CoinGecko Releases Cryptocurrency Derivatives Section

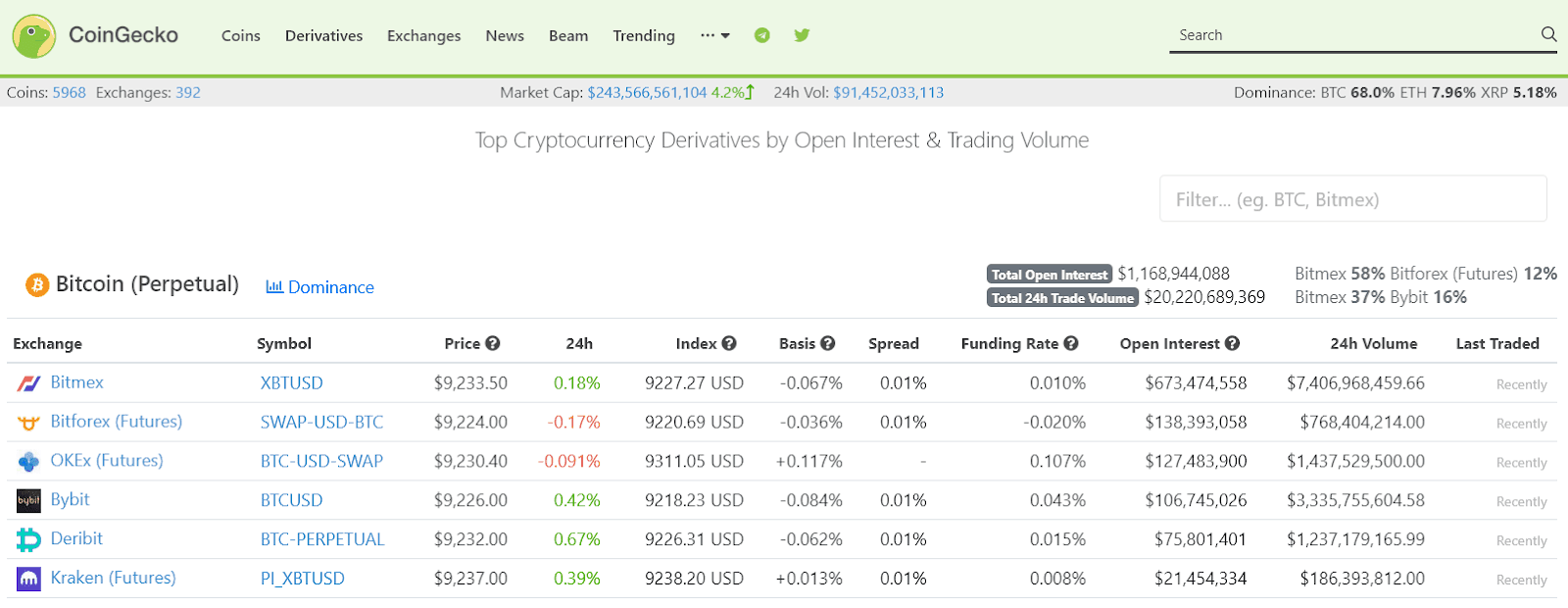

[Press Release 29 October 2019] – CoinGecko, a leading cryptocurrency data aggregator, today announced that it is releasing a Derivatives section to display aggregated metrics for crypto derivative products such as Perpetual Swaps & Futures. CoinGecko is the first data aggregator to provide information about crypto derivatives and aims to be the most comprehensive database as this sector develops further.

In September 2019, the crypto derivatives market hit a new high, with BitMEX, the most popular crypto derivative exchange, reaching nearly USD 9 billion in daily trading volume.

In CoinGecko’s Derivatives section, users will be able to browse more than 100 derivatives products offered by over 20 derivatives exchanges. This will be the first time that traders will have free, unimpeded access to vital aggregated crypto derivatives data such as price, open interest, basis, funding rates, expiry dates, trading volume, and more.

“This year, we have observed strong growth in the crypto derivatives market. Being a leading crypto data aggregator, CoinGecko aims to lead the industry with innovation and we are proud to be the first to launch such a service. We hope to empower traders with more data that they can use to make better-informed decisions. We are excited about the potential growth of crypto derivatives and look forward to further democratizing data access as we continue to commit to the maturation of the digital asset space,” said TM Lee, CEO of CoinGecko.

At launch, CoinGecko’s users will have full access to three different tools through which to view the Crypto Derivatives Market.

1. Derivatives Product Overview

2. Derivatives Exchanges Overview

3. Derivatives Exchanges Profile (e.g., BitMEX):

The launch of this Derivatives section marks CoinGecko’s first step toward adding further metrics to the growing derivatives market. CoinGecko expects to see strong growth in crypto derivatives, with volume outpacing the spot market in the near future, mirroring the traditional commodities market. Soon, CoinGecko will also start tracking options as well as other derivatives offerings, such as leveraged tokens offered by certain exchanges.

The derivatives data will soon be made available on CoinGecko’s mobile app as well as in its free public API.

The post CoinGecko Releases Cryptocurrency Derivatives Section appeared first on CryptoPotato.