CoinDesk’s Ethereum Validator Enters Final Weeks, Sitting on More Than $30K of Gains

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/4jlkVfIJyhWbHl-4dZKorrHWZHQ=/arc-photo-coindesk/arc2-prod/public/AD4ZHCPHURCXLMUECKW67TDXSY.png)

Bradley Keoun is the managing editor of CoinDesk’s Markets team. He owns less than $1,000 each of several cryptocurrencies.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

The Valid Points newsletter was founded in December 2020 with the express purpose of chronicling CoinDesk’s project to start and maintain its own validator on the Ethereum blockchain.

The goal, as stated in the first issue, co-authored by former reporters Christine Kim and Will Foxley, was to “deepen CoinDesk’s editorial coverage” and “gain an unvarnished perspective” as the Ethereum network made its landmark shift from the original “proof-of-work” consensus mechanism – the same cryptographic security system used by Bitcoin – to a more energy-efficient “proof-of-stake” system.

A month earlier, CoinDesk Director of Engineering C. Spencer Beggs had set up a node on the cloud (currently hosted on Amazon Web Services), and the company bought the required amount of Ethereum’s native cryptocurrency, ether (ETH), to qualify as a security validator under the proof-of-stake system. Then we “staked” that 32 ETH, essentially depositing it into a Beacon chain smart contract. The Beacon chain was set up to run in parallel with the main Ethereum network in preparation for the eventual transition. At the time, the tokens were worth about $15,000.

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum’s evolution and its impact on crypto markets. Subscribe to get it in your inbox every Wednesday.

