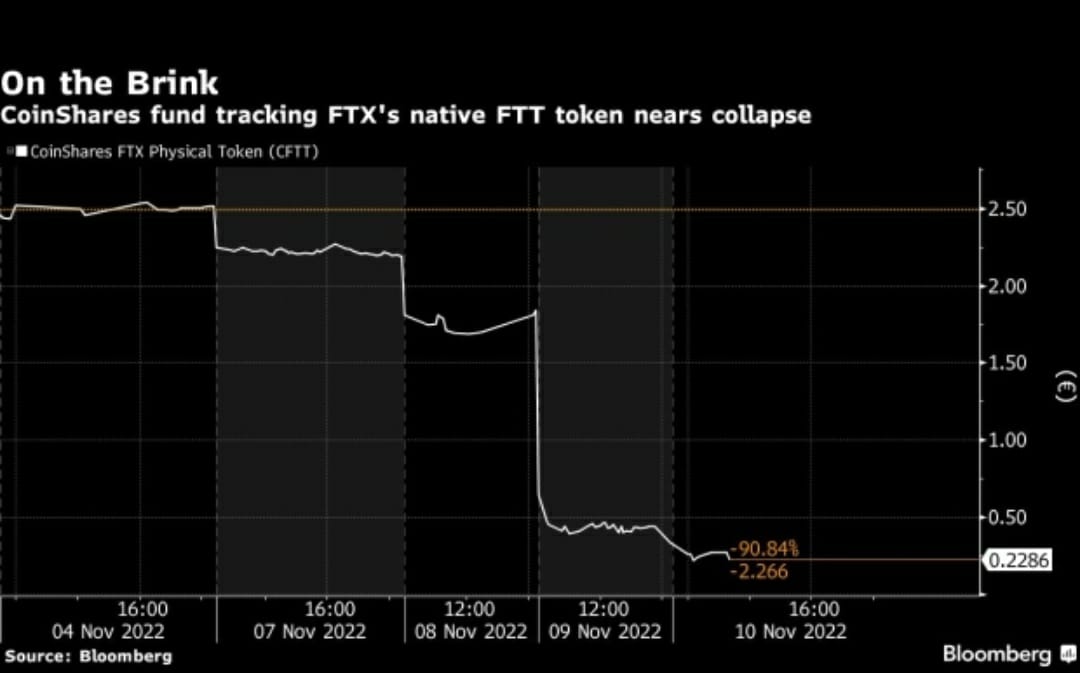

- The coin’s price crashed shortly after the announcement and currently trades at around $2.90 (a nearly 90% decline compared to last week’s figures).

- While Bankman-Fried initially assured that FTX and its assets were “fine,” the entity paused certain operations, such as withdrawals, which caused severe panic.

- In the following hours, the CEO changed his stance and said Binance will acquire his trading venue to stabilize its liquidity issues.

- Despite confirming the news at first, the world’s largest crypto exchange withdrew its intentions to purchase FTX, outlining that “the issues are beyond our control or ability to help.”

- Speaking on the matter, CoinShares’ CEO said dealing with cryptocurrencies on exchanges might be easy for market participants, but they should know this hides its risks:

“For too long, things like FTX have been perceived by investors as a quasi-bank or quasi-financial institution, which it is not. We can all trade crypto at an exchange, but you are exposing yourself to a variety of risks which are not really in your favor.”

- CoinShares offers an exchange-traded fund called FTX Physical FTX Token. It has plummeted over 90% since the FTX’s meltdown began.

CFTT Graphics, Souce: Bloomberg

The post CoinShares Reports Over $30 Million Worth of Crypto Stuck on FTX appeared first on CryptoPotato.