CoinDesk Turns 10: 2021 – The Year Bitcoin Became Salvadoran

The defining crypto story in 2021 came to us by way of Strike founder Jack Mallers and this teary-eyed proclamation at Bitcoin Magazine’s Bitcoin Conference in Miami that July.

El Salvador President Nayib Bukele had just told attendees via video-link that he planned to make bitcoin a legal tender – the first country to take this momentous step. Soon, consumers would be able to use BTC alongside the U.S. dollar.

El Salvador, a dollarized country since 2001, aimed to mitigate the negative impacts that stem from being tethered to the U.S. central bank. Now the Central American state was opting into a digital currency that cannot be controlled by any central authority and can be altered, as language in the bill outlined, only in accord with “objective and calculable criteria.”

This feature is part of our “CoinDesk Turns 10” series looking back at seminal stories from crypto history. El Salvador’s Bitcoin Law is our choice of the most momentous story from 2021.

The Bitcoin faithful were elated at the announcement. Finally, a real, tangible first step towards widespread adoption of Bitcoin. An entire country was going to make bitcoin its currency.

Former CoinDesker Colin Harper, now of Luxor, a mining company, was covering the announcement for CoinDesk alongside CoinDesk’s Danny Nelson. They said the energy on the floor was something to behold.

“Everyone went crazy,” Harper said.

“We were scrambling behind the scenes to get an article out,” said Nelson, showing how important the news was to a publication like CoinDesk, which had been covering relatively piecemeal crypto-adoption milestones for years. He then shared screenshots of Slack messages between CoinDeskers which featured enough typos to make any copy editor blush.

The onstage performance in Miami was a flashy, vibrant affair, befitting the city itself. But the announcement wasn’t the actual hard work in El Salvador to actually make the idea a reality. That came with the passage of the country’s Bitcoin Law in September 2021. Meanwhile the U.S. Bitcoin community was heading south in droves, pursuing local Bitcoin projects in places like the surf town of El Zonte on Bitcoin Beach, a circular bitcoin economy. The work continues now there and elsewhere in the country.

But the rollout did not go smoothly over the next few months.

In 2020, a group of bitcoiners based in and building out Bitcoin Beach met with El Salvador’s Ministry of Tourism, which led to meetings with the Ministry of Economy in March 2021 and Bukele’s economic advisors. Less than three months later, the Salvadoran President made his first surprise announcement at the Bitcoin Conference.

In that group of pioneer-Bitcoiners was Mike Peterson, Director at Bitcoin Beach. Peterson bought a home in El Salvador 20 years earlier. He argues that Bukele’s move was the result of a grassroots movement and was not something top-down, as some U.S. critics have alleged.

“El Salvador’s Bitcoin movement started in El Zonte,” Peterson told CoinDesk. “It just moved quickly from ideation, meeting with economic advisors, to Bukele quickly pushing it to law. During the official passage of the law in the assembly, Bukele joined a Twitter Spaces and told thousands of listeners that the government was inspired to make Bitcoin legal tender because of how Bitcoin was transforming the lives of the unbanked in El Zonte.”

In classic Bitcoin fashion, the law’s passing was first shared with the world in the most bitcoin way possible, on a Twitter Spaces hosted by CoinDesk columnist Nic Carter.

Once the Bitcoin Law was in place what followed is probably best described as a bit chaotic. President Bukele wanted to roll out a Bitcoin wallet as soon as possible and promised it quickly. He wanted Bitcoin ATMs set up around the country and to give every Salvadoran who downloaded the government-sponsored Chivo wallet $30 in bitcoin. The wallet was built hastily by Athena Bitcoin, then eventually rebuilt by AlphaPoint.

Salvadorans, meanwhile, had several misconceptions about Bitcoin, which added to the government’s rollout issues. They were not aware that Bitcoin was not President Bukele’s invention and that users would not actually be required to use the Chivo wallet and could instead use any wallet they wanted. To boot, the falling price of bitcoin at the time didn’t exactly do anyone any favors.

When the bill was announced in July 2021, BTC was trading at around $30,000. When the bill became law in September 2021, it was trading around $45,000. By September 2022, a year after the law was enacted, it was below $20,000. Any discussion around El Salvador and adoption would be incomplete without acknowledging these price swings and the bitcoin bear market.

Still, bitcoiners in El Salvador remain optimistic.