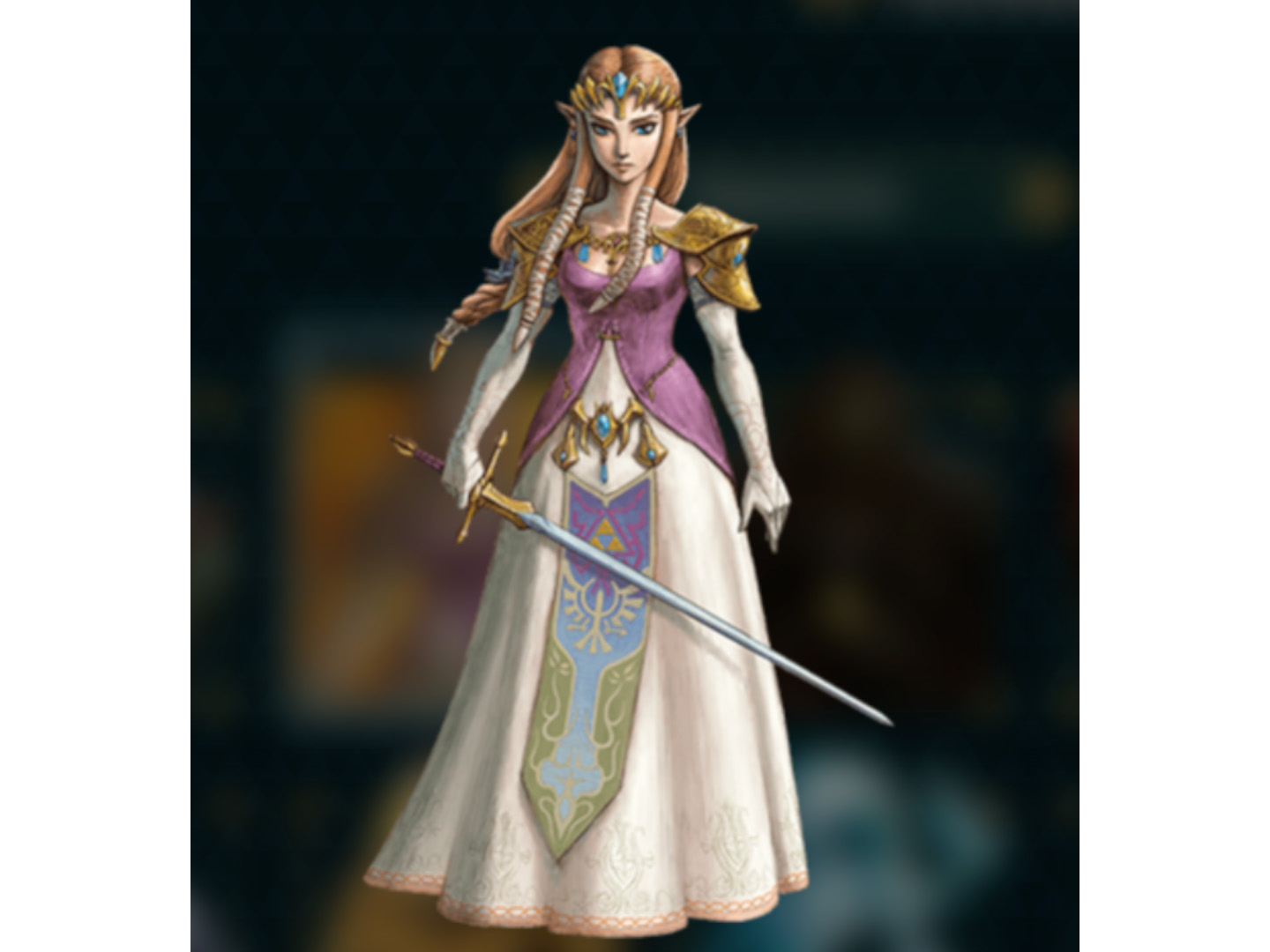

We even gave our validator a nickname, Zelda. Memories are fuzzy, but the choice was inspired either by Zelda Fitzgerald, the flamboyant wife of Great Gatsby novelist F. Scott Fitzgerald, or the character Princess Zelda from the game Legends of Zelda. Or it was just something that popped into Beggs’s head at the moment he was asked to type something into the Beacon Chain explorer.

Princess Zelda, likely namesake of our Ethereum validator. (Zelda.com)

A week from today, on April 12, Ethereum will undergo a key upgrade known as the “Shanghai hard fork” (referred to as “Shapella” by some insiders), and validators will now, for the first time, be able to withdraw the tokens in a process known as “unstaking.” It’s the biggest milestone for Ethereum since last September’s “Merge,” when the original proof-of-work blockchain was merged with the Beacon Chain to complete the transition to proof-of-stake. (Watch parties are already being planned for the big night. Geek out with the gang!)

In keeping with our original plan, CoinDesk plans to unstake its 32 ETH shortly after Shanghai goes live – again, so we can test for ourselves if and how the process actually works.

To prepare, we are taking the step of updating our validator software to the most up-to-date version – as recommended in this official blog post from the Ethereum Foundation – as well as migrating our validator to include a 0x01 withdrawal credential and mapping out the technical steps for unstaking.

At the end of the day, Zelda managed to earn 3.598 ETH worth about $6,750 in staking rewards which we pledged from the outset to donate to charity (exactly which charity has yet to be determined). Not bad for a bunch of journalists!

CoinDesk can also return the original outlay of 32 staked ether to its coffers feeling pretty good about its gains. Over the past couple of years, the price of ETH has appreciated substantially, more than tripling in price, for more than $30,000 of principal gains in dollar terms.

With the project now entering its final weeks (assuming everything goes smoothly), we decided to provide a brief recap of our experience as a validator.

Once CoinDesk decided to claim a front row seat to Ethereum’s switch to the proof-of-stake consensus model, spinning up the validator had its own set of logistical challenges.

Christine Kim, one of the former CoinDesk reporters who spearheaded the project, now a vice president of research at Galaxy Digital, said in an interview that “unless you had a higher level of programming knowledge, computer science knowledge, it’s actually quite difficult to pull data from your node in a readable format.”

One of the core tenets of public blockchains is that transactions and block validation data is accessible to everybody. But even reporters at CoinDesk, who spend their days analyzing the blockchain, realized that trying to glean data from a node in a cohesive way was harder than expected.

Kim said she originally thought that “once I had the node up and running, it shouldn’t take too much effort to build up a data dashboard to analyze that information, but it was actually quite difficult.”

“You actually need to do a lot more heavy engineering work to parse through that data,” she said.

Eventually we figured out where to get the data on our node’s performance. It was available from a publicly accessible, open-source blockchain explorer, beaconcha.in. (The info on our particular node is right here.)

