It’s been almost a year since bitcoin traded near $20,000, but that isn’t stopping innovation in the market from reaching other kinds of all-time highs.

In fact, according to CoinMarketCap, the leading provider of cryptocurrency data, there’s never been more cryptocurrencies in existence than now. Launched in 2013, CoinMarketCap listed its 2,000th crypto asset this month with the addition of Labh Coin (LABH).

The milestone officially passed on October 3, there are now 2,112 cryptocurrencies tracked by the data site, the most trafficked according to data from Alexa.com. Data from the company shows a 3,000 percent increase in the number of cryptocurrencies on the website since it tracked just 66 assets in 2013.

According to current figures, the site averages 422 newly listed cryptocurrencies per year which could be broken down to nearly 8 per week. The explosive creation of cryptocurrencies is surprising to many people, but not all.

The explosive creation of cryptocurrencies is surprising to many people, but not all.

In fact, the founder of CoinMarketCap, Brandon Chez, told CoinDesk he anticipated the growth early on, although the reality of the situation has become a sight to behold.

He explained:

“It was apparent that the idea of cryptocurrencies wasn’t going away, especially being part of the emerging community that rallied around the promise of what a world with cryptocurrencies would look like. I did imagine at the start that it would reach this number in the near future, but it’s still quite amazing to see it finally come to fruition.”

But, what does it mean?

To Chez, the meaning of the rise in the number of cryptocurrencies is quite clear – the demand for secure representation of value still exceeds the number of preferred options.

“This is something that cryptocurrencies and related technology excel at, so the crypto industry will definitely also benefit from this rise,” he said.

After nearly a year of cryptocurrency price declines in what history will remember as “the infamous 2018 bear market,” one has to wonder if the poor market conditions will take a toll on the rate of cryptocurrency creation. Chez believes this to already be the case, an effect he calls asset creation “fatigue.”

“I think the industry is fatigued with new asset creation right now in the bear market, especially since ICO prevalence has died down.”

Much like time, though, bull markets seem to heal all wounds. Chez remains optimistic about the industry, envisioning the positive impact a bull market in 2019 could have on new projects.

“Assuming a bull market in 2019, I expect token creation to speed back up as teams are willing to pour more capital into new projects as their existing crypto portfolios appreciate in value.”

Market Cap

The rise in one of the site’s featured metrics, total market capitalization of all cryptocurrencies, is perhaps even more staggering that the number of assets created.

According to historical data provided from the CoinMarketCap, the total market capitalization of all cryptocurrencies aggregated from just seven listed assets on April 28th, 2013 (its first month in business) was just shy of $1.6 billion.

That number today represents over $200 billion and a more than 13,000 percent increase since 2013. It should be noted the all-time high in total market capitalization of roughly $830 – set last January – represented an astounding growth percentage of 55,000 percent.

CoinMarketCap doesn’t list every cryptocurrency in existence, however, so some competing websites with different listing criteria may provide data for many more. For example, CoinGecko is closing in on 3,000 listed cryptocurrencies with 2,982 at the time of writing.

According to CoinMarketCap’s FAQ page, each listing must adhere to a few requirements.

Each asset must “be a cryptocurrency or crypto token on a public exchange with an API that reports the last traded price and the last 24-hour trading volume.” Further, each “must have a non-zero trading volume on at least one supported exchange so a price can be determined, and for market cap ranking, an accurate circulating supply figure is required.”

While the listing criteria remain the same, Chez does tend to identify different themes among the listed cryptocurrencies per year. When asked about the types of assets listed now versus years past, Chez simply answered “2018: security tokens.”

Disclosure: The author holds BTC, AST, REQ, OMG, FUEL, 1st and AMP at the time of writing.

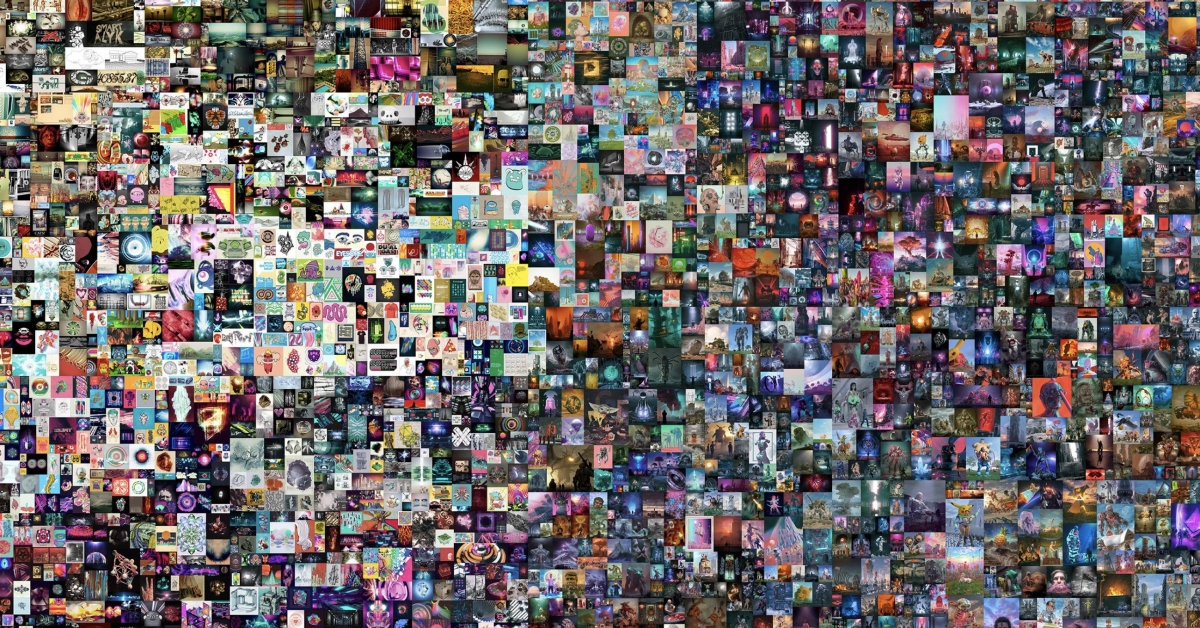

Image Credit: CoinMarketCap/Facebook

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

The explosive creation of cryptocurrencies is surprising to many people, but not all.

The explosive creation of cryptocurrencies is surprising to many people, but not all.