The CEO of Blink (aka the Bitcoin Beach Wallet) Noor El Bawab told CoinDesk in an interview that “although rollout was slow, you can still live fully on Bitcoin in El Salvador.” Noor also urged people to look at per capita numbers when discussing transaction volume (or lack thereof) in the country.

El Salvador is the smallest country in Central America, home to only about 6 million people. Of those 6 million people, Chivo amassed 3.8 million clients, according to a report from the International Monetary Fund (IMF).

Now, of course, most of those 3.8 million Salvadorans could have taken the $30 and never touched bitcoin again, just as easily as those 3.8 million could still be using Bitcoin. But 2022 survey data from the U.S. National Bureau of Economic Research suggested that only four in ten Salvadorans who downloaded Chivo still use it.

Perhaps Salvadorans moved their bitcoin off the custodial, state-owned Chivo wallet into a non-custodial wallet or even into self-custody via a hardware wallet. We don’t know.

We posed this question to Noor, knowing that the Blink wallet was a custodial wallet, and she offered a sobering perspective: “It’s expensive.”

Now when you consider that the average income in El Salvador is around $300 a month and a hardware wallet setup at a minimum costs around $100, then sacrificing one-third of a month’s income for self-custody is a tall order. It’s cheaper to use a custodial solution.

Andrew Mahowald and Pretyflaco, who works at Blink’s parent company Galoy, recently wrote in support of custodial solutions which introduces the concept of “Satoshi’s hierarchy of needs.” That argues for the use of professional Bitcoin-only custodians as an intermediate solution for those not ready for self-custody. This could be a result of Noor and Pretyflaco speaking from a biased source, given Blink is custodial, but there could be a kernel of truth in there.

What is certain is that companies and individuals are still building Bitcoin solutions in El Salvador to this day. Even though plans for El Salvador’s utopic “Bitcoin City” fell through – which was to be built at the foot of a volcano after the placement of so-called “bitcoin bonds.” Still, companies like Galoy have cropped up and are dedicated on Bitcoin in El Salvador. Others still, like Strike, have either opened up offices in El Salvador or made some sort of public commitment to the country.

Then there’s President Bukele himself.