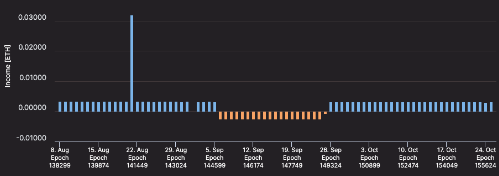

Our responsibility as a validator is to secure the Ethereum network and help it reach consensus by storing data, processing transactions and adding new blocks to the blockchain. We generated income in two ways: attesting to the current state of the blockchain and proposing data blocks when randomly selected to do so. As happens when one runs a validator node, we earned a daily income from the attesting, but the bigger rewards came when we were chosen to propose a block.

Here are our lifetime stats as a validator: Active since Feb. 17, 2021, the CoinDesk validator has proposed 19 blocks and had more than 174,660 attestation assignments. We executed more than 99% of all attestation assignments, missing roughly 1,250.

We are currently just one of 562,031 total validators, but hey, these stats show our contribution to the daily work of keeping the Ethereum blockchain running securely.

(In May 2021 we estimated it cost about $200 a month to run the validator, essentially the fees we paid to AWS. Beggs, our director of engineering, figured that would be a better alternative, ultimately, than spending $3,000 on a quality computer to host it onsite. An added consideration was that we wouldn’t have to go into the office during the then-lingering Covid pandemic.)

“We needed our own Ethereum 1 node, so we needed all the data for that, and for that you would need a 2-4 terabyte, solid-state hard drive, and those can be very expensive,” Beggs said in an interview.

Last year, after the Merge, we took the necessary technical steps to stay current as a validator on the new integrated system.

We weren’t perfect, of course. (Hey, we’re a media company!) For a period of 20 days last year, from Sept. 6 to Sept. 25, the CoinDesk validator stopped attesting, due to a data corruption issue.

The issue was noticed by CoinDesk reporter Sage D. Young, whose job duties included looking up the validator’s performance data each week to put into Valid Points. He noticed that our “attestation inclusion effectiveness” had dropped dramatically to 8%.

“Attestation inclusion effectiveness should be 80% or higher to minimize reward penalties,” according to beaconcha.in.

During the period, CoinDesk racked up penalties of about 0.002372 ETH a day, and obviously we left another 0.0032 ETH on the table for each day, on average, when we weren’t attesting – and maybe missed out on some chances to propose new blocks.

This chart shows CoinDesk’s daily validator income in ether (ETH) during a period of time from August through October. The large blue spike on the left shows the fat reward booked when we were chosen to propose a block. The series of orange bars in the middle reflect penalties when we briefly stopped attesting. The mini blue bars represent income from attesting, on a typical day. (beaconcha.in/validator/90969)

According to Beggs, the CoinDesk node “had some corrupted data,” and we needed to revalidate roughly eight months of transactions. To make sure our validator was back on track and running without hiccups, Beggs conducted a system reboot, set up a new setting for the Merge and updated our Ethereum execution software client, Geth, and consensus software client, Lighthouse.

Our income from the project resumed Sept. 26, but the penalties over the period amounted to an estimated 0.04744 ETH, with another 0.064 ETH of income we left on the table – a net reduction in lifetime project proceeds of 0.11144 ETH ($208.28 at today’s price), versus what we would have expected had we avoided the issue.

It bears noting that, despite digital-asset markets still being mired in crypto winter, with the price of ether off 62% from its all-time high, CoinDesk has still done quite well on the investment. Over the longer timeframe since we bought the ether, the price has roughly tripled.

What’s impossible to argue is that Ethereum has maintained its position since December 2020 as the dominant “smart-contracts” blockchain – one that’s capable of functioning like an actual computer, in contrast to the Bitcoin’s ambitions as a decentralized financial network.

In that sense, getting a multiple return on our original investment is, at least to some extent, a reflection of the ecosystem’s successful execution (so far) of its transition to a full proof-of-stake network and the community’s enduring loyalty.

Our project will end soon but we will continue to follow Ethereum’s story closely.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/4jlkVfIJyhWbHl-4dZKorrHWZHQ=/arc-photo-coindesk/arc2-prod/public/AD4ZHCPHURCXLMUECKW67TDXSY.png)

Bradley Keoun is the managing editor of CoinDesk’s Markets team. He owns less than $1,000 each of several cryptocurrencies.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/4jlkVfIJyhWbHl-4dZKorrHWZHQ=/arc-photo-coindesk/arc2-prod/public/AD4ZHCPHURCXLMUECKW67TDXSY.png)

Bradley Keoun is the managing editor of CoinDesk’s Markets team. He owns less than $1,000 each of several cryptocurrencies.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.