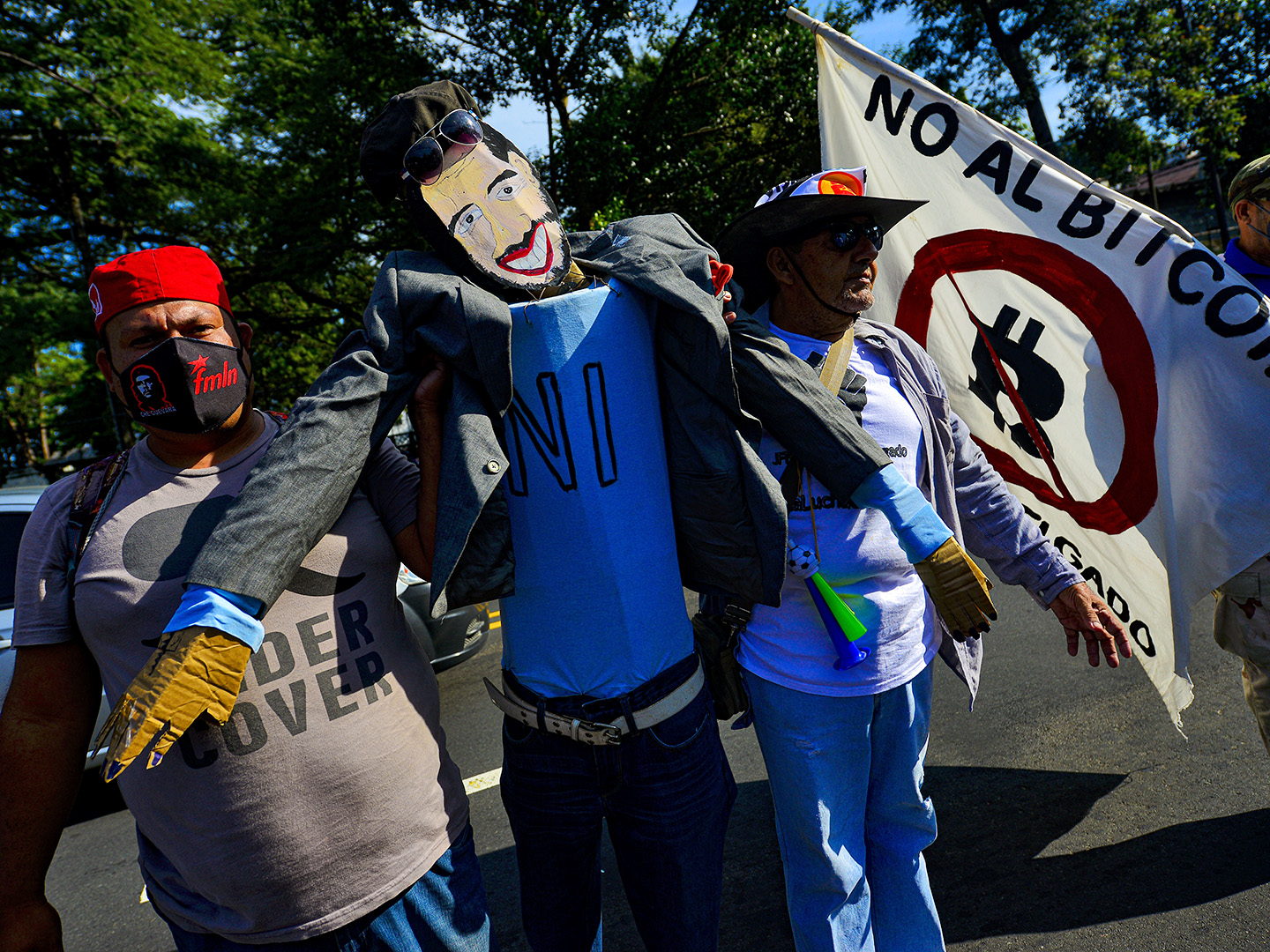

Although he is immensely popular in El Salvador, boasting a >90% approval rating according to some polls, the rest of the world has a problematic relationship with President Bukele, who has a reputation for authoritarian impulses.

Bitcoin advocate Alex Gladstein, Chief Strategy Officer at Human Rights Foundation, told CoinDesk over Twitter direct messages that he has mixed feelings about “the world’s coolest dictator.”

“I continue to question and oppose the authoritarian tactics of the Bukele administration – like scrapping presidential term limits, spying on dissidents, and arresting tens of thousands of people without due process – but I consider the Bitcoin Law to be historic,” he writes. “I wish my own country [the U.S.] would add Bitcoin as legal tender, and I think it’s only fair if people worldwide could freely use an open neutral decentralized currency as opposed to a centralized, rent-seeking fiat currency.”

The mainstream finance community has been unsupportive of Bukele’s efforts.In fact, the International Monetary Fund issued a report in 2022 which included a warning that El Salvador’s adoption of Bitcoin “as legal tender … entails large risks for financial and market integrity, financial stability, and consumer protection.”

The IMF is currently owed 287.2 million of Special Drawing Rights (SDRs) from El Salvador (roughly $382.1 million, as of May 25, 2023).

The IMF then issued another report earlier this year reiterating its concerns. “While risks have not materialized due to the limited Bitcoin use so far – as suggested by survey and remittances data – its use could grow given its legal tender status … In this context, underlying risks to financial integrity and stability, fiscal sustainability, and consumer protection persist …”

There is something to be said about that on both sides.

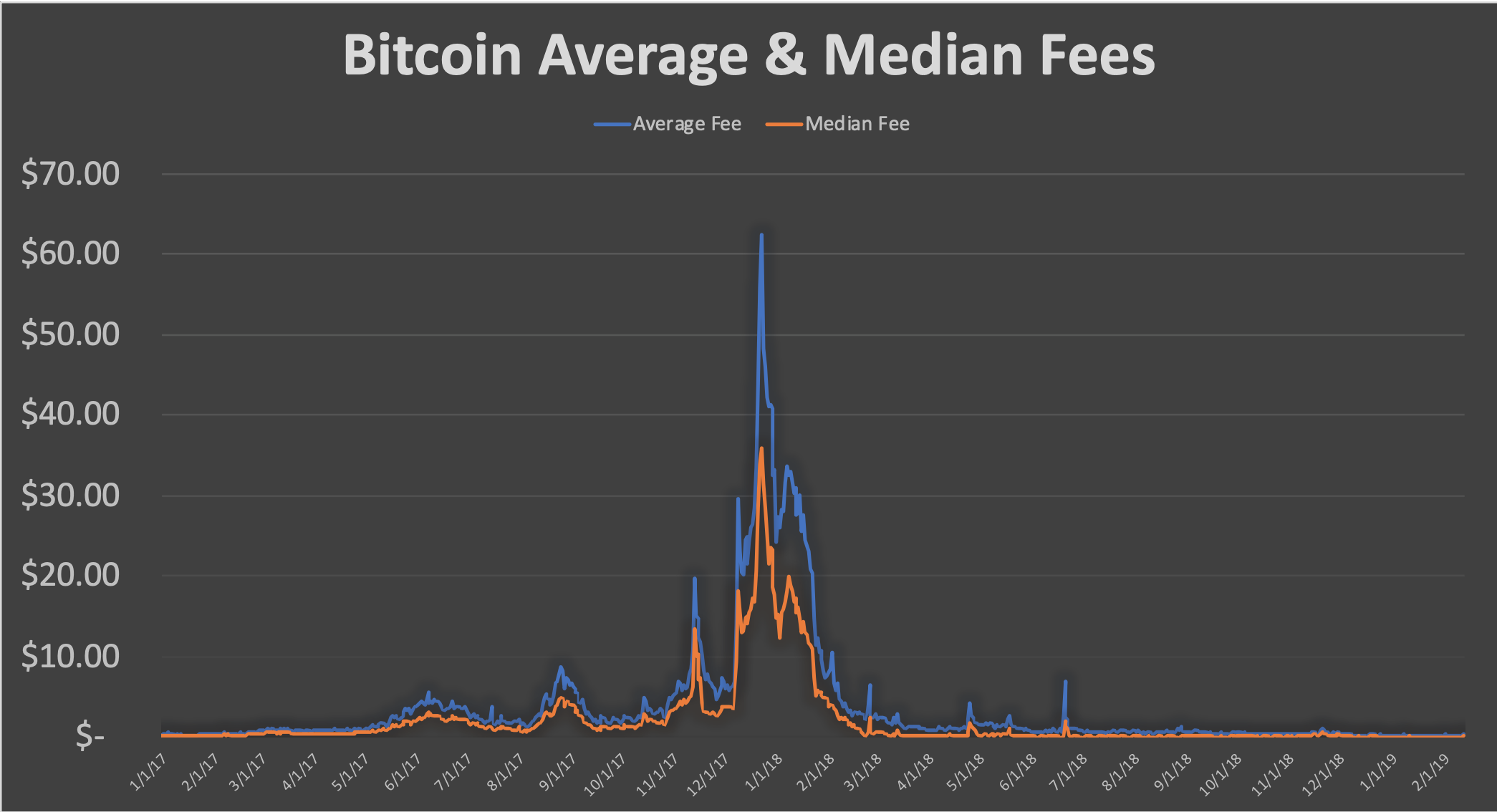

For one, the IMF’s concern around instability in El Salvador is supportable and understandable. The price of bitcoin is volatile and volatility can be destabilizing. That said, a country can suffer greatly economically when it doesn’t control its own monetary policy. Just look at when struggling eurozone countries needed a weaker currency during the European sovereign debt crisis in the early 2010s to stimulate the economy, but instead had to suffer through endless austerity packages.

So while El Salvador doesn’t control the monetary policies of either of its currencies, at least Bitcoin’s monetary policy is known and unchanging.

Then again, these are just IMF reports with warnings embedded, there hasn’t been much loud opposition. But on that point, Gladstein offered a sharper take on the IMF, El Salvador and Bitcoin.

“The IMF is opposed to Bitcoin adoption in El Salvador because it gives people an escape from the debt colonialism that it imposes on much of the world,” says Gladstein “The IMF has been relatively muted in its opposition so far, in part because El Salvador is a dollarized economy and in part because the [Salvadoran] government has still sought its assistance … But if another country, let’s say Argentina, adopted Bitcoin, they would enter panic mode.”

All said, 2021 was a monumental and important year for Bitcoin and Salvadorans. If crypto lives on for many decades, the story of a sovereign nation adopting Bitcoin as its legal tender will go down in history as a critical milestone.

CoinDesk’s interviews with Salvadorans and with those in El Salvador working on bitcoin there show a good level of enthusiasm and excitement for Bitcoin. One individual working in El Salvador offered that they believed 50% of the population will use Bitcoin regularly in the next bull market.

If that happens, then 2021 will go down as the year when Bitcoin truly became Salvadoran.